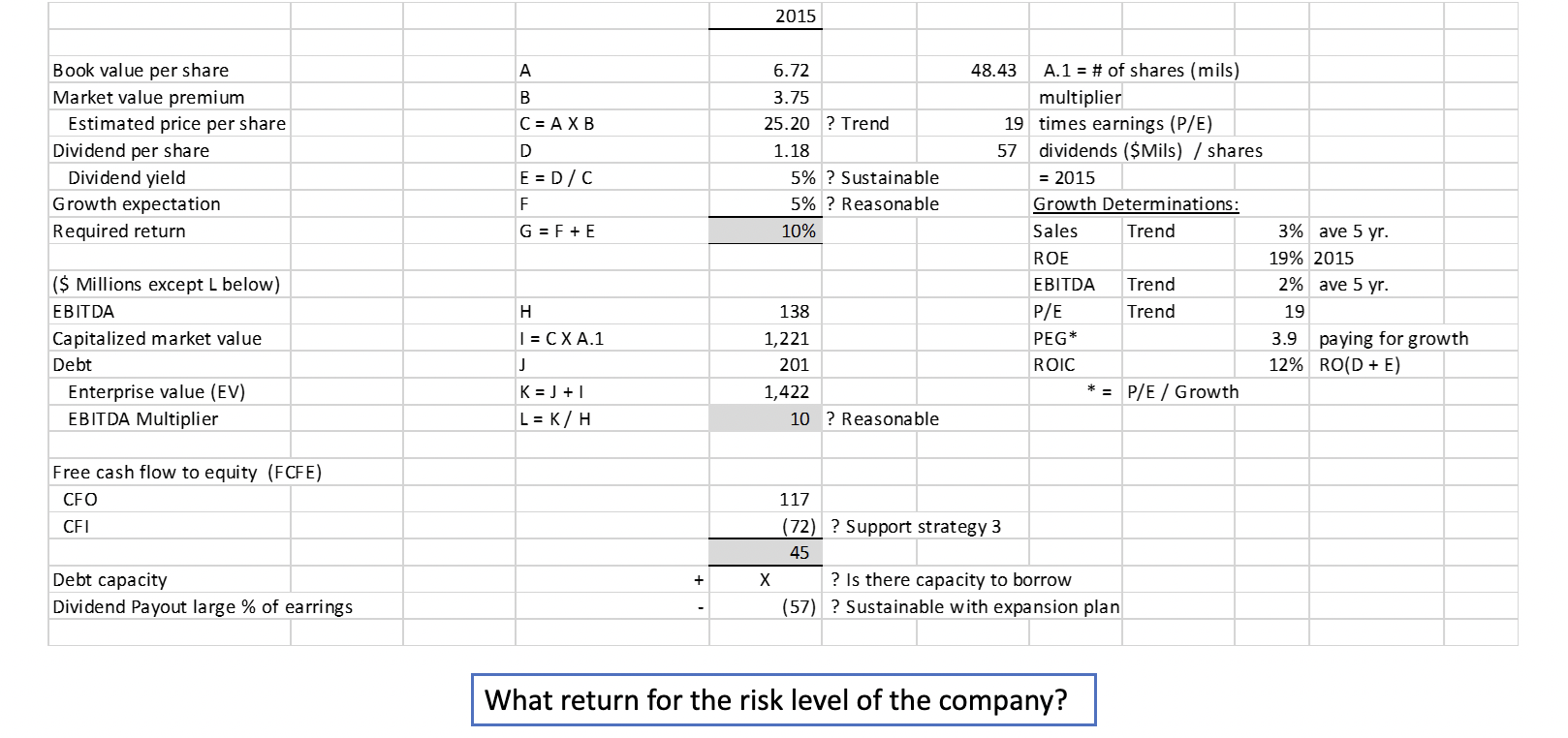

Question: 2015 6.72 3.75 C = AXB 25.20 ? Trend D 1.18 E=D/C F 5% ? Sustainable 5% ? Reasonable Book value per share Market

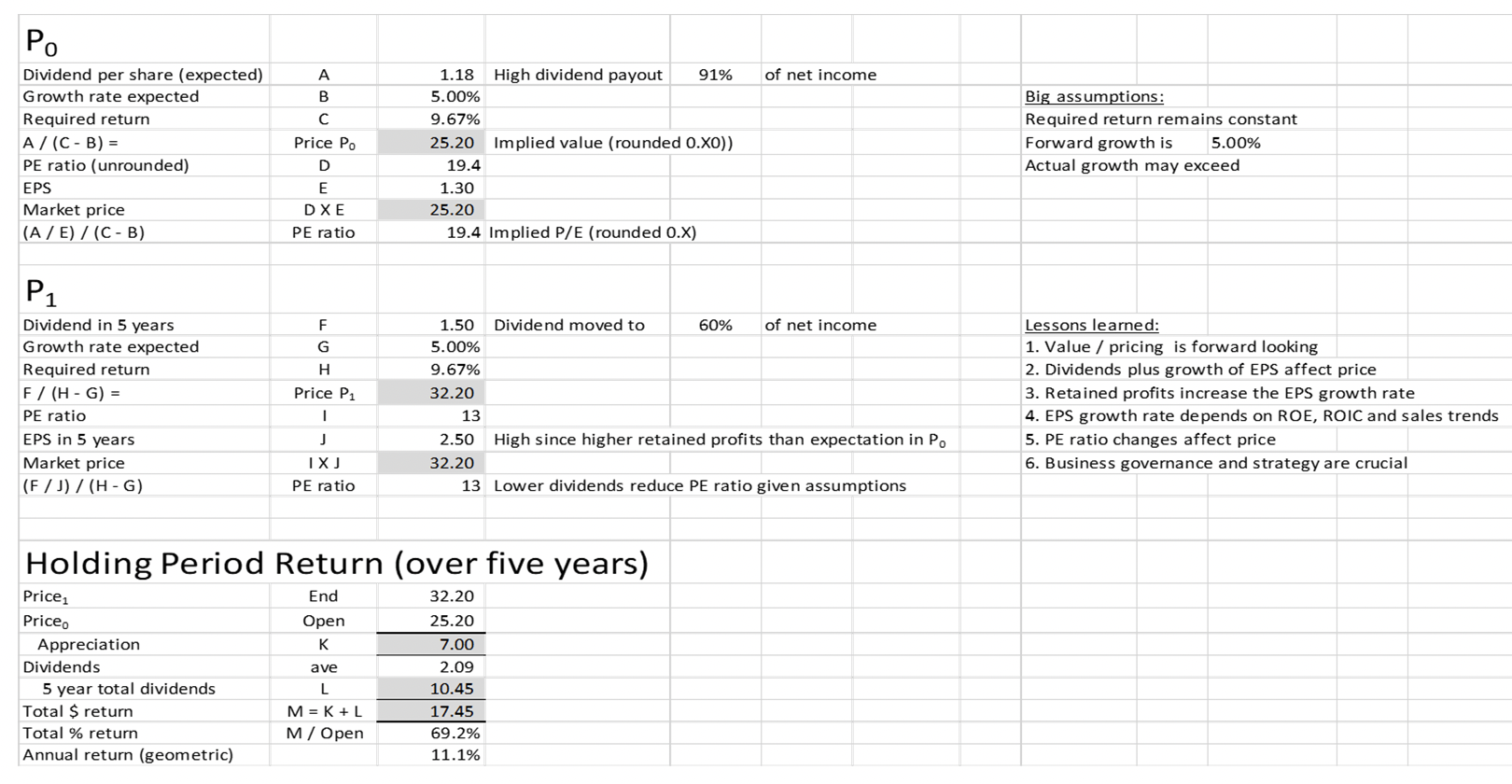

2015 6.72 3.75 C = AXB 25.20 ? Trend D 1.18 E=D/C F 5% ? Sustainable 5% ? Reasonable Book value per share Market value premium Estimated price per share Dividend per share Dividend yield Growth expectation Required return ($ Millions except L below) A B EBITDA Capitalized market value Debt Enterprise value (EV) EBITDA Multiplier Free cash flow to equity (FCFE) CFO CFI Debt capacity Dividend Payout large % of earrings G = F + E 10% H 138 || = CX A.1 J 1,221 201 K=J+1 1,422 L = K/H 10? Reasonable 117 48.43 (72) ? Support strategy 3 A.1 # of shares (mils) multiplier 19 times earnings (P/E) dividends ($Mils) / shares = 2015 Growth Determinations: Sales Trend 3% ave 5 yr. ROE 19% 2015 EBITDA Trend 2% ave 5 yr. P/E Trend 19 PEG 3.9 paying for growth ROIC 12% RO(D+E) * = P/E/ Growth 45 + X ? Is there capacity to borrow (57) ? Sustainable with expansion plan What return for the risk level of the company? Po Dividend per share (expected) A Growth rate expected B 1.18 High dividend payout 91% 5.00% of net income Big assumptions: A/(C-B)= Required return PE ratio (unrounded) EPS Market price (A/E)/(CB) P1 C 9.67% Price Po 25.20 Implied value (rounded 0.XO)) Forward growth is D 19.4 Required return remains constant 5.00% Actual growth may exceed E 1.30 DXE 25.20 PE ratio 19.4 Implied P/E (rounded 0.X) Dividend in 5 years F Growth rate expected G 1.50 Dividend moved to 5.00% 60% of net income Required return H 9.67% F/(H-G)- Price P1 32.20 PE ratio | 13 EPS in 5 years J Market price IXJ (F/J)/(H-G) PE ratio 2.50 High since higher retained profits than expectation in Po 32.20 13 Lower dividends reduce PE ratio given assumptions Lessons learned: 1. Value/pricing is forward looking 2. Dividends plus growth of EPS affect price 3. Retained profits increase the EPS growth rate 4. EPS growth rate depends on ROE, ROIC and sales trends 5. PE ratio changes affect price 6. Business governance and strategy are crucial Holding Period Return (over five years) Price1 End 32.20 Price Dividends Open 25.20 Appreciation K 7.00 ave 2.09 5 year total dividends L 10.45 Total $ return M = K + L 17.45 Total % return M/Open 69.2% Annual return (geometric) 11.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts