Question: 2022 pdt - Adobe Acrobat Reader DC (32-01) Window Help Assignment 2 Wint... * 1255 The CEO of LifeGamer, Pat Millerano has asked you to

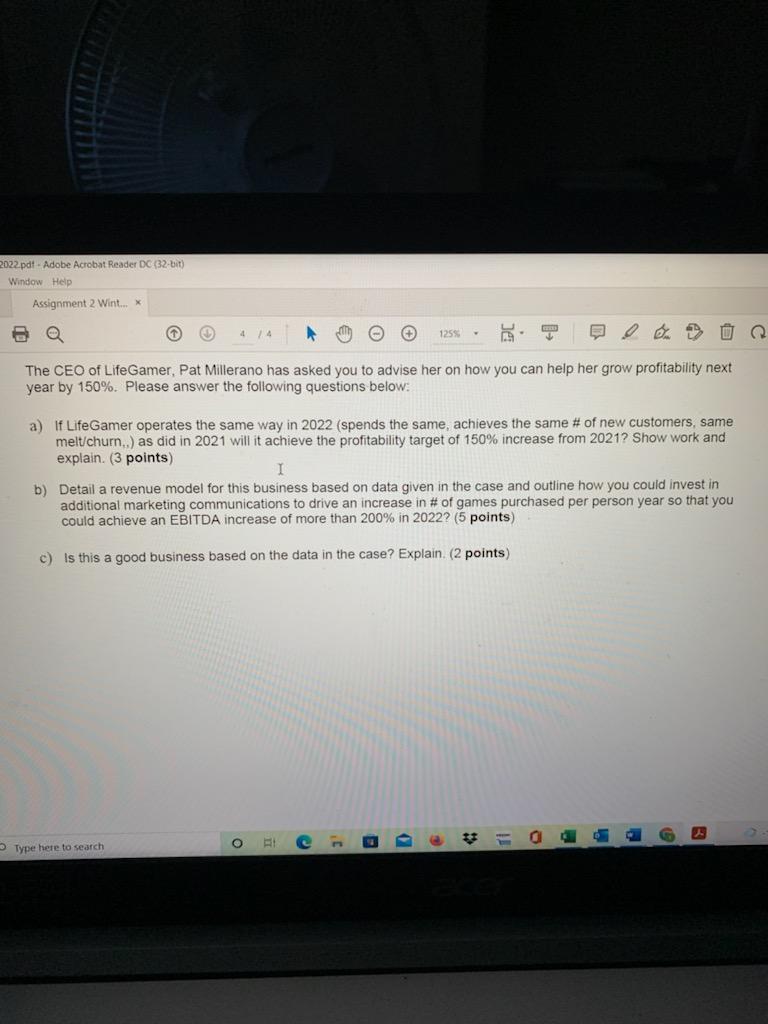

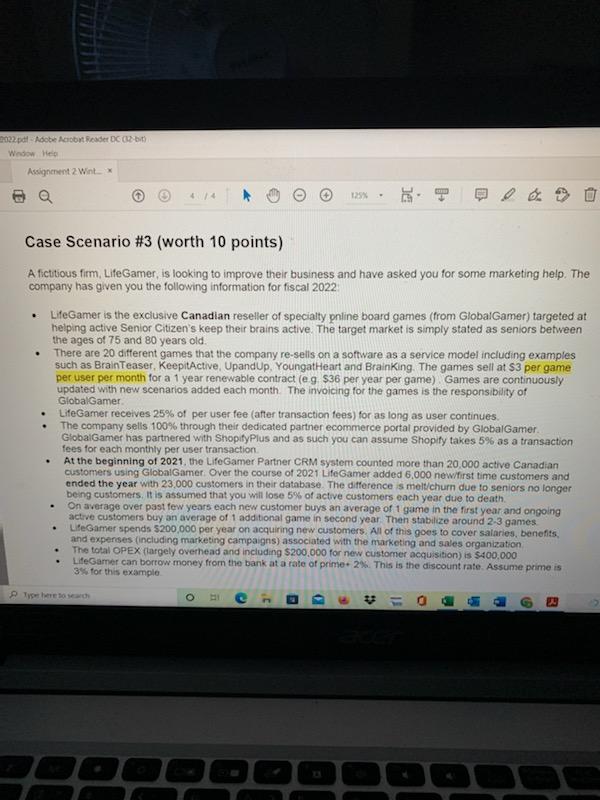

2022 pdt - Adobe Acrobat Reader DC (32-01) Window Help Assignment 2 Wint... * 1255 The CEO of LifeGamer, Pat Millerano has asked you to advise her on how you can help her grow profitability next year by 150%. Please answer the following questions below: a) If LifeGamer operates the same way in 2022 (spends the same, achieves the same # of new customers, same melt/churn.) as did in 2021 will it achieve the profitability target of 150% increase from 2021? Show work and explain. (3 points) b) Detail a revenue model for this business based on data given in the case and outline how you could invest in additional marketing communications to drive an increase in # of games purchased per person year so that you could achieve an EBITDA increase of more than 200% in 2022? (5 points) c) Is this a good business based on the data in the case? Explain (2 points) o g Type here to search D > 0022.pdf Adobe Acrobat Reader DC | | | Assignment 2 Wint. 125 D Case Scenario #3 (worth 10 points) A fictitious firm, LifeGamer, is looking to improve their business and have asked you for some marketing help. The company has given you the following information for fiscal 2022 LifeGamer is the exclusive Canadian reseller of specialty online board games (from GlobalGamer) targeted at helping active Senior Citizen's keep their brains active. The target market is simply stated as seniors between the ages of 75 and 80 years old. There are 20 different games that the company re-seils on a software as a service model including examples such as BrainTeaser, KeepitActive, UpandUp, YoungatHeart and Brainking. The games sell at $3 per game per user per month for a 1 year renewable contract (eg S36 per year per game) Games are continuously updated with new scenarios added each month The invoicing for the games is the responsibility of GlobalGamer LifeGamer receives 25% of per user fee (after transaction fees) for as long as user continues The company sells 100% through their dedicated partner ecommerce portal provided by GlobalGamer. GlobalGamer has partnered with ShopifyPlus and as such you can assume Shopify takes 5% as a transaction fees for each monthly per user transaction At the beginning of 2021, the LifeGamer Partner CRM system counted more than 20,000 active Canadian customers using GlobalGamer. Over the course of 2021 LifeGamer added 6,000 new/first time customers and ended the year with 23,000 customers in their database. The difference is melt/churn due to seniors no longer being customers. It is assumed that you will lose 5% of active customers each year due to death On average over past few years each new customer buys an average of 1 game in the first year and ongoing active customers buy an average of 1 additional game in second year. Then stabilize around 2-3 games LiteGamer spends 5200,000 per year on acquiring new customers. All of this goes to cover salaries, benefits and expenses (including marketing campaigns) associated with the marketing and sales organization The total OPEX (largely overhead and including $200.000 for new customer acquisition) is $400,000 LifeGamer can borrow money from the bank at a rate of prime 2%. This is the discount rate. Assume prime is 3% for this example . O > 20 2022 pdt - Adobe Acrobat Reader DC (32-01) Window Help Assignment 2 Wint... * 1255 The CEO of LifeGamer, Pat Millerano has asked you to advise her on how you can help her grow profitability next year by 150%. Please answer the following questions below: a) If LifeGamer operates the same way in 2022 (spends the same, achieves the same # of new customers, same melt/churn.) as did in 2021 will it achieve the profitability target of 150% increase from 2021? Show work and explain. (3 points) b) Detail a revenue model for this business based on data given in the case and outline how you could invest in additional marketing communications to drive an increase in # of games purchased per person year so that you could achieve an EBITDA increase of more than 200% in 2022? (5 points) c) Is this a good business based on the data in the case? Explain (2 points) o g Type here to search D > 0022.pdf Adobe Acrobat Reader DC | | | Assignment 2 Wint. 125 D Case Scenario #3 (worth 10 points) A fictitious firm, LifeGamer, is looking to improve their business and have asked you for some marketing help. The company has given you the following information for fiscal 2022 LifeGamer is the exclusive Canadian reseller of specialty online board games (from GlobalGamer) targeted at helping active Senior Citizen's keep their brains active. The target market is simply stated as seniors between the ages of 75 and 80 years old. There are 20 different games that the company re-seils on a software as a service model including examples such as BrainTeaser, KeepitActive, UpandUp, YoungatHeart and Brainking. The games sell at $3 per game per user per month for a 1 year renewable contract (eg S36 per year per game) Games are continuously updated with new scenarios added each month The invoicing for the games is the responsibility of GlobalGamer LifeGamer receives 25% of per user fee (after transaction fees) for as long as user continues The company sells 100% through their dedicated partner ecommerce portal provided by GlobalGamer. GlobalGamer has partnered with ShopifyPlus and as such you can assume Shopify takes 5% as a transaction fees for each monthly per user transaction At the beginning of 2021, the LifeGamer Partner CRM system counted more than 20,000 active Canadian customers using GlobalGamer. Over the course of 2021 LifeGamer added 6,000 new/first time customers and ended the year with 23,000 customers in their database. The difference is melt/churn due to seniors no longer being customers. It is assumed that you will lose 5% of active customers each year due to death On average over past few years each new customer buys an average of 1 game in the first year and ongoing active customers buy an average of 1 additional game in second year. Then stabilize around 2-3 games LiteGamer spends 5200,000 per year on acquiring new customers. All of this goes to cover salaries, benefits and expenses (including marketing campaigns) associated with the marketing and sales organization The total OPEX (largely overhead and including $200.000 for new customer acquisition) is $400,000 LifeGamer can borrow money from the bank at a rate of prime 2%. This is the discount rate. Assume prime is 3% for this example . O > 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts