Question: (20 points) You enter into a 3 year interest rate swap as the payer. The variable interest rate will be the one year spot rate

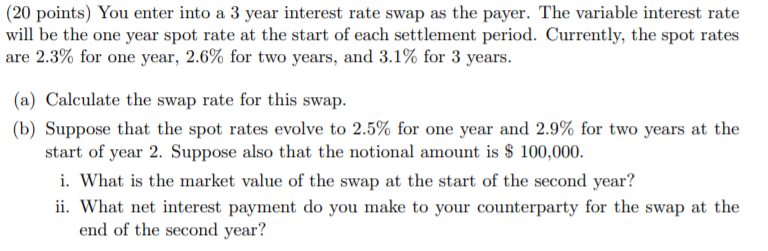

(20 points) You enter into a 3 year interest rate swap as the payer. The variable interest rate will be the one year spot rate at the start of each settlement period. Currently, the spot rates are 2.3% for one year, 2.6% for two years, and 3.1% for 3 years. (a) Calculate the swap rate for this swap. (b) Suppose that the spot rates evolve to 2.5% for one year and 2.9% for two years at the start of year 2. Suppose also that the notional amount is $ 100,000. i. What is the market value of the swap at the start of the second year? ii. What net interest payment do you make to your counterparty for the swap at the end of the second year? (20 points) You enter into a 3 year interest rate swap as the payer. The variable interest rate will be the one year spot rate at the start of each settlement period. Currently, the spot rates are 2.3% for one year, 2.6% for two years, and 3.1% for 3 years. (a) Calculate the swap rate for this swap. (b) Suppose that the spot rates evolve to 2.5% for one year and 2.9% for two years at the start of year 2. Suppose also that the notional amount is $ 100,000. i. What is the market value of the swap at the start of the second year? ii. What net interest payment do you make to your counterparty for the swap at the end of the second year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts