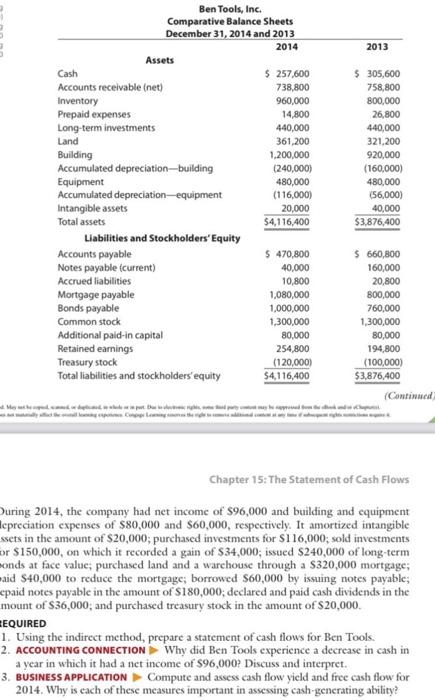

Question: 2013 Ben Tools, Inc. Comparative Balance Sheets December 31, 2014 and 2013 2014 Assets Cash $ 257,600 Accounts receivable (net) 738,800 Inventory 960,000 Prepaid expenses

2013 Ben Tools, Inc. Comparative Balance Sheets December 31, 2014 and 2013 2014 Assets Cash $ 257,600 Accounts receivable (net) 738,800 Inventory 960,000 Prepaid expenses 14,800 Long-term investments 440,000 Land 361,200 Building 1.200,000 Accumulated depreciation-building (240,000) Equipment 480,000 Accumulated depreciation equipment (116,000) Intangible assets 20,000 Total assets $4,116,400 Liabilities and Stockholders' Equity Accounts payable $ 470,800 Notes payable (current) 40.000 Accrued liabilities 10,800 Mortgage payable 1,080,000 Bonds payable 1,000,000 Common stock 1,300,000 Additional paid-in capital 80,000 Retained earnings 254,800 Treasury stock (120,000) Total liabilities and stockholders' equity $4,116,400 $ 305,600 758,800 800,000 26,800 440,000 321,200 920,000 (160,000) 480,000 (56,000) 40,000 $3.876,400 $ 660,800 160,000 20,800 800,000 760,000 1,300,000 80,000 194,800 (100,000) $3.876,400 (Continued Chapter 15: The Statement of Cash Flows During 2014, the company had net income of $96,000 and building and equipment lepreciation expenses of $80,000 and $60,000, respectively. It amortized intangible ssets in the amount of $20,000; purchased investments for $116,000; sold investments or $150,000, on which it recorded a gain of $34,000, issued $240,000 of long-term onds at face value; purchased land and a warchouse through a S320,000 mortgage; aid $40,000 to reduce the mortgage; borrowed $60,000 by issuing notes payable; epaid notes payable in the amount of S180,000; declared and paid cash dividends in the mount of S36,000; and purchased treasury stock in the amount of $20,000 EEQUIRED 1. Using the indirect method, prepare a statement of cash tilows for Ben Tools. 2. ACCOUNTING CONNECTION Why did Ben Tools experience a decrease in cash in a year in which it had a net income of $96,000? Discuss and interpret. 3. BUSINESS APPLICATION Compute and assess cash flow yield and free cash flow for 2014. Why is each of these measures important in assessing cash-generating ability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts