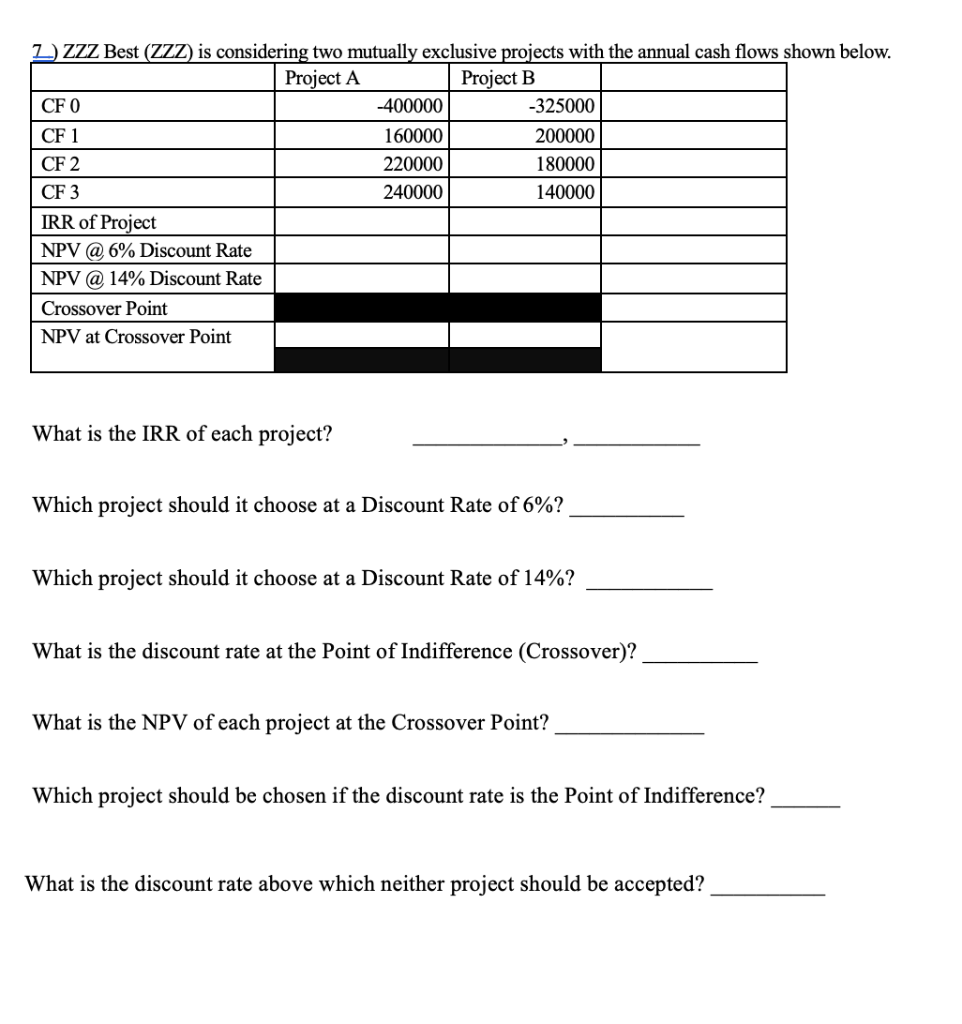

Question: 2 ZZZ Best (ZZZ) is considering two mutually exclusive projects with the annual cash flows shown below. Project A Project B CFO -400000 -325000 CF

2 ZZZ Best (ZZZ) is considering two mutually exclusive projects with the annual cash flows shown below. Project A Project B CFO -400000 -325000 CF 1 160000 200000 CF 2 220000 180000 CF 3 240000 140000 IRR of Project NPV @ 6% Discount Rate NPV @ 14% Discount Rate Crossover Point NPV at Crossover Point What is the IRR of each project? Which project should it choose at a Discount Rate of 6%? Which project should it choose at a Discount Rate of 14%? What is the discount rate at the Point of Indifference (Crossover)? What is the NPV of each project at the Crossover Point? Which project should be chosen if the discount rate is the Point of Indifference? What is the discount rate above which neither project should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts