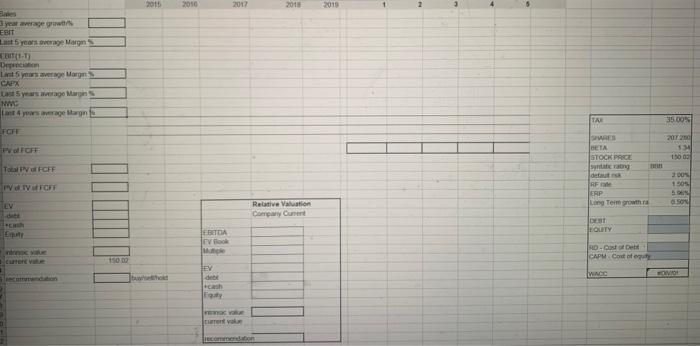

Question: 2015 2010 2017 2011 2010 3 you average EBIT Last 5 years average Margins CBITI Dec Lantys average Mag CAPX Last 5 years ago Mars

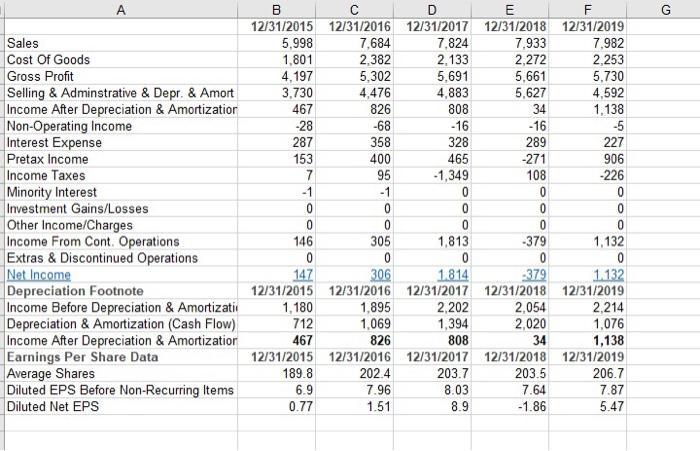

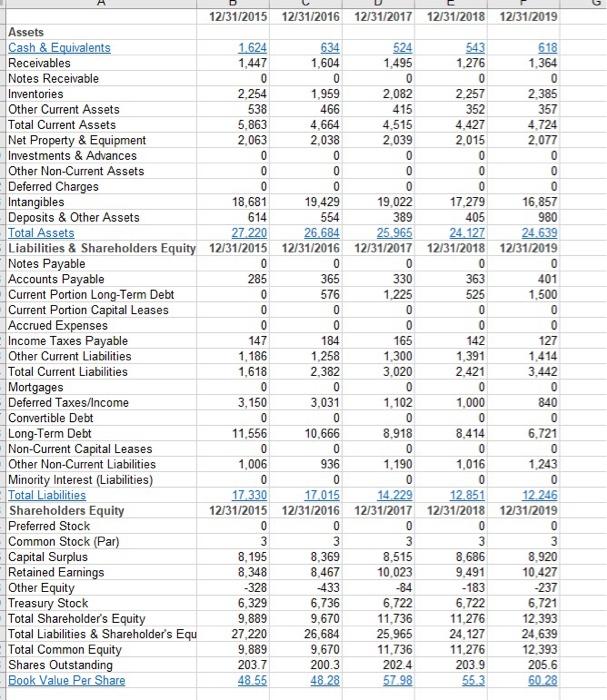

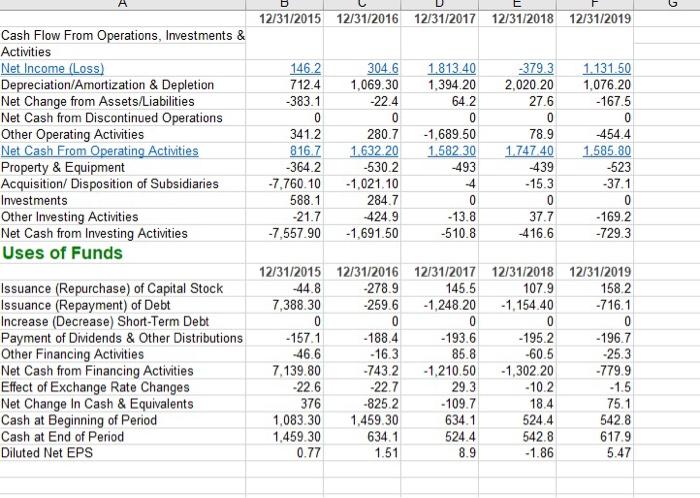

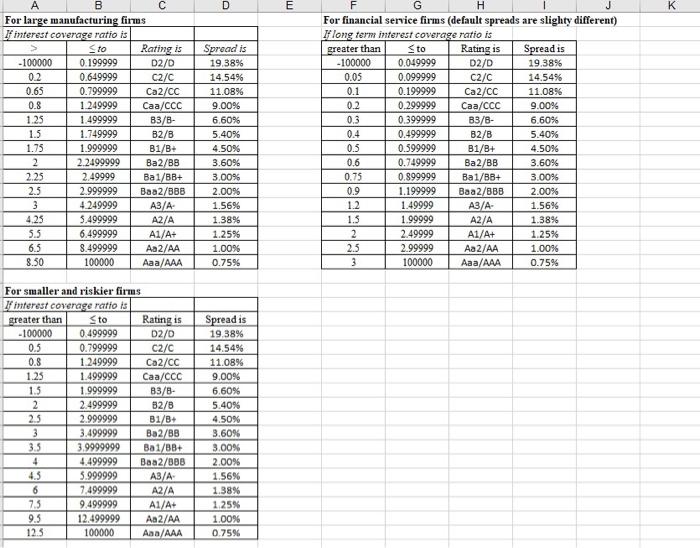

2015 2010 2017 2011 2010 3 you average EBIT Last 5 years average Margins CBITI Dec Lantys average Mag CAPX Last 5 years ago Mars WC Las average Margins TA 3500% FFCF 2012 134 100 Total of FCFF DETA STOCK PRICE state and out (RF on ERP Long Term growth 2005 1305 PV TV FCFT OLSON EV Relative Valuation Comowy Current FOUTY Em EBETDA TV Me DO CAPM Condo 150 EV WING Equity va econdo A G Sales Cost Of Goods Gross Profit Selling & Adminstrative & Depr. & Amort Income After Depreciation & Amortizatior Non-Operating Income Interest Expense Pretax Income Income Taxes Minority Interest Investment Gains/Losses Other Income/Charges Income From Cont. Operations Extras & Discontinued Operations Net Income Depreciation Footnote Income Before Depreciation & Amortizati Depreciation & Amortization (Cash Flow) Income After Depreciation & Amortization Earnings Per Share Data Average Shares Diluted EPS Before Non-Recurring Items Diluted Net EPS B D E F 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 5,998 7,684 7.824 7,933 7.982 1,801 2,382 2,133 2,272 2,253 4,197 5,302 5.691 5,661 5,730 3,730 4.476 4,883 5,627 4,592 467 826 808 34 1,138 -28 -68 - 16 -16 -5 287 358 328 289 227 153 400 465 -271 906 7 95 -1,349 108 -226 -1 -1 0 0 0 0 0 0 0 0 0 0 0 0 0 146 305 1,813 -379 1,132 0 0 0 0 147 306 1814 -379 1.132 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 1,180 1,895 2,202 2,054 2,214 712 1,069 1,394 2,020 1,076 467 826 808 34 1,138 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 189.8 202.4 203.7 203.5 206.7 6.9 7.96 8.03 7.64 7.87 0.77 1.51 -1.86 5.47 8.9 12/31/2017 12/31/2018 12/31/2019 OO 12/31/2015 12/31/2016 Assets Cash & Equivalents 1.624 634 Receivables 1,447 1,604 Notes Receivable 0 0 Inventories 2.254 1,959 Other Current Assets 538 466 Total Current Assets 5.863 4,664 Net Property & Equipment 2,063 2,038 Investments & Advances 0 0 Other Non-Current Assets 0 Deferred Charges 0 Intangibles 18,681 19,429 Deposits & Other Assets 614 554 Total Assets 27.220 26.684 Liabilities & Shareholders Equity 12/31/2015 12/31/2016 Notes Payable 0 0 Accounts Payable 285 365 Current Portion Long-Term Debt 0 576 Current Portion Capital Leases 0 0 Accrued Expenses 0 0 Income Taxes Payable 147 184 Other Current Liabilities 1.186 1,258 Total Current Liabilities 1,618 2.382 Mortgages 0 0 Deferred Taxes/Income 3,150 3,031 Convertible Debt 0 0 Long-Term Debt 11,556 10,666 Non-Current Capital Leases 0 0 Other Non-Current Liabilities 1,006 936 Minority Interest (Liabilities) 0 0 Total Liabilities 17.330 17.015 Shareholders Equity 12/31/2015 12/31/2016 Preferred Stock 0 0 Common Stock (Par) 3 3 Capital Surplus 8.195 8,369 Retained Earnings 8,348 8,467 Other Equity -328 433 Treasury Stock 6,329 6,736 Total Shareholder's Equity 9,889 9,670 Total Liabilities & Shareholder's Equ 27 220 26,684 Total Common Equity 9.889 9,670 Shares Outstanding 203.7 200.3 Book Value Per Share 48.55 48 28 524 1,495 0 2,082 415 4,515 2,039 0 0 0 19,022 389 25.965 12/31/2017 0 330 1.225 0 0 165 1,300 3.020 0 1.102 0 8,918 0 1.190 0 14.229 12/31/2017 543 618 1,276 1,364 0 0 2.257 2.385 352 357 4,427 4,724 2.015 2,077 0 0 0 0 0 0 17,279 16,857 405 980 24.127 24.639 12/31/2018 12/31/2019 0 0 363 401 525 1,500 0 0 0 0 142 127 1,391 1.414 2.421 3.442 0 0 1.000 840 0 0 8,414 6,721 0 0 1,016 1,243 0 0 12.851 12.246 12/31/2018 12/31/2019 0 0 3 3 8,686 8.920 9.491 10,427 - 183 -237 6.722 6,721 11.276 12,393 24.127 24.639 11,276 12.393 203.9 205.6 55.3 60.28 3 8,515 10.023 -84 6,722 11.736 25.965 11.736 202.4 57.98 G 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 Cash Flow From Operations, Investments & Activities Net Income (Loss) Depreciation/Amortization & Depletion Net Change from Assets/Liabilities Net Cash from Discontinued Operations Other Operating Activities Net Cash From Operating Activities Property & Equipment Acquisition/Disposition of Subsidiaries Investments Other Investing Activities Net Cash from Investing Activities Uses of Funds 146.2 712.4 -383.1 0 341.2 816.7 -364.2 -7,760.10 588.1 -21.7 -7,557.90 304.6 1,069.30 -22.4 0 280.7 1.632.20 -530.2 -1,021.10 284.7 424.9 -1.691.50 1.813.40 1.394.20 64.2 0 -1.689.50 1.582.30 -493 -4 0 -13.8 -510.8 -379.3 2,020.20 27.6 0 78.9 1.747.40 -439 -15.3 0 37.7 416.6 1.131.50 1,076 20 -167.5 0 454.4 1.585.80 -523 -37.1 0 - 1692 -729.3 Issuance (Repurchase) of Capital Stock Issuance (Repayment) of Debt Increase (Decrease) Short-Term Debt Payment of Dividends & Other Distributions Other Financing Activities Net Cash from Financing Activities Effect of Exchange Rate Changes Net Change In Cash & Equivalents Cash at Beginning of Period Cash at End of Period Diluted Net EPS 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 -44.8 -278.9 145.5 107.9 158.2 7,388.30 -2596 -1.248.20 -1.154.40 -716.1 0 0 0 0 0 -1571 - 188.4 -193.6 -195.2 -196.7 -46.6 -16.3 85.8 -60.5 -25.3 7,139.80 -743.2 -1.210.50 -1,302.20 -779.9 22.6 -22.7 29.3 - 10.2 -1.5 376 -825.2 -109.7 18.4 75.1 1,083.30 1.459.30 634.1 524.4 542.8 1.459.30 634.1 524.4 542.8 617.9 0.77 1.51 8.9 -1.86 5.47 D E K B For large manufacturing firms If interest coverage ratio is Sto Rating is -100000 0.199999 D2/D 0.2 0.649999 C2/C 0.65 0.799999 Ca2/CC 0.8 1.249999 Caa/CCC 1.25 1.499999 B3/B- 1.5 1.749999 B2/8 1.75 1.999999 B1/B 2 2.2499999 Ba2/88 2.25 2.49999 Ba1/BB+ 2.5 2.999999 Baa2/888 3 4.249999 A3/A 4.25 5.499999 A2/A 5.5 6.499999 A1/A+ 6.5 8.499999 Aa2/AA 8.50 100000 Aaa/AAA Spread is 19.38% 14.54% 11.0896 9.00% 6.60% 5.40% 4.50% 3.60% 3.00% 2.00% 1.56% 1.38% 1.25% 1.00% 0.75% For financial service firms (default spreads are slighty different) If long term interest coverage ratio is greater than

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts