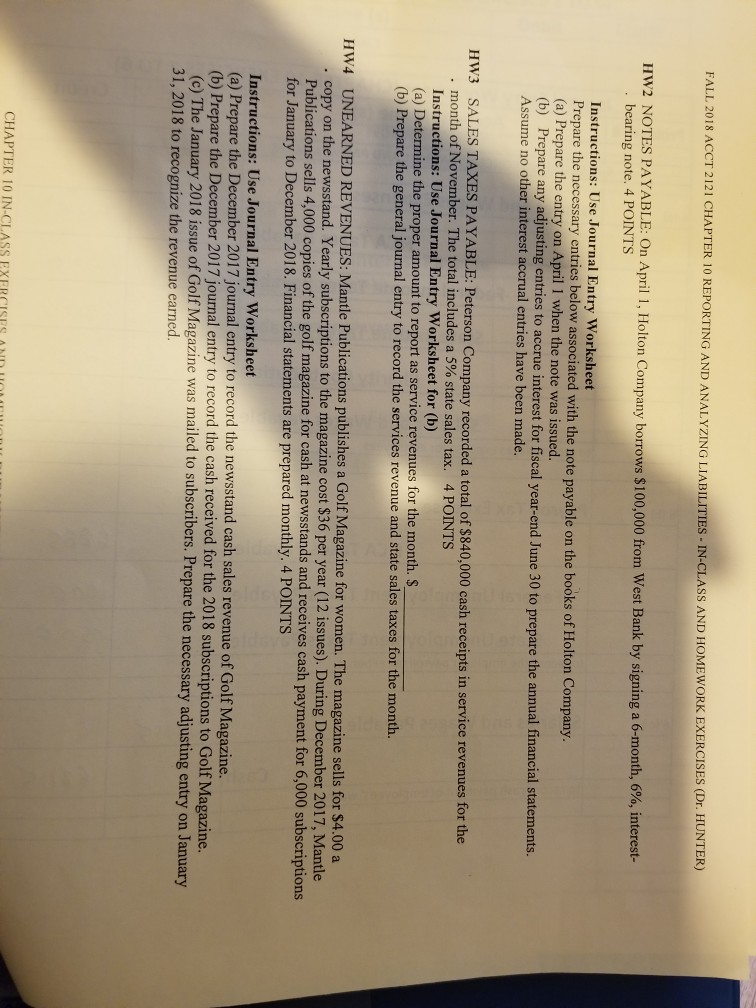

Question: 2018 ACCT 2121 CHAPTER 10 REPORTING AND ANALYZING LIABILITIES IN-CLASS AND HOMEWORK EXERCISES (Dr. HUNTER) E: On April 1, Holton Company borrows $100,000 from West

2018 ACCT 2121 CHAPTER 10 REPORTING AND ANALYZING LIABILITIES IN-CLASS AND HOMEWORK EXERCISES (Dr. HUNTER) E: On April 1, Holton Company borrows $100,000 from West Bank by signing a 6-month, 6%, interest- bearing note, 4 POINTS Instructions: Use Journal Entry Worksheet Prepare the necessary entries below associated with the note payable on the books of Holton Company (a) Prepare the entry on April 1 when the note was issued. (b) Prepare any adjusting entries to accrue interest for fiscal year-end June 30 to prepare the annual financial statements. Assume no other interest accrual entries have been made. Hw3 SALES TAXES PAYABLE: Peterson Company recorded a total of $840,000 cash receipts in service revenues for the month ofNovember. The total includes a 5% state sales tax. 4 POINTS Instructions: Use Journal Entry Worksheet for (b) (a) Determine the proper amount to report as service revenues for the month. $ (b) Prepare the general journal entry to record the services revenue and state sales taxes for the month. UNEARNED REVENUES: Mantle Publications publishes a Golf Magazine for women. The magazine sells for $4.00 a copy on the newsstand. Yearly subscriptions to the magazine cost $36 per year (12 issues). During December 2017, Mantle Publications sells 4,000 Hw4 copies of the golf magazine for cash at newstands and receives cash payment for 6,000 subscriptions for January to December 2018. Financial statements are prepared monthly. 4 POINTS Instructions: Use Journal Entry Worksheet (a) Prepare the December 2017 journal entry to record the newsstand cash sales revenue of Golf Magazine. (b) Prepare the December 2017 journal entry to record the cash received for the 2018 subscriptions to Golf Magazine (c) The January 2018 issue of Golf Magazine was mailed to subscribers. Prepare the neces sary adjusting entry on January 31, 2018 to recognize the revenue earned. CHAPTER 10 IN-CLASS EXERCISES AD n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts