Question: 20. What is a performance obligation, and how is it used to determine when revenue should be recognized? 21. What are the five steps used

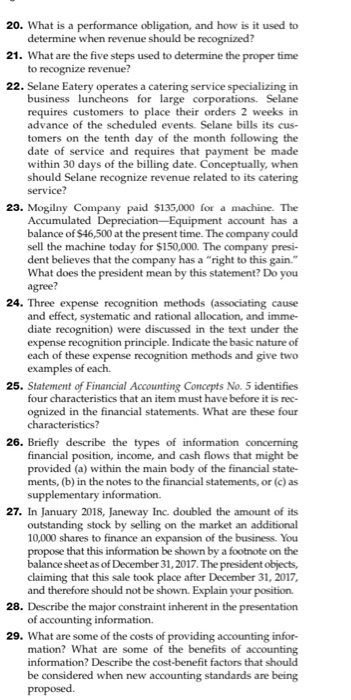

20. What is a performance obligation, and how is it used to determine when revenue should be recognized? 21. What are the five steps used to determine the proper time to recognize revenue? 22. Selane Eatery operates a catering service specializing in business luncheons for large corporations. Selane requires customers to place their orders 2 weeks in advance of the scheduled events. Selane bills its cus- tomers on the tenth day of the month following the date of service and requires that payment be made within 30 days of the billing date. Conceptually, when should Selane recognize revenue related to its catering service? 23. Mogilny Company paid $135,000 for a machine. The Accumulated Depreciation-Equipment account has a balance of $46,500 at the present time. The company could sell the machine today for $150,000. The company presi- dent believes that the company has a right to this gain." What does the president mean by this statement? Do you agree? 24. Three expense recognition methods (associating cause and effect, systematic and rational allocation, and imme- diate recognition) were discussed in the text under the expense recognition principle. Indicate the basic nature of each of these expense recognition methods and give two examples of each. 25. Statement of Financial Accounting Concepts No. 5 identifies four characteristics that an item must have before it is rec- ognized in the financial statements. What are these four characteristics? 26. Briefly describe the types of information concerning financial position, income, and cash flows that might be provided (a) within the main body of the financial state- ments, (b) in the notes to the financial statements, or (c) as supplementary information. 27. In January 2018, Janeway Inc. doubled the amount of its outstanding stock by selling on the market an additional 10,000 shares to finance an expansion of the business. You propose that this information be shown by a footnote on the balance sheet as of December 31, 2017. The president objects, claiming that this sale took place after December 31, 2017, and therefore should not be shown. Explain your position. 28. Describe the major constraint inherent in the presentation of accounting information. 29. What are some of the costs of providing accounting infor- mation? What are some of the benefits of accounting information? Describe the cost-benefit factors that should be considered when new accounting standards are being proposed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts