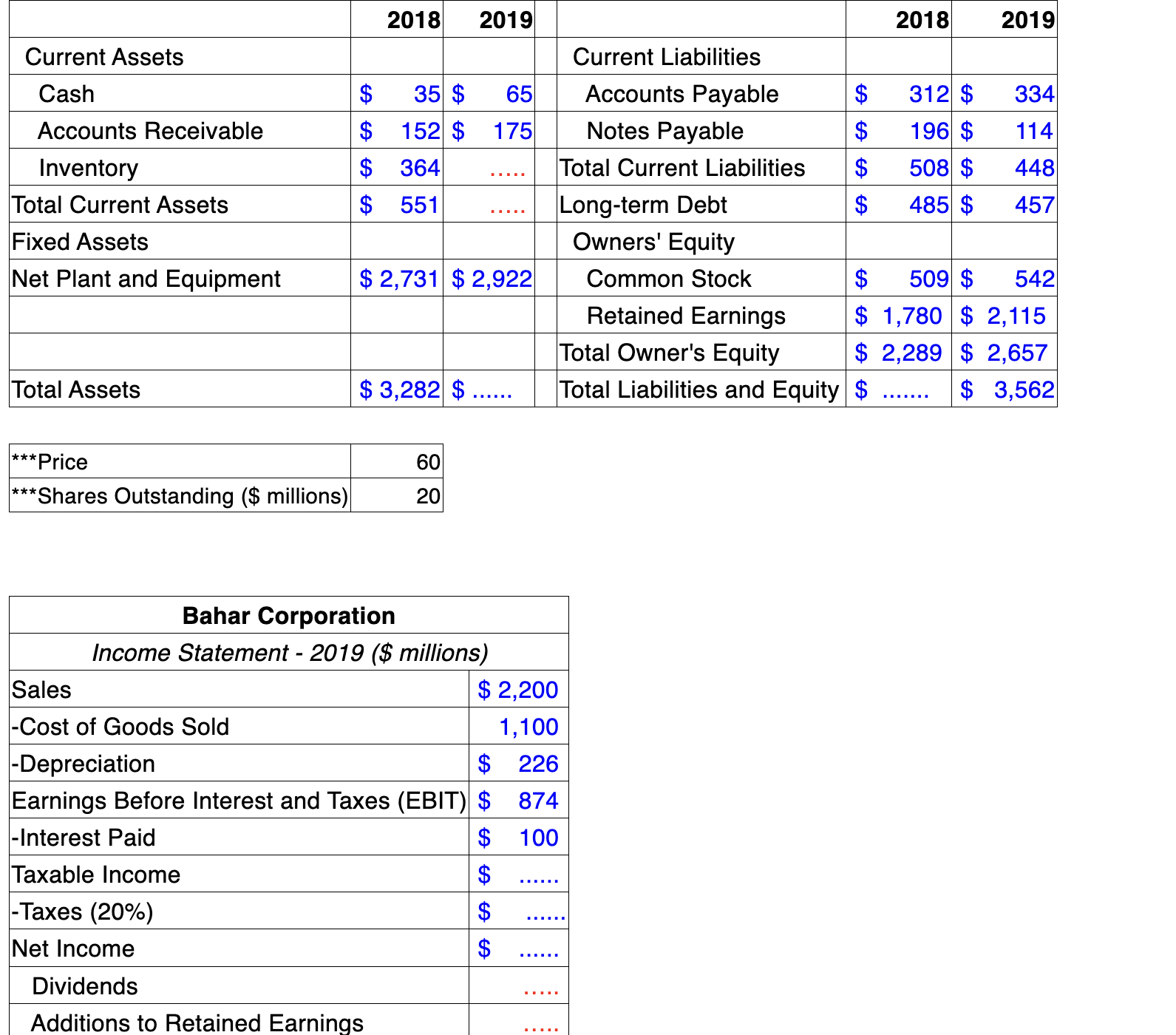

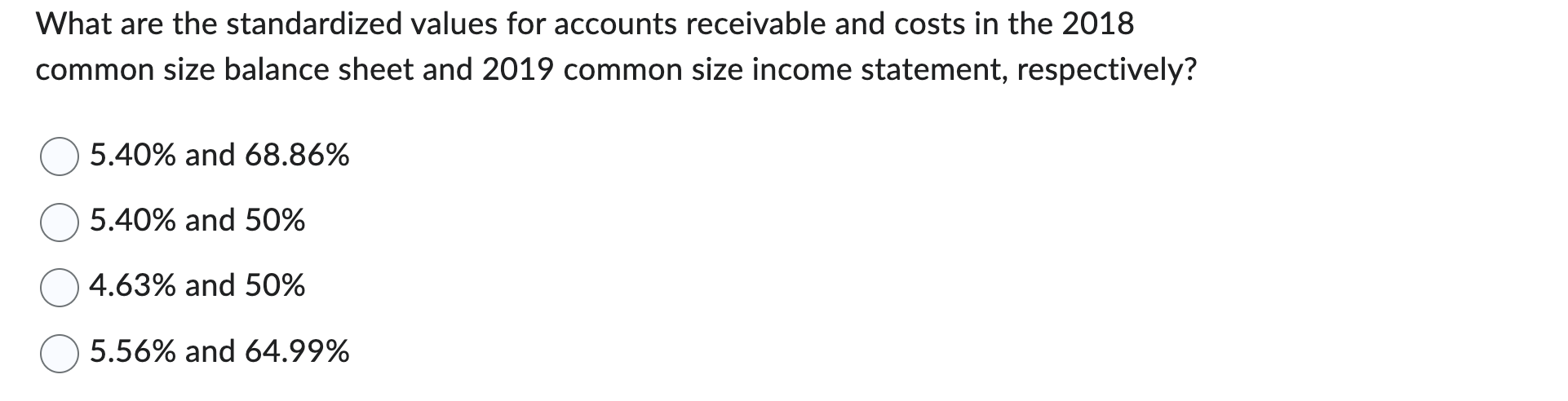

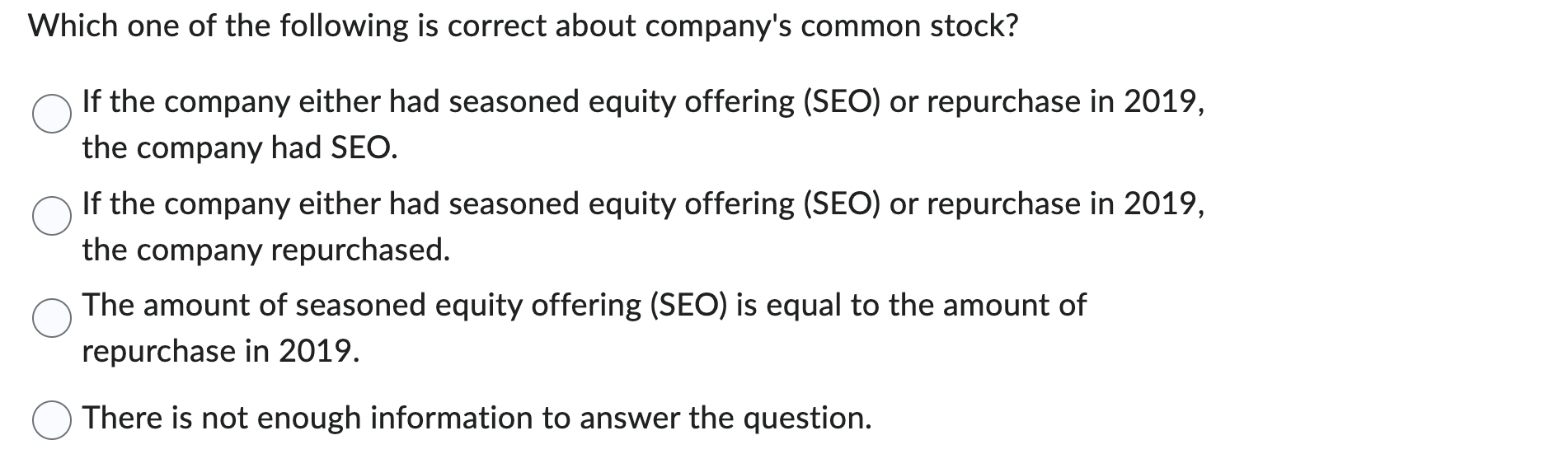

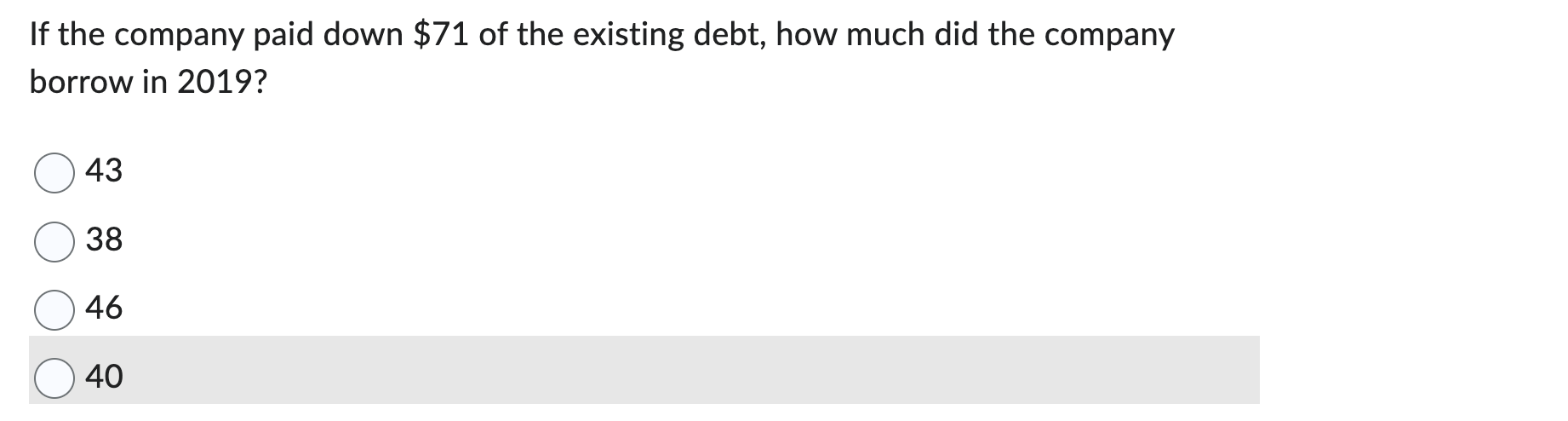

Question: 2018 2019 2013 2019 Current Assets Current Liabilities Cash $ 35 $ 65 Accounts Payable $ 312 $ 334 Accounts Receivable $ 152 $ 175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts