Question: 20. SAWAYA Construction Inc. is choosing between two mutually exclusive projects. The company has a cost of capital of 12%, and the risk of the

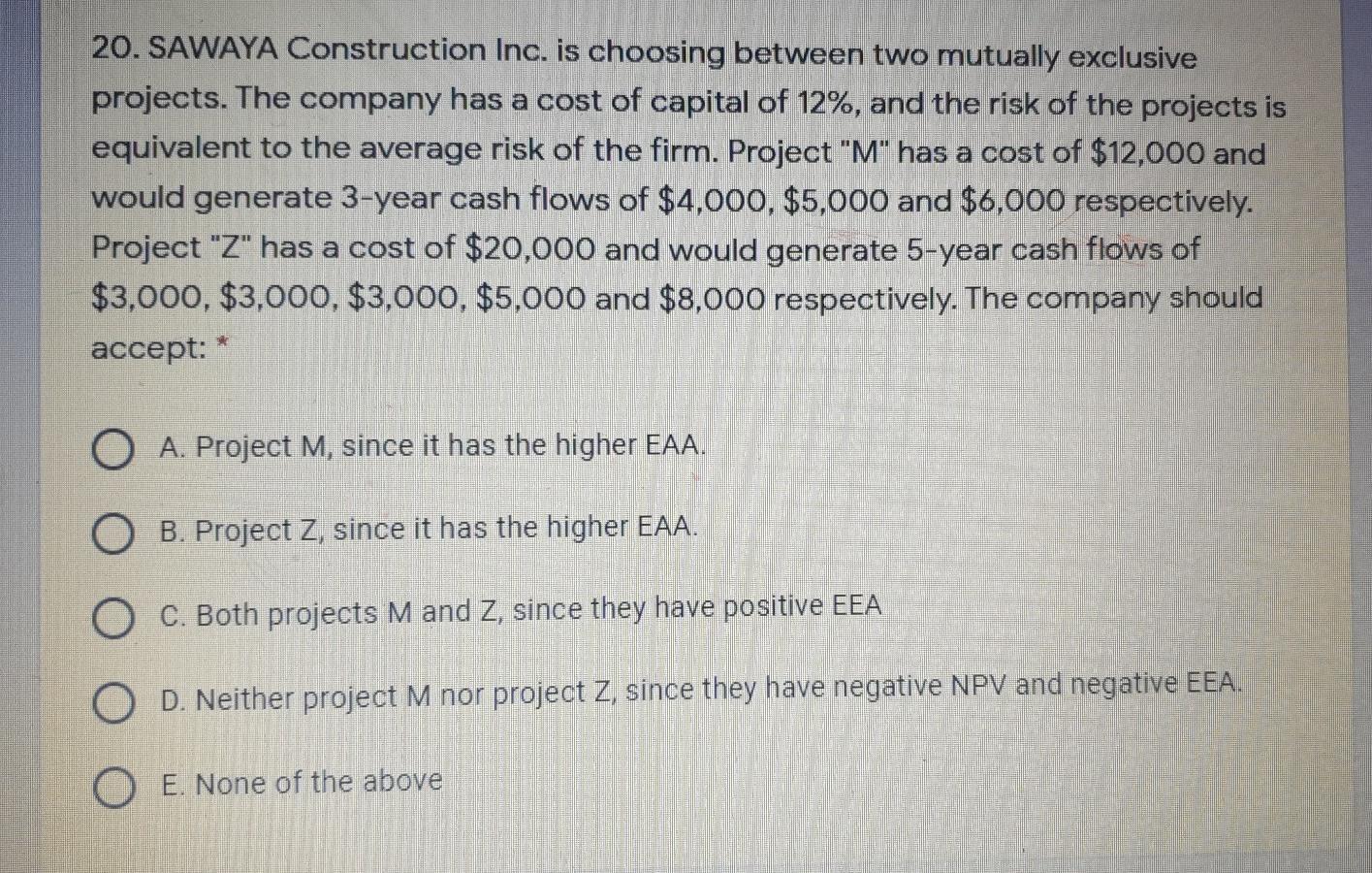

20. SAWAYA Construction Inc. is choosing between two mutually exclusive projects. The company has a cost of capital of 12%, and the risk of the projects is equivalent to the average risk of the firm. Project "M" has a cost of $12,000 and would generate 3-year cash flows of $4,000, $5,000 and $6,000 respectively. Project "Z" has a cost of $20,000 and would generate 5-year cash flows of $3,000, $3,000, $3,000, $5,000 and $8,000 respectively. The company should accept: O A. Project M, since it has the higher EAA. O B. Project Z, since it has the higher EAA. O C. Both projects M and Z, since they have positive EEA O D. Neither project M nor project Z, since they have negative NPV and negative EEA. O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts