Question: 20. A share buyback could be interpreted as a reflection of management's view that the market price of the firm's shares is lower than their

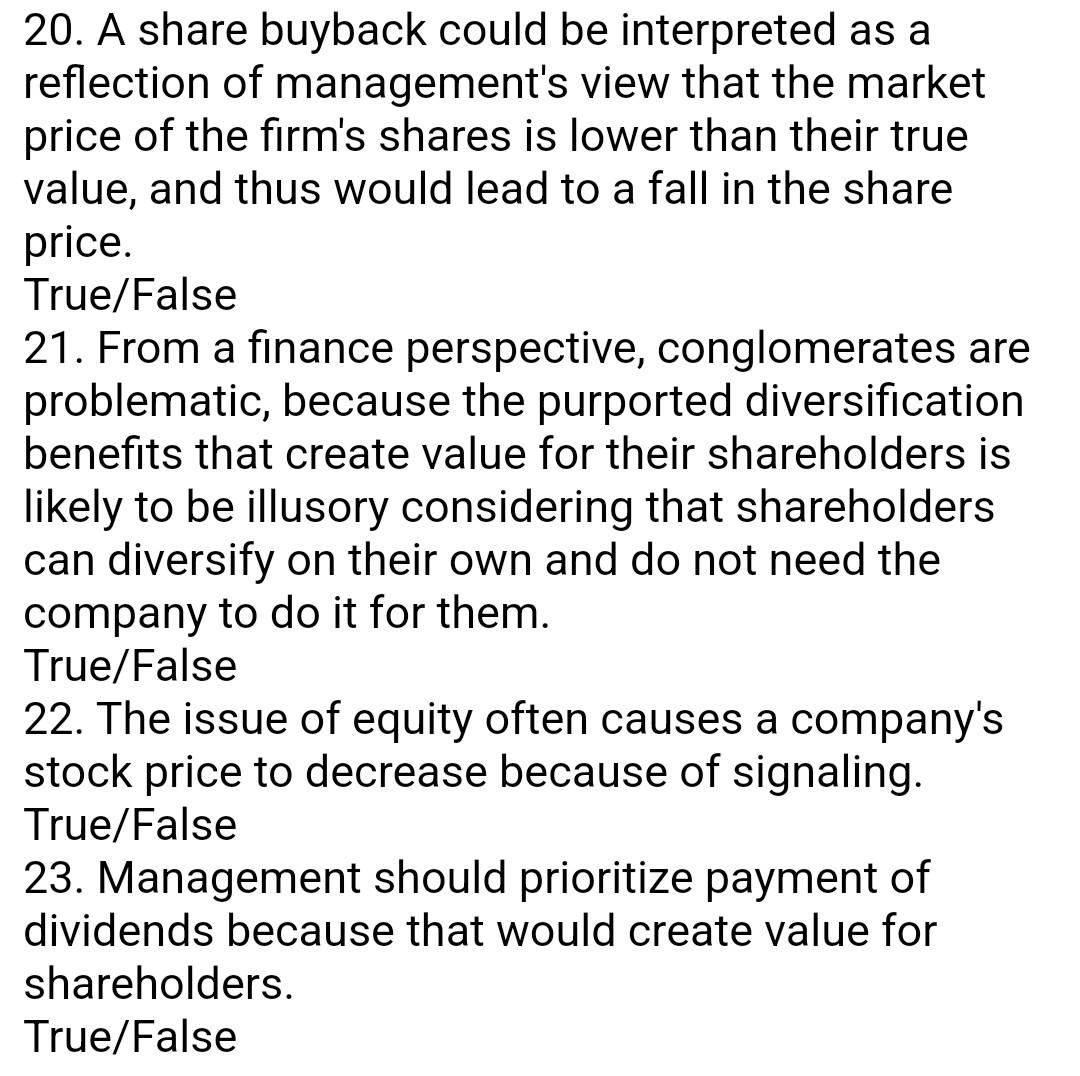

20. A share buyback could be interpreted as a reflection of management's view that the market price of the firm's shares is lower than their true value, and thus would lead to a fall in the share price. True/False 21. From a finance perspective, conglomerates are problematic, because the purported diversification benefits that create value for their shareholders is likely to be illusory considering that shareholders can diversify on their own and do not need the company to do it for them. True/False 22. The issue of equity often causes a company's stock price to decrease because of signaling. True/False 23. Management should prioritize payment of dividends because that would create value for shareholders. True/False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts