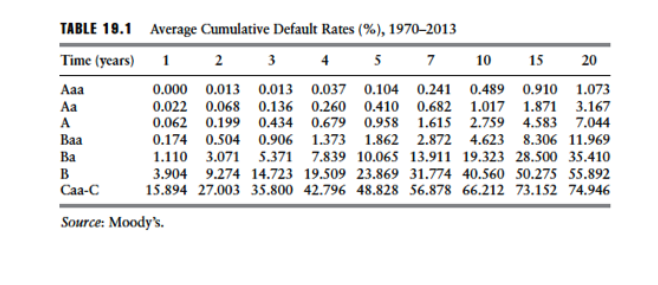

Question: 20 TABLE 19.1 Average Cumulative Default Rates (%), 1970-2013 Time (years) 1 2 3 4 5 7 10 15 0.000 0.013 0.013 0.037 0.104 0.241

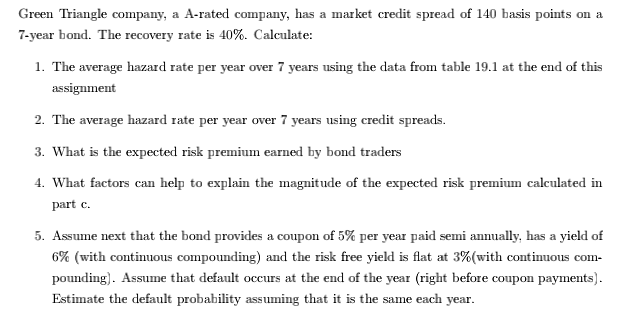

20 TABLE 19.1 Average Cumulative Default Rates (%), 1970-2013 Time (years) 1 2 3 4 5 7 10 15 0.000 0.013 0.013 0.037 0.104 0.241 0.489 0.910 1.073 0.022 0.068 0.136 0.260 0.410 0.682 1.017 1.871 3.167 A 0.062 0.199 0.434 0.679 0.958 1.615 2.759 4.583 7.044 Baa 0.174 0.504 0.906 1.373 1.862 2.872 4.623 8.306 11.969 Ba 1.110 3.071 5.371 7.839 10.065 13.911 19.323 28.500 35.410 B 3.904 9.274 14.723 19.509 23.869 31.774 40.560 50.275 55.892 Caa-C 15.894 27.003 35.800 42.796 48.828 56.878 66.212 73.152 74.946 Source: Moody's. Green Triangle company, a A-rated company, has a market credit spread of 140 basis points on a 7-year bond. The recovery rate is 40%. Calculate: 1. The average hazard rate per year over 7 years using the data from table 19.1 at the end of this assignment 2. The average hazard rate per year over 7 years using credit spreads. 3. What is the expected risk premium earned by bond traders 4. What factors can help to explain the magnitude of the expected risk premium calculated in part c. 5. Assume next that the bond provides a coupon of 5% per year paid semi annually, has a yield of 6% (with continuous compounding) and the risk free yield is flat at 3%(with continuous com- pounding). Assume that default occurs at the end of the year (right before coupon payments). Estimate the default probability assuming that it is the same each year. 20 TABLE 19.1 Average Cumulative Default Rates (%), 1970-2013 Time (years) 1 2 3 4 5 7 10 15 0.000 0.013 0.013 0.037 0.104 0.241 0.489 0.910 1.073 0.022 0.068 0.136 0.260 0.410 0.682 1.017 1.871 3.167 A 0.062 0.199 0.434 0.679 0.958 1.615 2.759 4.583 7.044 Baa 0.174 0.504 0.906 1.373 1.862 2.872 4.623 8.306 11.969 Ba 1.110 3.071 5.371 7.839 10.065 13.911 19.323 28.500 35.410 B 3.904 9.274 14.723 19.509 23.869 31.774 40.560 50.275 55.892 Caa-C 15.894 27.003 35.800 42.796 48.828 56.878 66.212 73.152 74.946 Source: Moody's. Green Triangle company, a A-rated company, has a market credit spread of 140 basis points on a 7-year bond. The recovery rate is 40%. Calculate: 1. The average hazard rate per year over 7 years using the data from table 19.1 at the end of this assignment 2. The average hazard rate per year over 7 years using credit spreads. 3. What is the expected risk premium earned by bond traders 4. What factors can help to explain the magnitude of the expected risk premium calculated in part c. 5. Assume next that the bond provides a coupon of 5% per year paid semi annually, has a yield of 6% (with continuous compounding) and the risk free yield is flat at 3%(with continuous com- pounding). Assume that default occurs at the end of the year (right before coupon payments). Estimate the default probability assuming that it is the same each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts