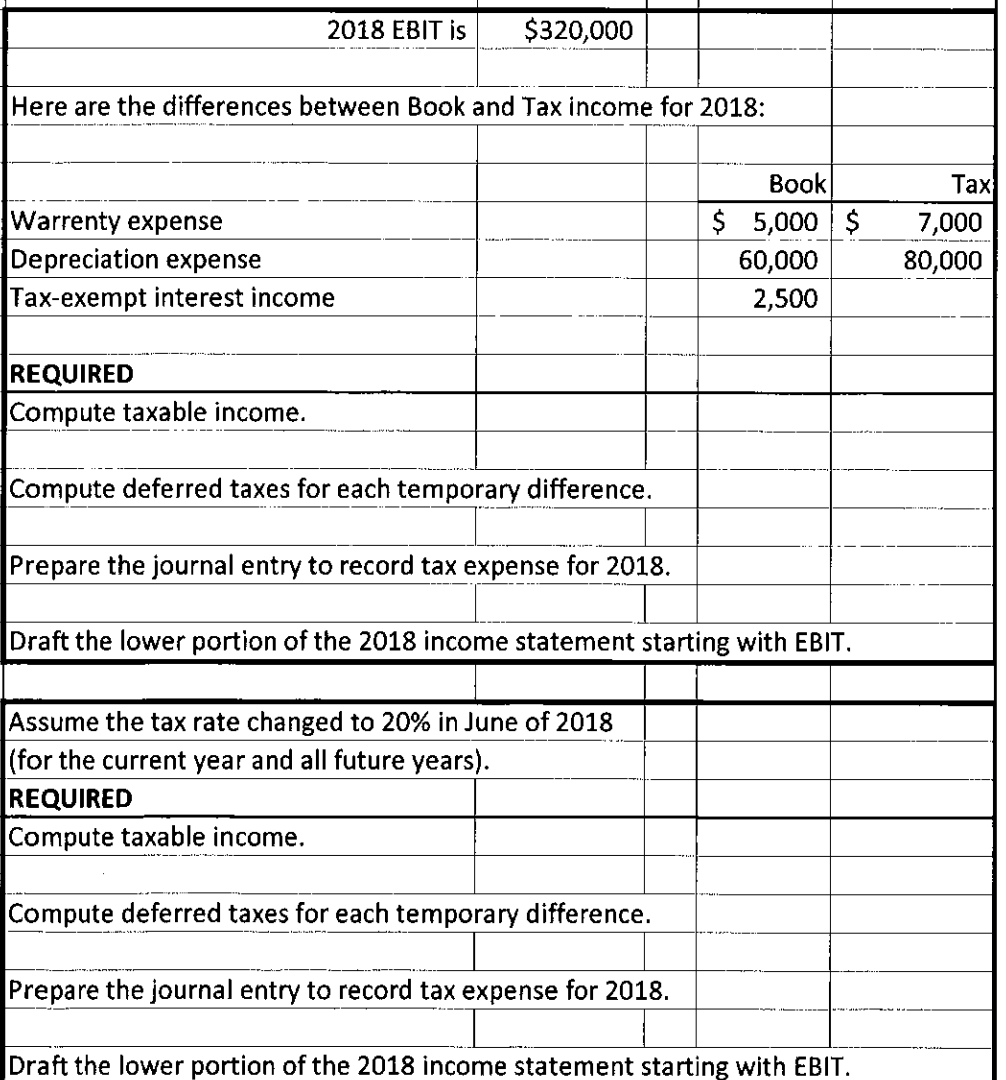

Question: 2018 EBIT is $320,000 Here are the differences between Book and Tax income for 2018: $ Warrenty expense Depreciation expense Tax-exempt interest income Book $

2018 EBIT is $320,000 Here are the differences between Book and Tax income for 2018: $ Warrenty expense Depreciation expense Tax-exempt interest income Book $ 5,000 60,000 2,500 Tax 7,000 80,000 REQUIRED Compute taxable income. Compute deferred taxes for each temporary difference. Prepare the journal entry to record tax expense for 2018. Draft the lower portion of the 2018 income statement starting with EBIT. Assume the tax rate changed to 20% in June of 2018 (for the current year and all future years). REQUIRED Compute taxable income. Compute deferred taxes for each temporary difference. Prepare the journal entry to record tax expense for 2018. Draft the lower portion of the 2018 income statement starting with EBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts