Question: 20. Based on the table above, if you apply Regression Analysis method to find the optimal allocation for the 3-stock portfolio (SBUX, KLIC, NFLX), what

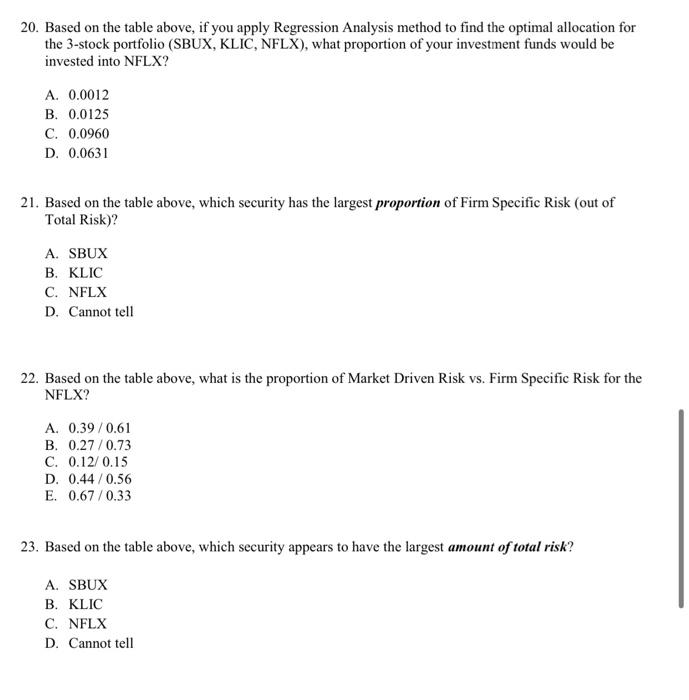

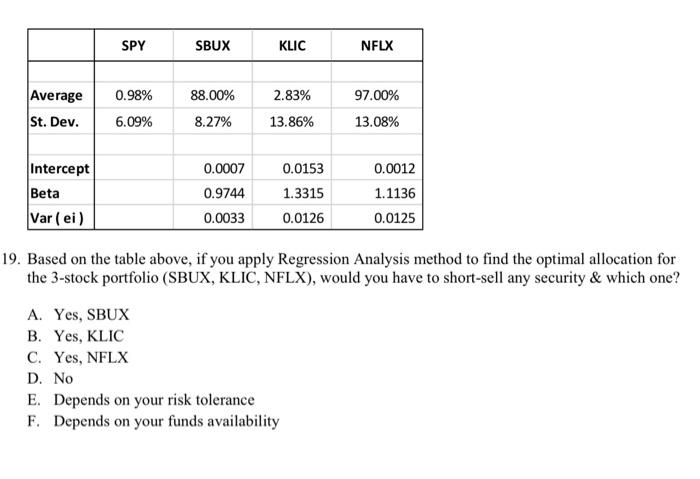

20. Based on the table above, if you apply Regression Analysis method to find the optimal allocation for the 3-stock portfolio (SBUX, KLIC, NFLX), what proportion of your investment funds would be invested into NFLX? A. 0.0012 B. 0.0125 C. 0.0960 D. 0.0631 21. Based on the table above, which security has the largest proportion of Firm Specific Risk (out of Total Risk)? A. SBUX B. KLIC C. NFLX D. Cannot tell 22. Based on the table above, what is the proportion of Market Driven Risk vs. Firm Specific Risk for the NFLX? A. 0.39/0.61 B. 0.27/0.73 C. 0.12/0.15 D. 0.44/0.56 E. 0.67/0.33 23. Based on the table above, which security appears to have the largest amount of total risk ? A. SBUX B. KLIC C. NFLX D. Cannot tell Based on the table above, if you apply Regression Analysis method to find the optimal allocation for the 3 -stock portfolio (SBUX, KLIC, NFLX), would you have to short-sell any security \& which one? A. Yes, SBUX B. Yes, KLIC C. Yes, NFLX D. No E. Depends on your risk tolerance F. Depends on your funds availability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts