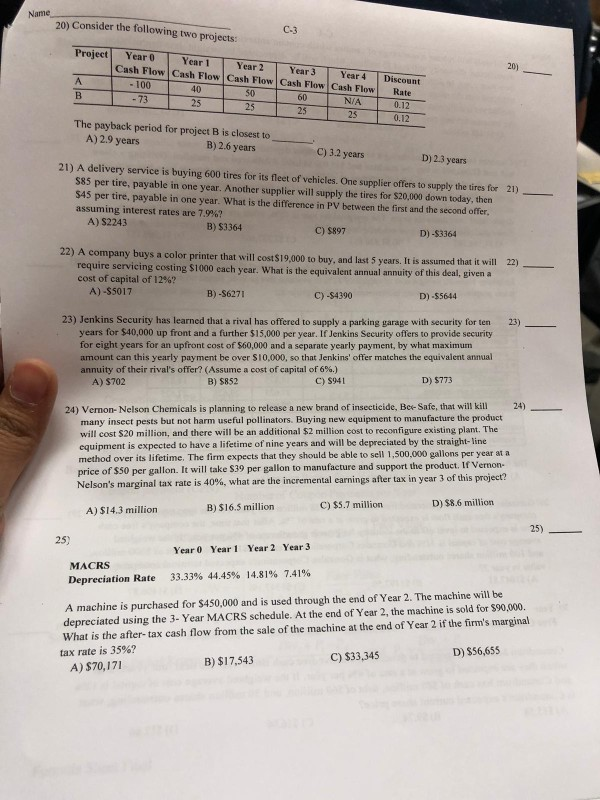

Question: 20) Consider the following two projects: C-3 Project Year YearYear2 Year 3 Year4 Discount Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow 100

20) Consider the following two projects: C-3 Project Year YearYear2 Year 3 Year4 Discount Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow 100 40 Rate 50 60 73 N/A 25 0.12 25 25 The payback period for project B is closest to A) 2.9 years B) 2.6 years C) 3.2 years D) 2.3 years 21) A delivery service is buying 600 tires for its fleet of vehicles. One supplier offers to supply the tires for 21) S85 per tire, payable in one year. Another supplier will supply the tires for $20,000 down today, ther $45 per tire, payable in one year. What is the difference in PV between the first and the second offer assuming interest rates are 7.9%? A) $2243 B) $3364 C) $897 D)-$3364 22) A company buys a color printer that will cost$19,000 to buy, and last 5 years. It is assum require servicing costing $1000 each year. What is the equivalent annual amnuity of this deal, cost of capital of 12%? A)-$5017 B) -S6271 C) -$4390 D)-$5644 23) Jenkins Security has learned that a rival has offered to supply a parking garage with security for ten years for $40,000 up front and a further $15,000 per year. If Jenkins Security offers to provide security for eight years for an upfront cost of $60,000 and a separate yearly payment, by what maximum amount can this yearly payment be over S10,000, so that Jenkins' offer matches the equivalent annual annuity of their rival's offer? (Assume a cost of capital of 6%.) A) $702 23) C) S941 D) $773 B) $852 24) Vernon-Nelson Chemicals is planning to release a new brand of insecticide, Bee Safe, that will kill 24) many insect pests but not harm useful pollinators. Buying new equipment to manufacture the product will cost $20 million, and there will be an additional $2 million cost to reconfigure existing plant. The equipment is expected to have a lifetime of nine years and will be depreciated by the straight-line method over its lifetime. The firm expects that they should be able to sell 1,500,000 gallons per year at a price of $50 per gallon. It will take $39 per gallon to manufacture and support the product. If Vermon of this project? Nelson's marginal tax rate is 40%, what are the incremental earnings after tax in year 3 D) $8.6 million C) $5.7 million B) $16.5 million A) S14.3 million 25) Year 3 Year 2 Year 0 Year 1 MACRS 7.41% 14.81% 33.33% 44.45% Depreciation Rate A machine is purchased for $450,000 and is used through the end of Year 2. The machine will be depreciated using the 3- Year MACRS schedule. At the end of Year 2, the machine is sold for $90,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal D) S56,655 tax rate is 35%? C) $33,345 B) $17,543 A) $70,171

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts