Question: 20. ZU Question is Uploaded here (Non-anonymous question b1) (9 Points) Question (9 Marks): As a portfolio manager if you got the following information about

20.

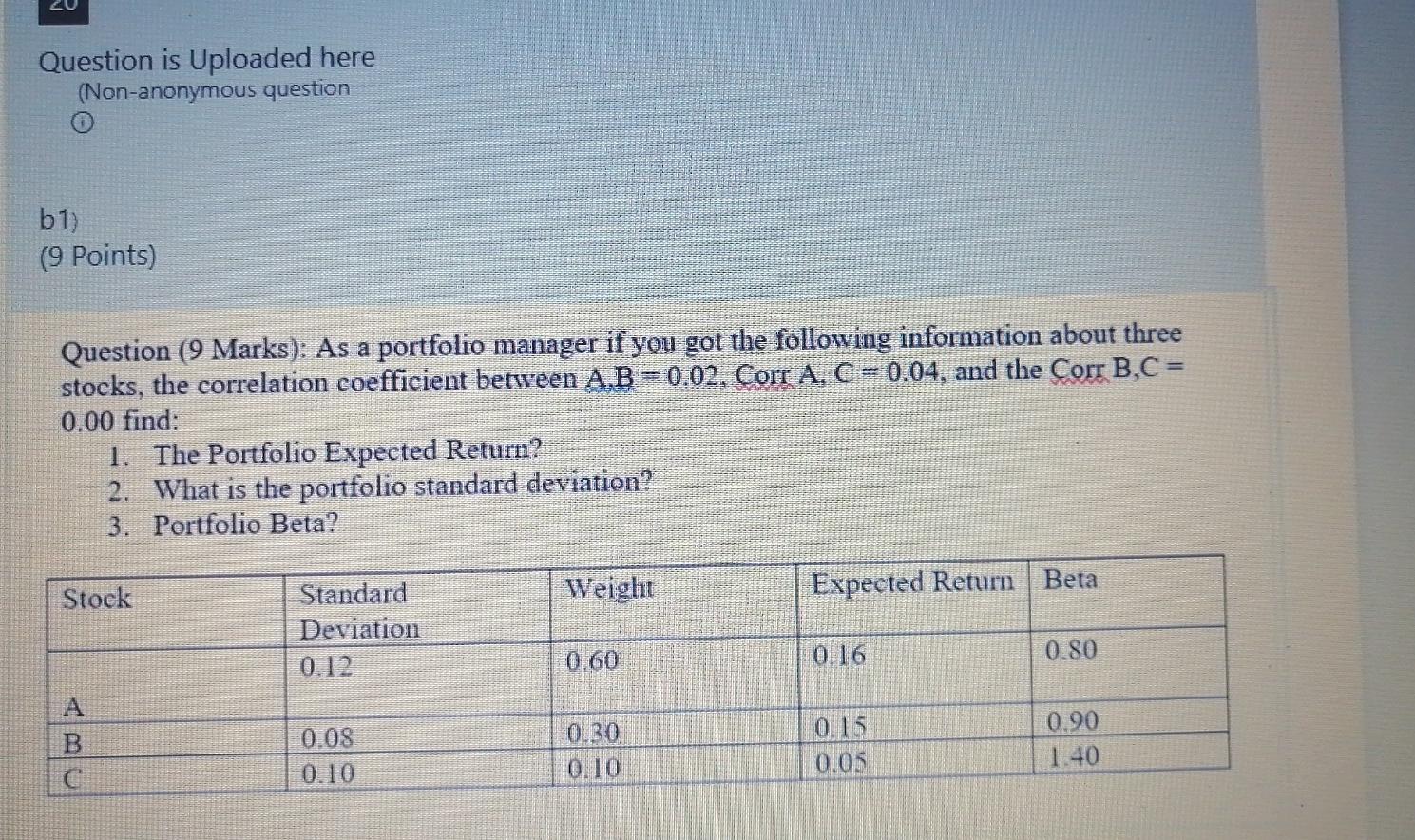

ZU Question is Uploaded here (Non-anonymous question b1) (9 Points) Question (9 Marks): As a portfolio manager if you got the following information about three stocks, the correlation coefficient between A.B = 0.02. Corr A, C = 0.04, and the Corr B,C = 0.00 find: 1. The Portfolio Expected Return? 2. What is the portfolio standard deviation? 3. Portfolio Beta? WW Stock Weight Expected Return Beta Standard Deviation 0.12 0.60 0.16 0.80 A 0.90 B 0.08 0.10 OBO 0.10 0.15 0.05 1.40 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts