Question: . (20%) Suppose Anheuser Busch InBev is considering introducing a new uftra-lig beer with zero calories to be called BudZero. The firm believes that the

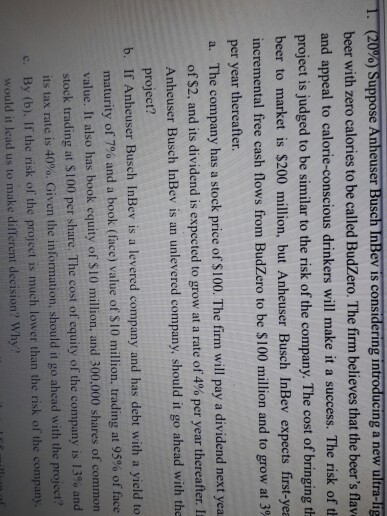

. (20%) Suppose Anheuser Busch InBev is considering introducing a new uftra-lig beer with zero calories to be called BudZero. The firm believes that the beer's flave and appeal to calorie-conscious drinkers will make it a success. The risk of t project is judged to be similar to the risk of the company. The cost of bringing th beer to market is $200 million, but Anheuser Busch InBev expects first-yea incremental free cash flows from BudZero to be $100 million and to grow at 39 per year thereafter. a. The company has a stock price of $100. The firm will pay a dividend next yea of $2, and ts dividend is expected to grow at a rate of 4% per year thereafter. Anheuser Busch InBev is an unlevered company, should it go ahead with the project? b. If Anheuser Busch InBev is a levered company and has debt with a yield to maturity of 7% and a book (face) value of S10 million, trading at 95% of face value. It also has book equity of S10 million, and 300.000 shares of common er share. The cost of equity of the company is 13% and stock trading at S100 p its tax rate is 40%. Given the information, should it go ahead with the project? c. By (b). If the risk of the project is much lower than the risk of the company. would it lead us to make different decision? Why? . (20%) Suppose Anheuser Busch InBev is considering introducing a new uftra-lig beer with zero calories to be called BudZero. The firm believes that the beer's flave and appeal to calorie-conscious drinkers will make it a success. The risk of t project is judged to be similar to the risk of the company. The cost of bringing th beer to market is $200 million, but Anheuser Busch InBev expects first-yea incremental free cash flows from BudZero to be $100 million and to grow at 39 per year thereafter. a. The company has a stock price of $100. The firm will pay a dividend next yea of $2, and ts dividend is expected to grow at a rate of 4% per year thereafter. Anheuser Busch InBev is an unlevered company, should it go ahead with the project? b. If Anheuser Busch InBev is a levered company and has debt with a yield to maturity of 7% and a book (face) value of S10 million, trading at 95% of face value. It also has book equity of S10 million, and 300.000 shares of common er share. The cost of equity of the company is 13% and stock trading at S100 p its tax rate is 40%. Given the information, should it go ahead with the project? c. By (b). If the risk of the project is much lower than the risk of the company. would it lead us to make different decision? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts