Question: 20. Probability-weighted mean and standard deviation Aa Aa A financial analyst following Singh, Inc, has created the following probability distribution to describe Singh's expected return

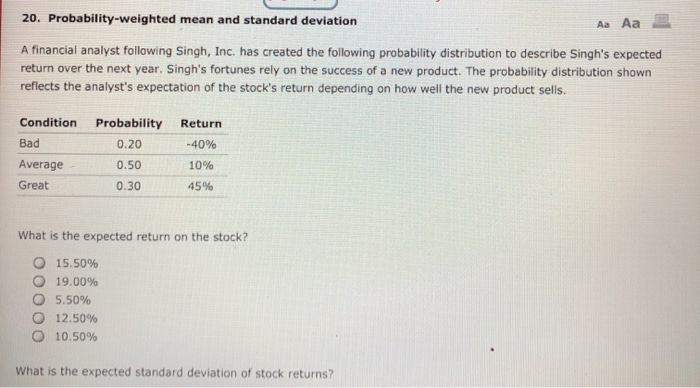

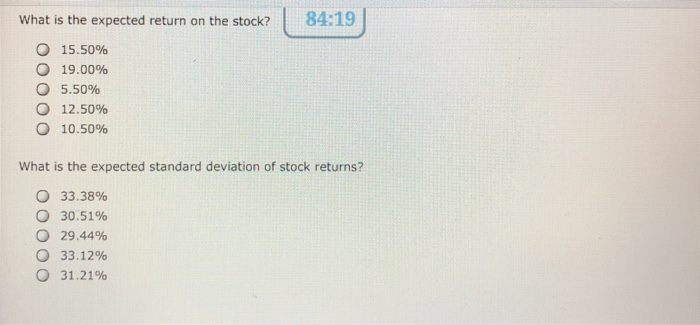

20. Probability-weighted mean and standard deviation Aa Aa A financial analyst following Singh, Inc, has created the following probability distribution to describe Singh's expected return over the next year, Singh's fortunes rely on the success of a new product. The probability distribution shown reflects the analyst's expectation of the stock's return depending on how well the new product sells. Condition Probability Return Bad Average Great 0.20 0.50 0.30 -40% 10% 45% What is the expected return on the stock? 15.50% 19.00% 5.50% 12.50% 10.50% What is the expected standard deviation of stock returns? What is the expected return on the stock? 84:19 15.50% 19.00% 5.50% 12.50% 10.50% What is the expected standard deviation of stock returns? 33.38% 30.51% 29.44% 33.12% 31.21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts