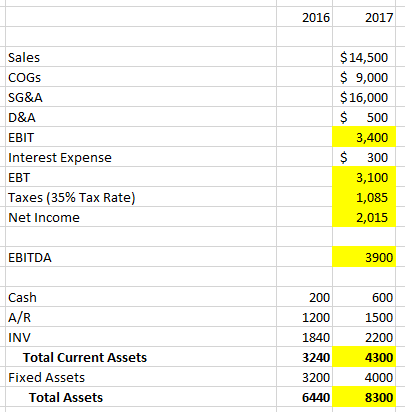

Question: 2016 2017 Sales COGS SG&A D&A EBIT Interest Expense EBT Taxes (35% Tax Rate) Net Income $14,500 $ 9,000 $ 16,000 $ 500 3,400 $

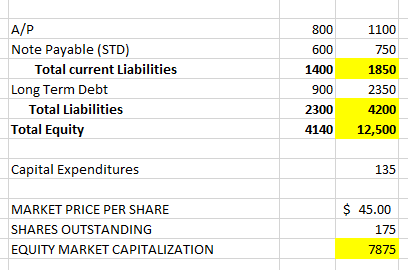

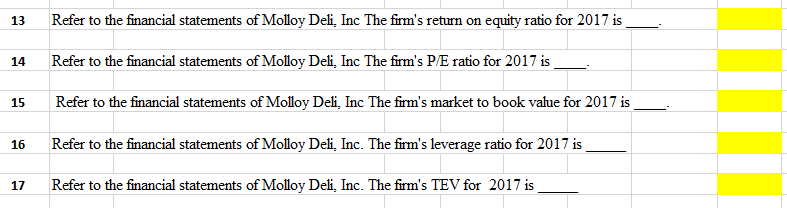

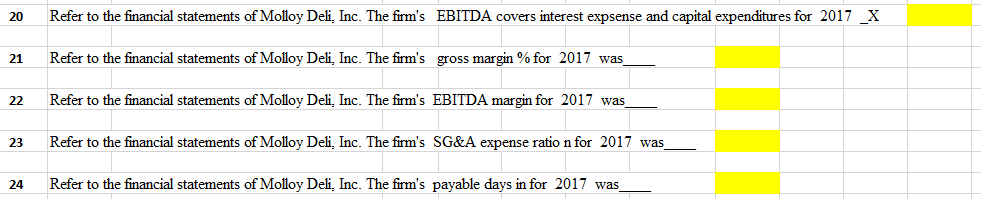

2016 2017 Sales COGS SG&A D&A EBIT Interest Expense EBT Taxes (35% Tax Rate) Net Income $14,500 $ 9,000 $ 16,000 $ 500 3,400 $ 300 3,100 1,085 2,015 EBITDA 3900 200 600 1200 1840 1500 2200 Cash A/R INV Total Current Assets Fixed Assets Total Assets 4300 3240 3200 6440 4000 8300 800 1100 600 750 A/P Note Payable (STD) Total current Liabilities Long Term Debt Total Liabilities Total Equity 1850 2350 1400 900 2300 4140 4200 12,500 Capital Expenditures 135 MARKET PRICE PER SHARE SHARES OUTSTANDING EQUITY MARKET CAPITALIZATION $ 45.00 175 7875 13 Refer to the financial statements of Molloy Deli, Inc The firm's return on equity ratio for 2017 is 14 Refer to the financial statements of Molloy Deli, Inc The firm's P/E ratio for 2017 is 15 Refer to the financial statements of Molloy Deli, Inc The firm's market to book value for 2017 is 16 Refer to the financial statements of Molloy Deli, Inc. The firm's leverage ratio for 2017 is 17 Refer to the financial statements of Molloy Deli Inc. The firm's TEV for 2017 is 20 Refer to the financial statements of Molloy Deli, Inc. The firm's EBITDA covers interest expsense and capital expenditures for 2017 _X 21 Refer to the financial statements of Molloy Deli. Inc. The firm's gross margin % for 2017 was 22 Refer to the financial statements of Molloy Deli Inc. The firm's EBITDA margin for 2017 was 23 Refer to the financial statements of Molloy Deli. Inc. The firm's SG&A expense ratio n for 2017 was 24 Refer to the financial statements of Molloy Deli Inc. The firm's payable days in for 2017 was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts