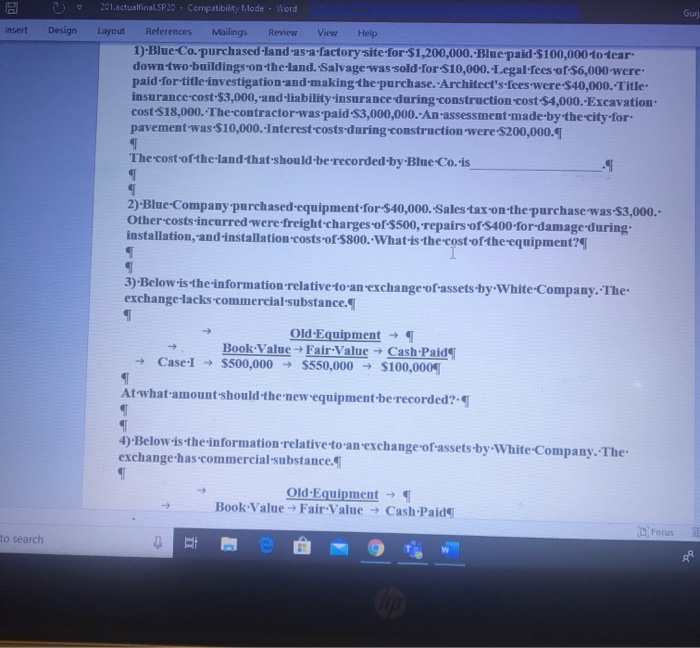

Question: 201.actualfinal.SP20 - Compatibility Mode - Word Guri Insert Design Layout References Mailings Review View Help 1)-Blue-Co. purchased-land-as-a-factorysite-for-$1,200,000.-Blue paid $100,000-to tear down two-buildings on-the-land. Salvage was

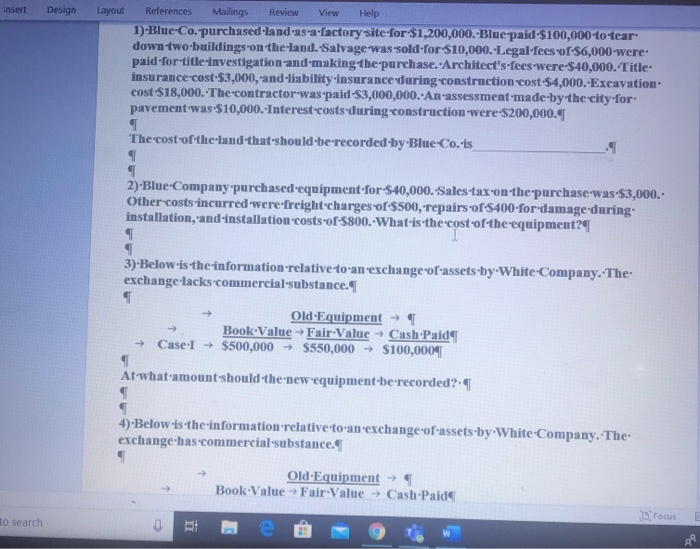

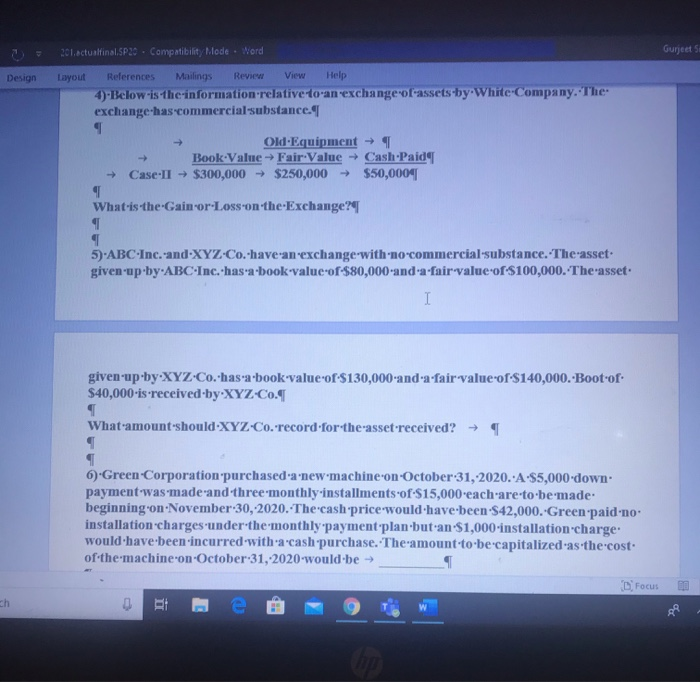

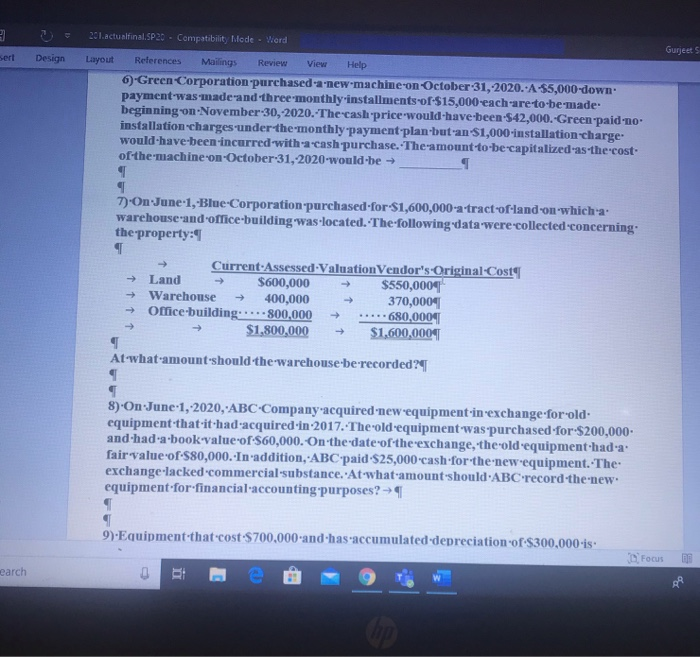

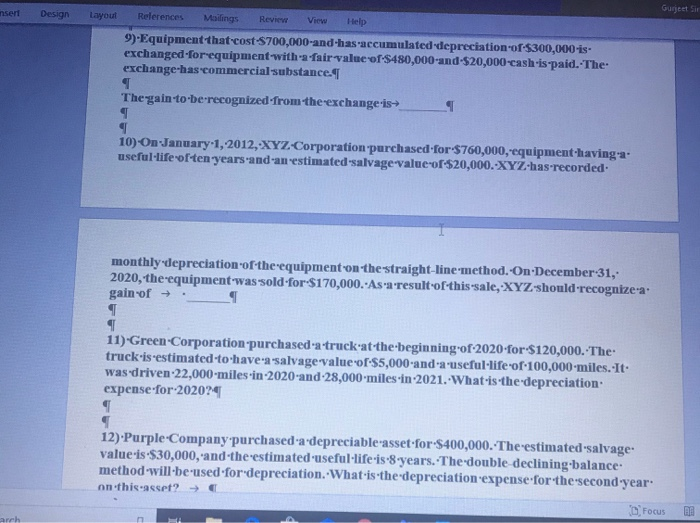

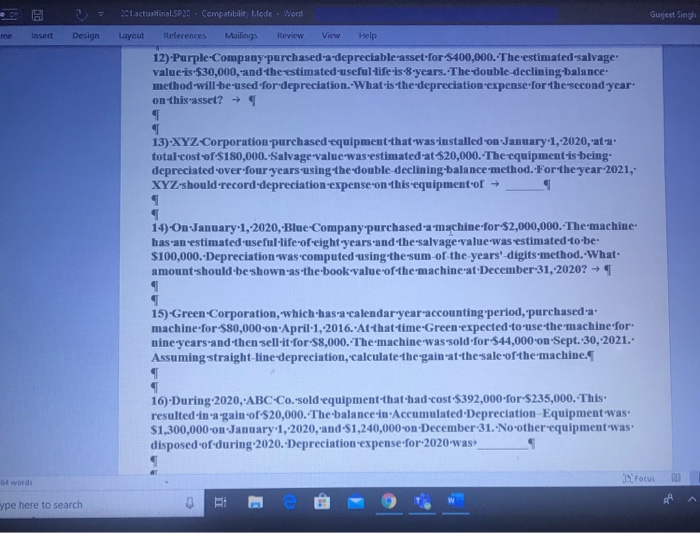

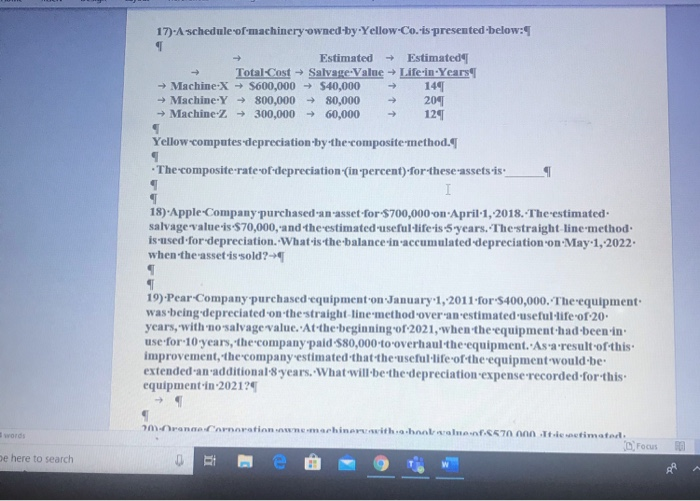

201.actualfinal.SP20 - Compatibility Mode - Word Guri Insert Design Layout References Mailings Review View Help 1)-Blue-Co. purchased-land-as-a-factorysite-for-$1,200,000.-Blue paid $100,000-to tear down two-buildings on-the-land. Salvage was sold for $10,000.-Legal fees of $6,000 were paid-for-title-investigation and making the purchase. Architect's fees were-S40,000. Title insurance cost-$3,000, and liability insurance during construction cost-$4,000.-Excavation: cost-$18,000. The contractor was paid $3,000,000. An assessment made by the city.for pavement was $10,000. Interest.costs during construction were $200,000. The-cost-of-the-land-that-should-be recorded-by-Blue-Co.is 2)-Blue-Company purchased-equipment for $40,000. Sales tax on the purchase was $3,000.- Other-costs-incurred were freight charges of $500, repairs of $400-for-damage during installation, and installationcosts-of-$800. What is the cost of the equipment? 3) Below is the information relative to an exchange-of-assets-by-White-Company. The exchange lacks commercial substance. . Old:Equipment Book Value FairValue Cash Paide CaseI $500,000 - $550,000 $100,000 At'whatamount should the new equipment.be recorded? 1 4).Below is the information relative-to-an-exchange-of-assets-by-White Company. The exchange has commercial substance. Old Equipment Book Value Fair-Value Cash Paide D) Focus to search 0 RI Insert Design Layout References Review Mailings View Help 1) Blue Co. purchased land as-a-factory site for $1,200,000.-Blue paid $100,000 to tear down two-buildings on-the-land. Salvage was sold for $10,000.-Legal fees of $6,000 were paid-for-title-investigation and making the purchase. Architect's fees-were-$40,000. Title: insurance-cost-$3,000, and liability insurance during construction cost $4,000. Excavation cost $18,000. The contractor was paid $3,000,000.-An assessment made by the city for pavement was $10,000. Interest-costs-during construction were $200,000.0 T The cost of the land that should-be-recorded-by-Blue-Co. is 4 2).Blue-Company purchased equipment for $40,000. Sales tax-on-the purchase was $3,000.- Other-costs-incurred-were-freight charges of $500, repairs-ofS400-for-damage-during installation, and installation costs-of-$800.-What-is-the-cost-ofthe-equipment? 1 3)-Below is the information relative to an exchange-of-assets-by-White-Company. The exchange-lacks commercial-substance. . Old Equipment 1 Book Value - Fair-Value Cash Paide Case:I + $500,000 $550,000 $100,000 At what amount should the new equipment be recorded? 4).Below is the information relative to an exchange-of-assets-by-White-Company. The exchange has commercial-substance. Old Equipment Book Value Fair-Value Cash Paid to search Focus 201.actualfinal.SP20 - Compatibility Mode - Word Gurjeets Design Layout Review View References Mailings Help 4)-Below is the information relative to an exchange of assets by White Company. The exchange has commercial substance. 9 Old Equipment Book Value - Fair.Value Cash Paid Case-II $300,000 $250,000 $50,000|| 1 What-is-the-Gain or Loss on the Exchange? 1 1 5)-ABC Inc.-and-XYZ-Co. have an exchange with no commercial substance. The asset given up by.ABC Inc. has-a-book-value-of-$80,000-and-a-fair-value of $100,000. The asset I given up by XYZ Co. has-a-book value of $130,000-and-a-fair value of $140,000.-Boot-of- $40,000-is received by XYZ.Co. 1 What amount should XYZ.Co.'record for the asset received? 6) Green Corporation purchased a new machine on October 31, 2020.-A-$5,000-down: payment was made and three monthly installments-of-$15,000 each are to be made. beginning on November 30, 2020. The cash price would have been $42,000.-Green-paid.no installation charges under the monthly payment plan-butan $1,000-installation charge. would have been incurred with a 'cash'purchase. The amount to be capitalized as the cost of the machine on October 31, 2020 would be D. Focus ch 201.actualfinal.SP20 - Compatibilit Mode . Word Gurjeet 5 Sert Design Layout View References Mailings Review Help -Green-Corporation purchased a new machine on October 31, 2020. A-$5,000-down: payment was made and three monthly installments-of-$15,000 each are to be made. beginning on November-30, 2020. The cash price would have been $42,000.-Green paid no installation charges under the monthly payment plan-butan $1,000-installation charge would have been incurred-with-a-cash purchase. The amount-to-be-capitalized-as-the-cost of the machine-on-October 31, 2020-would-be 1 7)-On June-1,-Blue-Corporation purchased for $1,600,000 -a -tract-of-land-on whicha: warehouse and office building was located. The following data were collected-concerning the property: T Current Assessed Valuation Vendor's Original Costa Land $600,000 $550,0001 Warehouse 400,000 370,00041 Office building.....800,000 .....680,000 $1,800,000 $1,600,000 At what-amount should the warehouse-be-recorded? -> 8) On June 1, 2020,"ABC-Company acquired new equipment-in-exchange-for-old equipment that it-hadacquired in 2017. The-old-equipment was purchased-for-S200,000 and had a book value of $60,000. On the date of the exchange, the old equipment hada fair value of $80,000. In addition, ABC paid $25,000 cash for the new equipment. The exchange-lacked-commercial substance. At what amount should'ABC-record the new equipment for financial accounting purposes? 9) Equipment that cost:$ 700,000 and has accumulated depreciation of $300,000 is. Focus earch nsert Design Gurjeet Sie Layout References Mailings Review View Help 9)-Equipment that cost-$700,000-and-has-accumulated depreciation of $300,000 -is- exchanged-for-equipment with-a-fair value of $480,000-and-$20,000-cash-is-paid. The exchange-hascommercial substance. The gain-to-be-recognized from the exchange-is- 9 10)-On-January 1, 2012, XYZ-Corporation purchased-for-$760,000,-equipment-havinga. useful life of ten years and an estimated-salvage value of $20,000.-XYZ has recorded monthly depreciation of the equipment on the straight-line-method. On December 31, 2020, the equipment was sold for $170,000.-As'a result of this sale, -XYZ-should-recognize a. gain of 1 11) Green Corporation purchased-a-truck at the beginning of-2020-for-$120,000. The truck-is-estimated-to-have-a-salvage value of $5,000 and a useful life of 100,000 miles. It was-driven-22,000 miles-in-2020-and-28,000 miles-in-2021. What-is-the-depreciation expense-for-202024 12).Purple Company purchased a depreciable asset-for-$400,000. The estimated-salvage value-is-$30,000, and the estimated useful life-is-8 years. The double declining balance method will be used for depreciation. What-isthe-depreciation-expense for the second year on this asset? D Focus arch . 201.actualfinal.SP20 - Compatibilit, t.lode . Word Gurjeet Singh Insert Design Layout Review References Mailings View Help 12)-Purple-Company purchased-a-depreciable asset-for-$400,000. The estimated-salvage value-is-$30,000, and the estimated-useful-life-is-8-years. The double declining balance method will be used fordepreciation. What is the depreciation-expense for the second year on this asset? 1 13).XYZ-Corporation purchased-equipment that was installed on January 1, 2020, ata total cost of $180,000. Salvage value was estimated-at-$20,000.-The-equipment-is-being. depreciated over four years using the double declining balance method. For the year 2021, XYZ-should-record-depreciation-expense-on-this-equipment of 9 14) On-January 1, 2020,-Blue-Company purchased a machine-for-$2,000,000. The machine has an estimated-useful-life-of-eight years and the salvage-value-was-estimated to be $100,000.Depreciation was-computed using the sum of the years' -digits method. What amount should be shown-as-the-book value of the machine at December 31, 2020? 15)-Green Corporation, which has a calendar year accounting period, purchased a machine-for-580,000 on April 1, 2016. At that time-Green-expected to use the machine for nine years and then sell-it-for-$8,000. The machine was sold for $44,000 on Sept. 30, 2021. Assuming straight-line depreciation, calculate the gain at the sale of the machine. 16) During 2020, ABC Co.'sold equipment that had cost-$392,000 for $235,000. This resulted-in-a-gain of S20,000. The balance in Accumulated Depreciation Equipment was $1,300,000 on January 1, 2020, and $1,240,000 on December 31. No other equipment was disposed-of-during-2020. Depreciation-expense for 2020 was 54 words Focus i ype here to search 17)-A schedule of machinery owned by Yellow-Co-is presented below: Estimated Estimated Total-Cost - Salvage Value Life-in-Years Machine X - $600,000 $40,000 149 Machine Y 800,000 80,000 209 Machine Z 300,000 60,000 124 Yellow computes depreciation by the composite-method. The-composite-rate-of-depreciation (in percent) for these-assets is 9 I 9 18) Apple-Company purchased an asset-for-$700,000 on April 1, 2018. The estimated: salvage-value-is-S70,000, and the estimated useful life-is-5-years. The straight line-method is used for depreciation. What is the balance-in-accumulated depreciation on May 1, 2022 when the asset is sold? 1 19).Pear-Company purchased equipment on January 1, 2011 for $400,000. The equipment was being depreciated on the straight line method over an estimated useful life of 20 years, with no salvage value. At the beginning of 2021, when the equipment had been in use for 10 years, the company paid $80,000 to overhaul the equipment. As a result of this improvement, the company estimated that the useful life of the equipment would be extended an additional 8 years. What will be the depreciation expense recorded for this equipment in 202124 om Orange Corneration owne machinervavitha-haak walanc570 000 Tesetimated 3 words Focus be here to search E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts