Question: 20, o.reak-even analysis is a technique for determining that point at which sales will juist cover total costs variable costs C. fixed costs d. sunk

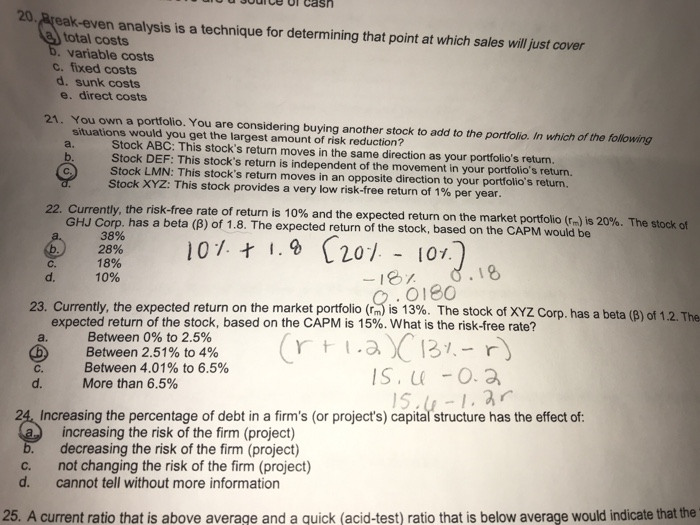

20, o.reak-even analysis is a technique for determining that point at which sales will juist cover total costs variable costs C. fixed costs d. sunk costs e. direct costs 21. You own a portfolio. You are considering buying another stock to add to the portfolio. In which of the folowing situations would you get the largest amount of risk reduction? a. Stock ABC: This stock's return moves in the same direction as your portfolio's return. Stock DEF: This stock's return is independent of the movement in your portfolio's return. Stock LMN: This stock's return moves in an opposite direction to your portfolio's return. Stock XYZ: This stock provides a very low risk-free return of 1% per year. Currently, the risk-free rate of return is 10% and the expected return on the market portfolio (%) is 20%. The stock of GHJ Corp, has a beta (B) of 1.8. The expected return of the stock, based on the CAPM would be 22. 38% 28% 18% 10% C. d. 0180 23. Currently, the expected return on the market portfolio (r. is 13%. The stock of XYZ Corp. has a beta (B) of 12.The expected return of the stock, based on the CAPM is 15%. What is the risk-free rate? Between 0% to 2.5% Between 2.51% to 4% Between 4.01% to 6.5% More than 6.5% C. IS,L -O. 3 d. 24 Increasing the percentage of debt in a firm's (or project's) capital structure has the effect of: increasing the risk of the firm (project) b. decreasing the risk of the firm (project) c. not changing the risk of the firm (project) d. cannot tell without more information 25. A current ratio that is above average and a quick (acid-test) ratio that is below average would indicate that the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts