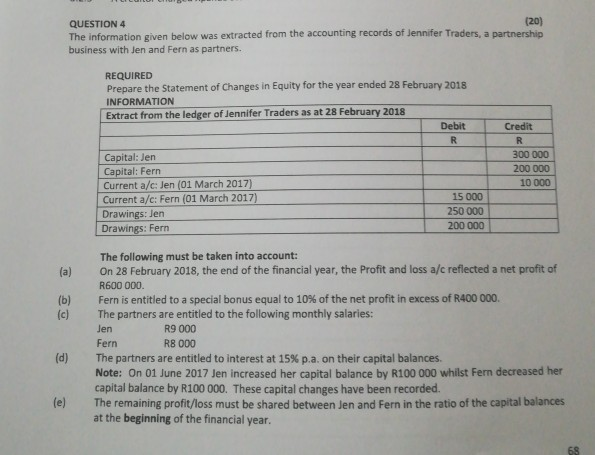

Question: (20) QUESTION 4 The information given below was extracted from the accounting records of Jennifer Traders, a partnership business with Jen and Fern as partners.

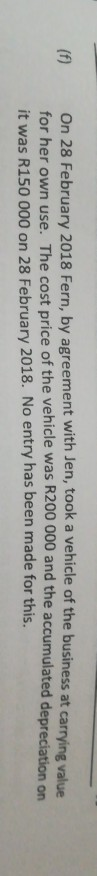

(20) QUESTION 4 The information given below was extracted from the accounting records of Jennifer Traders, a partnership business with Jen and Fern as partners. REQUIRED Prepare the Statement of Changes in Equity for the year ended 28 February 2018 INFORMATION Extract from the ledger of Jennifer Traders as at 28 February 2018 Debit Credit 300 000 200 000 10 000 Capital: Jen Capital: Fern Current a/c: Jen (01 March 2017) Current a/c: Fern (01 March 2017) Drawings: Jen Drawings: Fern 15 000 250 000 200 000 The following must be taken into account: (a) On 28 February 2018, the end of the financial year, the Profit and loss a/c reflected a net profit of R600 000. Fern is entitled to a special bonus equal to 10% of the net profit in excess of R400 000. The partners are entitled to the following monthly salaries: Jen Fern The partners are entitled to interest at 15% pa. on their capital balances. (b) (c) R9 000 R8 000 (d) Note: On 01 June 2017 Jen increased her capital balance by R100 000 whilst Fern decreased her capital balance by R100 000. These capital changes have been recorded. The remaining profit/loss must be shared between Jen and Fern in the ratio of the capital balances (e) at the beginning of the financial year. (f) On 28 February 2018 Fern, by agreement with Jen, took a vehicle of the business at carrying value for her own use. The cost price of the vehicle was R200 000 and the accumulated depreciation on it was R150 000 on 28 February 2018. No entry has been made for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts