Question: (20) please hell me answer this correctly The payroll register of Seaside Architecture Company indicates $930 of Social Security and $250 of Medicare tax withheld

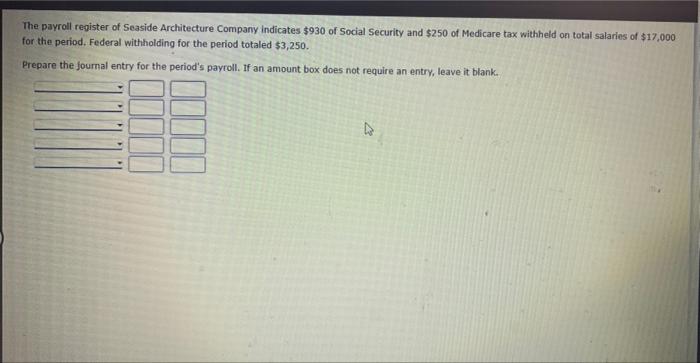

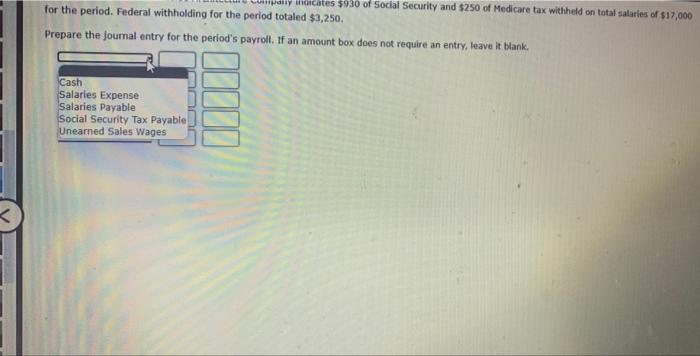

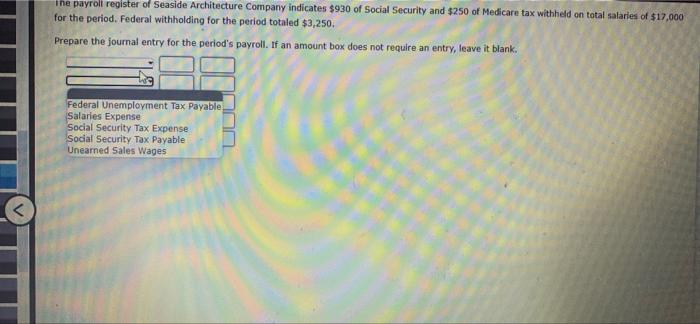

The payroll register of Seaside Architecture Company indicates $930 of Social Security and $250 of Medicare tax withheld on total salaries of $17,000 for the period. Federal withholding for the period totaled $3,250. Prepare the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. D pally indicates $930 of Social Security and $250 of Medicare tax withheld on total salaries of $17,000 for the period. Federal withholding for the period totaled $3,250. Prepare the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. Cash Salaries Expense Salaries Payable Social Security Tax Payable Unearned Sales Wages V The payroll register of Seaside Architecture Company indicates $930 of Social Security and $250 of Medicare tax withheld on total salaries of $17,000 for the period. Federal withholding for the period totaled $3,250. Prepare the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. Federal Unemployment Tax Payable Salaries Expense Social Security Tax Expense Social Security Tax Payable Unearned Sales Wages Medicare Tax Expense Medicare Tax Payable Payroll Tax Expense State Unemployment Tax Payable Unearned Sales Wages Prepare the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. Employees Federal Income Tax Expense Employees Federal Income Tax Payable Federal Unemployment Tax Expense Salaries Expense. Unearned Sales Wages V Cash Payroll Tax Expense Salaries Expense Salaries Payable Salaries Receivable uues not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts