Question: 20 P Task 1 You work for an Argentinian importer and expect to pay 1 million in one year to a European supplier. You can

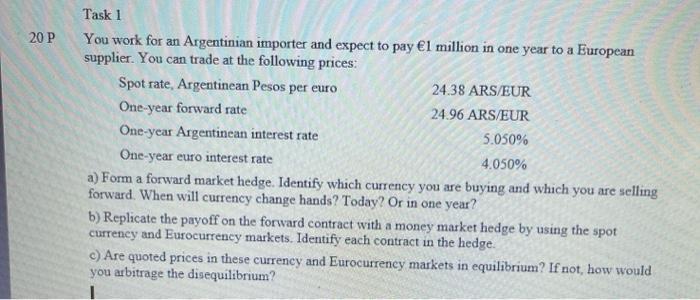

20 P Task 1 You work for an Argentinian importer and expect to pay 1 million in one year to a European supplier. You can trade at the following prices: Spot rate, Argentinean Pesos per euro 24.38 ARS/EUR One-year forward rate 24.96 ARS/EUR One-year Argentinean interest rate 5.050% One-year euro interest rate 4.050% a) Form a forward market hedge. Identify which currency you are buying and which you are selling forward. When will currency change hands? Today? Or in one year? b) Replicate the payoff on the forward contract with a money market hedge by using the spot currency and Eurocurrency markets. Identify each contract in the hedge. c) Are quoted prices in these currency and Eurocurrency markets in equilibrium? If not, how would you arbitrage the disequilibrium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts