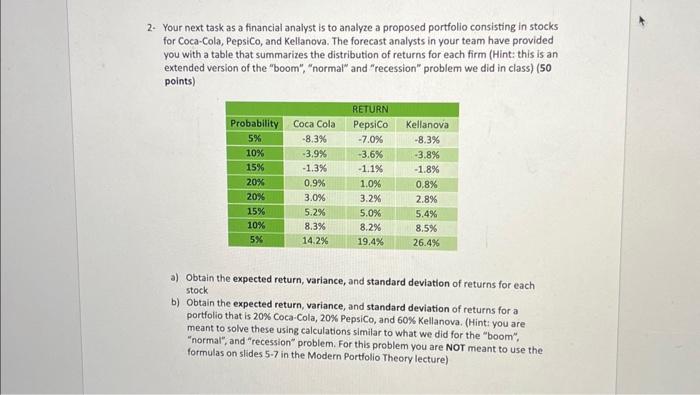

Question: 2. Your next task as a financial analyst is to analyze a proposed portfolio consisting in stocks for Coca-Cola, PepsiCo, and Kellanova. The forecast analysts

2. Your next task as a financial analyst is to analyze a proposed portfolio consisting in stocks for Coca-Cola, PepsiCo, and Kellanova. The forecast analysts in your team have provided you with a table that summarizes the distribution of returns for each firm (Hint: this is an extended version of the "boom", "normal" and "recession" problem we did in class) (50 points) a) Obtain the expected return, variance, and standard deviation of returns for each stock b) Obtain the expected return, variance, and standard deviation of returns for a portfolio that is 20% Coca-Cola, 20% PepsiCo, and 60% Kellanova. (Hint: you are meant to solve these using calculations similar to what we did for the "boom", "normal", and "recession" problem. For this problem you are NOr meant to use the formulas on stides 57 in the Modern Portfolio Theory lecture)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts