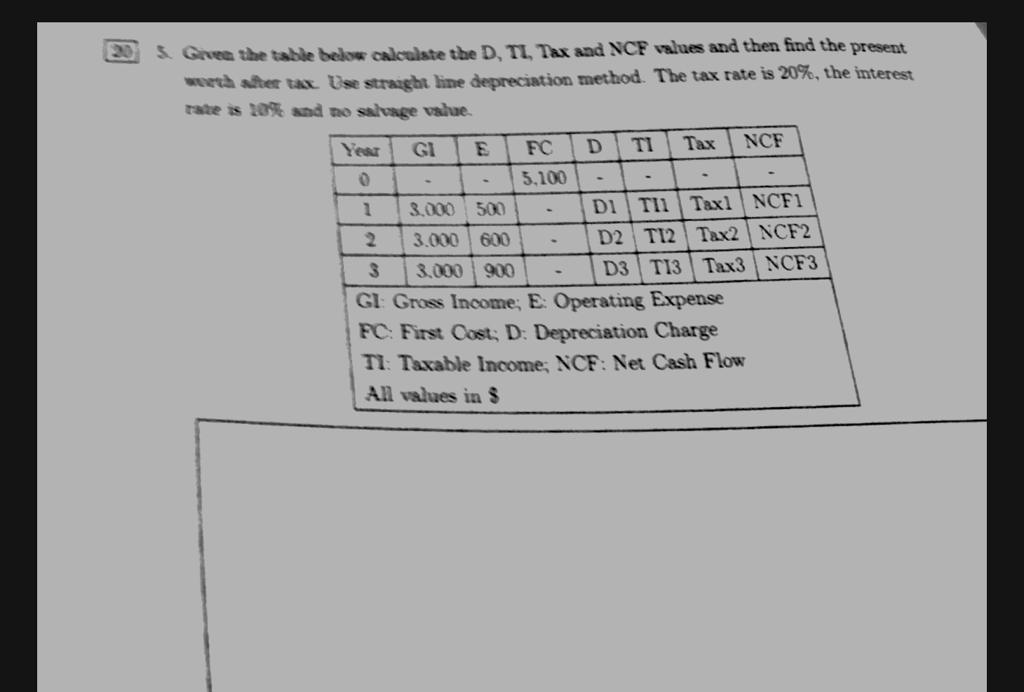

Question: 20 5. Given the table below calculate the D, TI, Tax and NCF values and then find the present worth after tax. Use straight line

20 5. Given the table below calculate the D, TI, Tax and NCF values and then find the present worth after tax. Use straight line depreciation method. The tax rate is 20%, the interest rate is 10% and no salvage value. Year GI E FC D Tax NCF 0 5,100 - 3.000 500 DI TII Tax1 NCF1 3.000 600 D2 T12 Tax2 NCF2 3 3.000 900 D3 T13 Tax3 NCF3 GI: Gross Income; E: Operating Expense FC: First Cost; D: Depreciation Charge TI: Taxable Income; NCF: Net Cash Flow All values in S 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts