Question: 2018 a. On September 5, opened checking accounts at Second Commercial Bank and negotiated a short-term line of credit of up to $15,000,000 at the

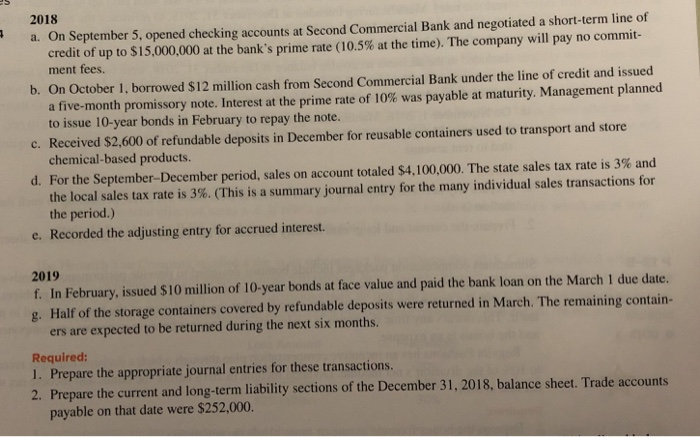

2018 a. On September 5, opened checking accounts at Second Commercial Bank and negotiated a short-term line of credit of up to $15,000,000 at the bank's prime rate (10.5% at the time. The company will pay no commit- ment fees. b. On October 1, borrowed $12 million cash from Second Commercial Bank under the line of credit and issued a five-month promissory note interest at the prime rate of 10% was payable at maturity. Management planned to issue 10-year bonds in February to repay the note. Received $2,600 of refundable deposits in December for reusable containers used to transport and store chemical-based products c. d. For the September-December period, sales on account totaled $4,100,000. The state sales tax rte is 3% and the local sales tax rate is 3% (This is a summary journal entry for the many individual sales transactions for the period.) Recorded the adjusting entry for accrued interest. e. 2019 f. In February, issued $10 million of 10-year bonds at face value and paid the bank loan on the March 1 due date. g. Half of the storage containers covered by refundable deposits were returned in March. The remaining contain- ers are expected to be returned during the next six months. Required: 1. Prepare the appropriate journal entries for these transactions. 2. Prepare the current and long-term liability sections of the December 31, 2018, balance sheet. Trade accounts payable on that date were $252,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts