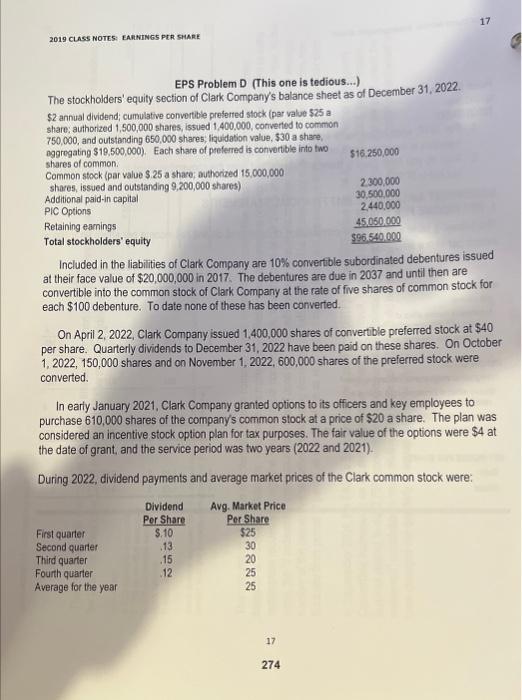

Question: 2019 CLASS NOTE5: EAMEINGS PER SHARE EPS Problem D (This one is tedious...) The stockholders' equity section of Clark Company's balance sheet as of December

2019 CLASS NOTE5: EAMEINGS PER SHARE EPS Problem D (This one is tedious...) The stockholders' equity section of Clark Company's balance sheet as of December 31, 2022. Included in the liabiities of Clark Company are 10% convertible subordinated debentures issued at their face value of $20,000,000 in 2017 . The debentures are due in 2037 and until then are convertible into the common stock of Clark Company at the rate of five shares of common stock for each $100 debenture. To date none of these has been converted. On April 2, 2022, Clark Company issued 1,400,000 shares of convertible preferred stock at $40 per share. Quarterly dividends to December 31,2022 have been paid on these shares. On October 1, 2022, 150,000 shares and on November 1, 2022, 600,000 shares of the preferred stock were converted. In early January 2021, Clark Company granted options to its officers and key employees to purchase 610,000 shares of the company's common stock at a price of $20 a share. The plan was considered an incentive stock option plan for tax purposes. The fair value of the options were $4 at the date of grant, and the service period was two years ( 2022 and 2021). During 2022, dividend payments and average market prices of the Clark common stock were: 2019 CLASS NOTES: EARNINGS PER SHARE Clark Company's consolidated net income for the year ended December 31, 2022, was $11,360,000. Income taxes were computed at a marginal rate of 20%. Instructions: (a) Calculate basic earnings per share for 2022 . Check figure $1.21 (b) Calculate diluted earning per share for 2022 . Check figure $1.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts