Question: 20 question problem--over risk return and capm. Please help. any wprk you can show is appreciate it. I really want to see what im doing

![doing wrong! QUESTION 1 [Q1-Q10] Questions 1-10 are designed to review some](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe36faddd95_25066fe36fa7cc92.jpg)

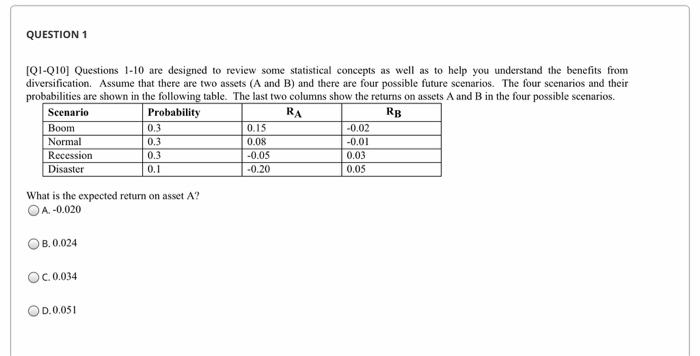

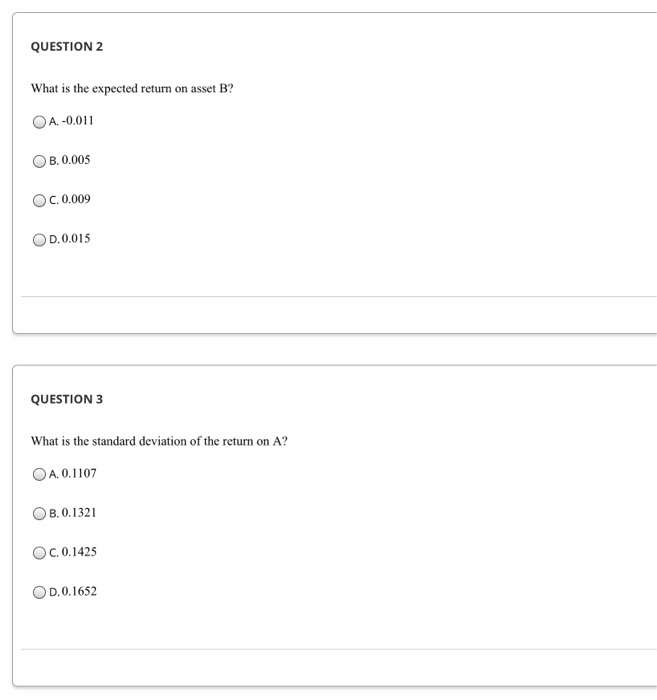

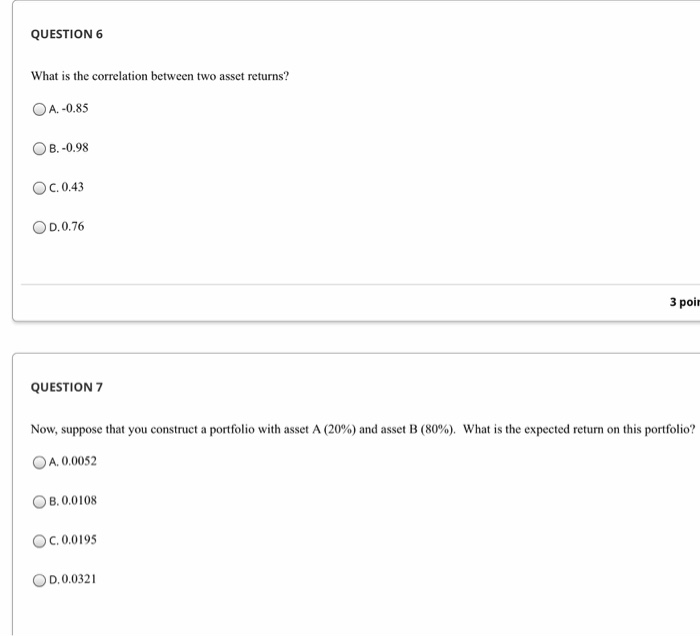

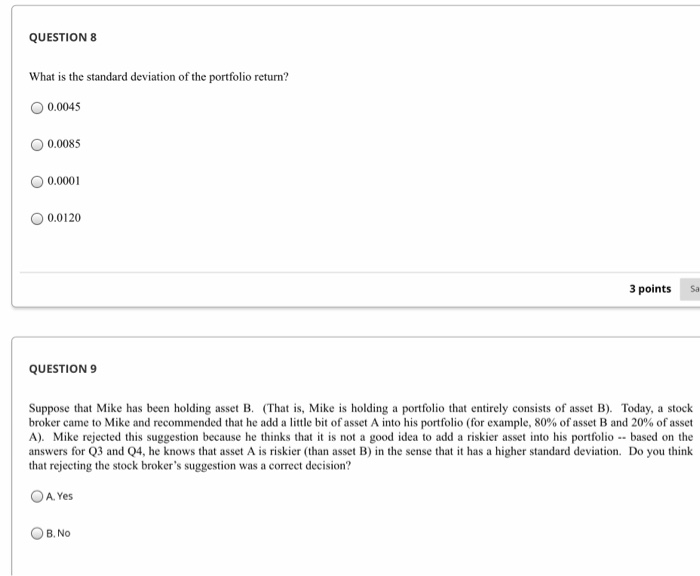

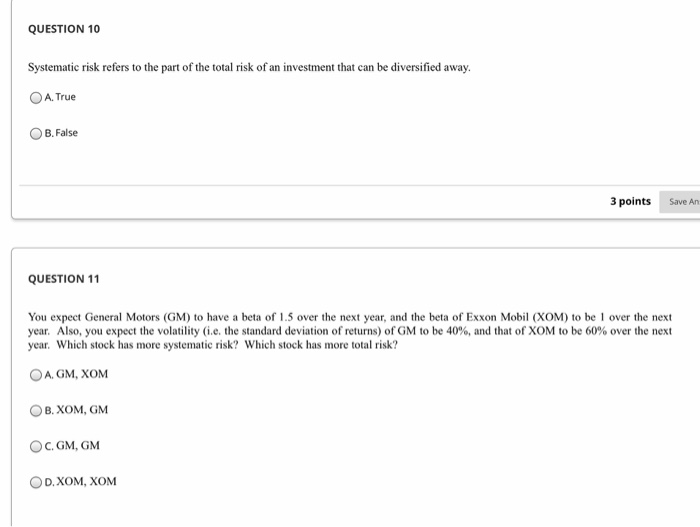

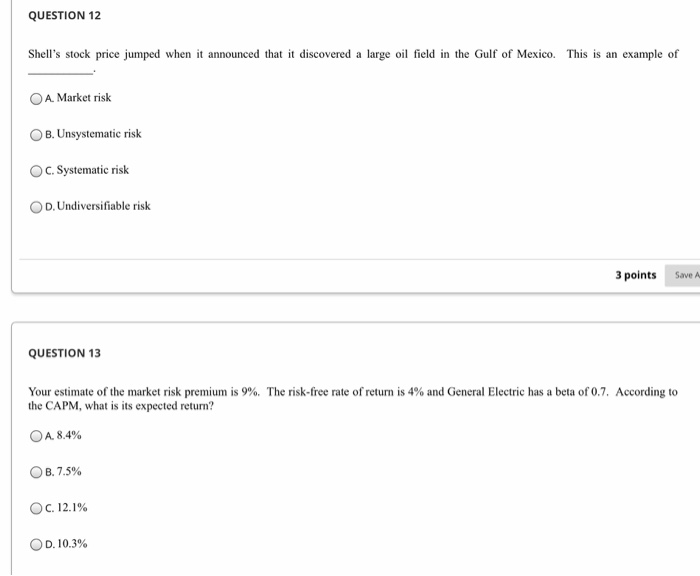

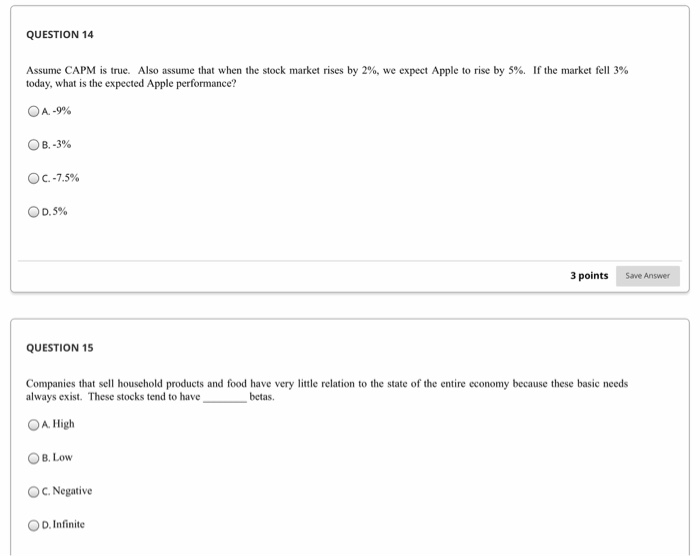

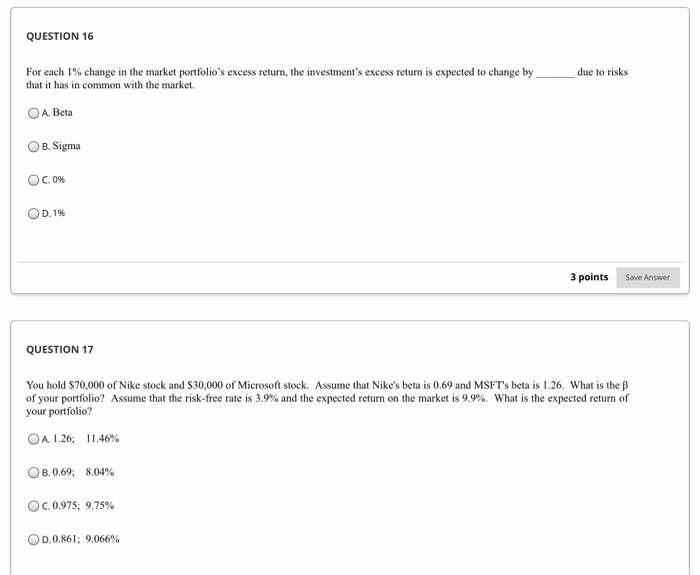

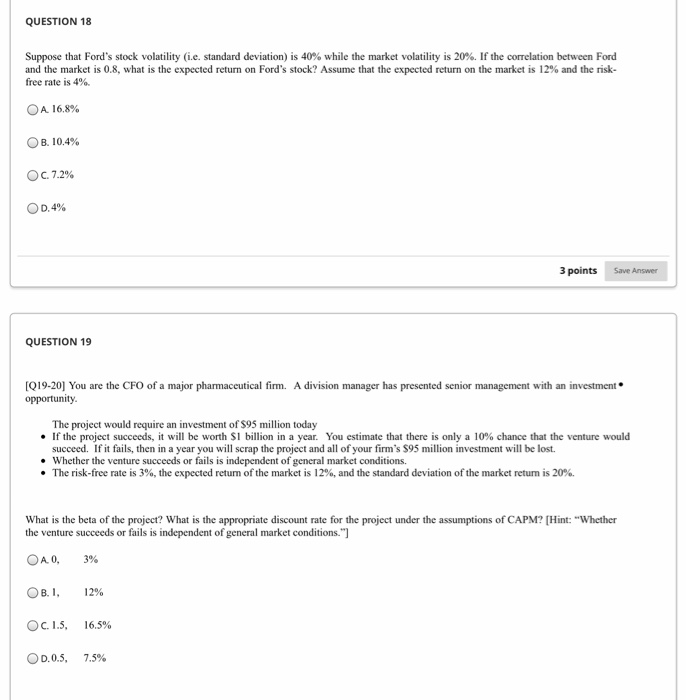

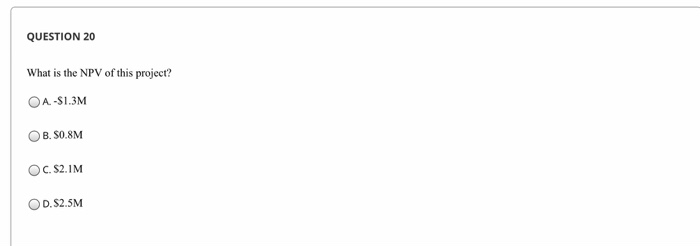

QUESTION 1 [Q1-Q10] Questions 1-10 are designed to review some statistical concepts as well as to help you understand the benefits from diversification. Assume that there are two assets (A and B) and there are four possible future scenarios. The four scenarios and their probabilities are shown in the following table. The last two columns show the returns on assets A and B in the four possible scenarios. Scenario Probability RA Boom 0.3 0.15 -0.02 Normal 0.3 0.08 -0.01 Recession 0.3 -0.05 0.03 Disaster 0.1 -0.20 0.05 What is the expected return on asset A? OA-0.020 OB. 0.024 OC. 0.034 OD.0.051 QUESTION 2 What is the expected return on asset B? OA.-0.011 OB. 0.005 OC. 0.009 OD.0.015 QUESTION 3 What is the standard deviation of the return on A? OA. 0.1107 OB. 0.1321 OC.0.1425 OD.0.1652 QUESTION 4 What is the standard deviation of the return on B? OA. 0.0124 OB. 0.0156 OC. 0.0214 OD. 0.0254 QUESTION 5 What is the covariance between two asset returns? O A. 0.00168 OB.-0.00168 OC. 0.00276 OD.-0.00276 QUESTION 6 What is the correlation between two asset returns? OA. -0.85 OB.-0.98 OC.0.43 OD.0.76 3 poir QUESTION 7 Now, suppose that you construct a portfolio with asset A (20%) and asset B (80%). What is the expected return on this portfolio? OA. 0.0052 OB. 0.0108 OC. 0.0195 OD.0.0321 QUESTION 8 What is the standard deviation of the portfolio return? 0.0045 0.0085 0.0001 0.0120 3 points sa QUESTION 9 Suppose that Mike has been holding asset B. (That is, Mike is holding a portfolio that entirely consists of asset B). Today, a stock broker came to Mike and recommended that he add a little bit of asset A into his portfolio (for example, 80% of asset B and 20% of asset A). Mike rejected this suggestion because he thinks that it is not a good idea to add a riskier asset into his portfolio -- based on the answers for Q3 and 04, he knows that asset A is riskier (than asset B) in the sense that it has a higher standard deviation. Do you think that rejecting the stock broker's suggestion was a correct decision? O A. Yes OB.NO QUESTION 10 Systematic risk refers to the part of the total risk of an investment that can be diversified away. A. True O B.False 3 points Save An QUESTION 11 You expect General Motors (GM) to have a beta of 1.5 over the next year, and the beta of Exxon Mobil (XOM) to be l over the next year. Also, you expect the volatility (ie the standard deviation of returns) of GM to be 40%, and that of XOM to be 60% over the next year. Which stock has more systematic risk? Which stock has more total risk? O AGM, XOM OB, XOM, GM OC.GM, GM OD.XOM, XOM QUESTION 12 Shell's stock price jumped when it announced that it discovered a large oil field in the Gulf of Mexico. This is an example of OA Market risk OB. Unsystematic risk OC. Systematic risk OD. Undiversifiable risk 3 points Save A QUESTION 13 Your estimate of the market risk premium is 9%. The risk-free rate of return is 4% and General Electric has a beta of 0.7. According to the CAPM, what is its expected return? OA. 8.4% OB. 7.5% OC 12.1% OD. 10.3% QUESTION 14 Assume CAPM is true. Also assume that when the stock market rises by 2%, we expect Apple to rise by 5%. If the market fell 3% today, what is the expected Apple performance? OA-9% OB.-3% OC.-7.5% OD.5% 3 points Save Answer QUESTION 15 Companies that sell household products and food have very little relation to the state of the entire economy because these basic needs always exist. These stocks tend to have betas. O A. High O B. Low OC. Negative OD. Infinite QUESTION 18 Suppose that Ford's stock volatility (i.e. standard deviation) is 40% while the market volatility is 20%. If the correlation between Ford and the market is 0.8, what is the expected return on Ford's stock? Assume that the expected return on the market is 12% and the risk- free rate is 4%. O A 16.8% OB. 10.4% Oc 7.2% OD.4% 3 points Save Answer QUESTION 19 [Q19-20) You are the CFO of a major pharmaceutical firm. A division manager has presented senior management with an investment opportunity The project would require an investment of $95 million today . If the project succeeds, it will be worth $1 billion in a year. You estimate that there is only a 10% chance that the venture would succeed. If it fails, then in a year you will scrap the project and all of your firm's $95 million investment will be lost. . Whether the venture succeeds or fails is independent of general market conditions. The risk-free rate is 3%, the expected return of the market is 12%, and the standard deviation of the market return is 20%. What is the beta of the project? What is the appropriate discount rate for the project under the assumptions of CAPM? (Hint: "Whether the venture succeeds or fails is independent of general market conditions.") OA 0, 3% OB.I, 12% OC.1.5. 16.5% OD.0.5, 7.5% QUESTION 20 What is the NPV of this project? OA-S1.3M OB. 80.8M OC. S2.IM OD. $2.5M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts