Question: (20 marks) The current machine has been purchased $100,000 two years ago with a useful life of 7 years and installed with cost of $5000.

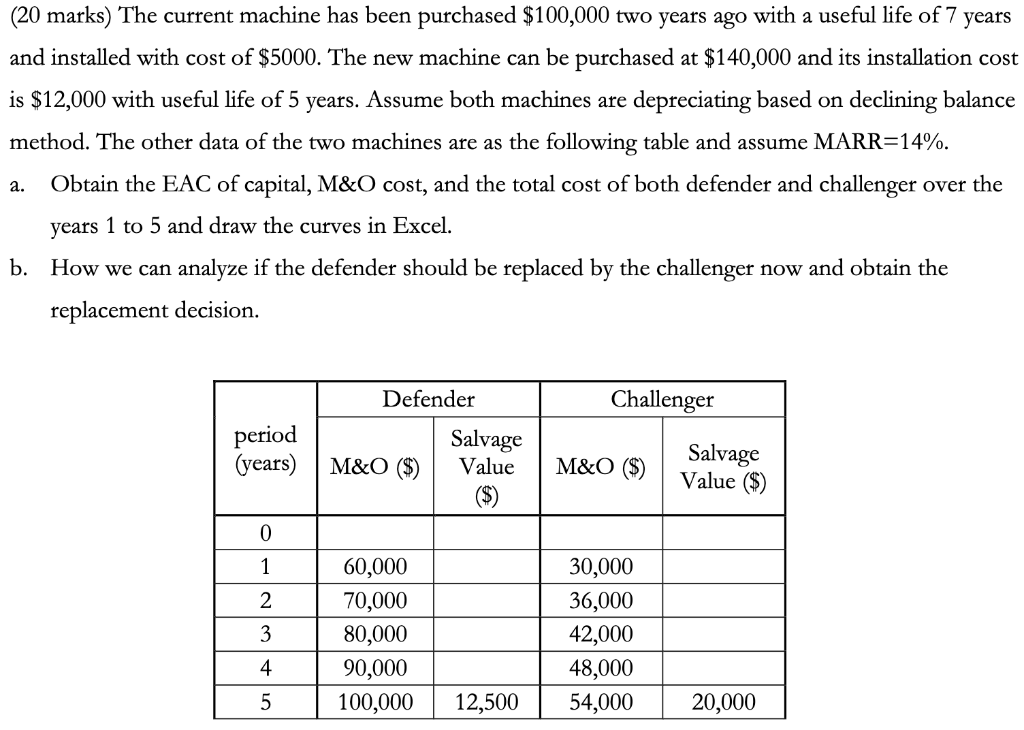

(20 marks) The current machine has been purchased $100,000 two years ago with a useful life of 7 years and installed with cost of $5000. The new machine can be purchased at $140,000 and its installation cost is $12,000 with useful life of 5 years. Assume both machines are depreciating based on declining balance method. The other data of the two machines are as the following table and assume MARR=14%. Obtain the EAC of capital, M&O cost, and the total cost of both defender and challenger over the years 1 to 5 and draw the curves in Excel. b. How we can analyze if the defender should be replaced by the challenger now and obtain the replacement decision. a. Defender Challenger period (years) M&O ($) Salvage Value ($) M&O ($) Salvage Value ($) 0 1 2 3 60,000 70,000 80,000 90,000 100,000 30,000 36,000 42,000 48,000 54,000 4 5 12,500 20,000 (20 marks) The current machine has been purchased $100,000 two years ago with a useful life of 7 years and installed with cost of $5000. The new machine can be purchased at $140,000 and its installation cost is $12,000 with useful life of 5 years. Assume both machines are depreciating based on declining balance method. The other data of the two machines are as the following table and assume MARR=14%. Obtain the EAC of capital, M&O cost, and the total cost of both defender and challenger over the years 1 to 5 and draw the curves in Excel. b. How we can analyze if the defender should be replaced by the challenger now and obtain the replacement decision. a. Defender Challenger period (years) M&O ($) Salvage Value ($) M&O ($) Salvage Value ($) 0 1 2 3 60,000 70,000 80,000 90,000 100,000 30,000 36,000 42,000 48,000 54,000 4 5 12,500 20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts