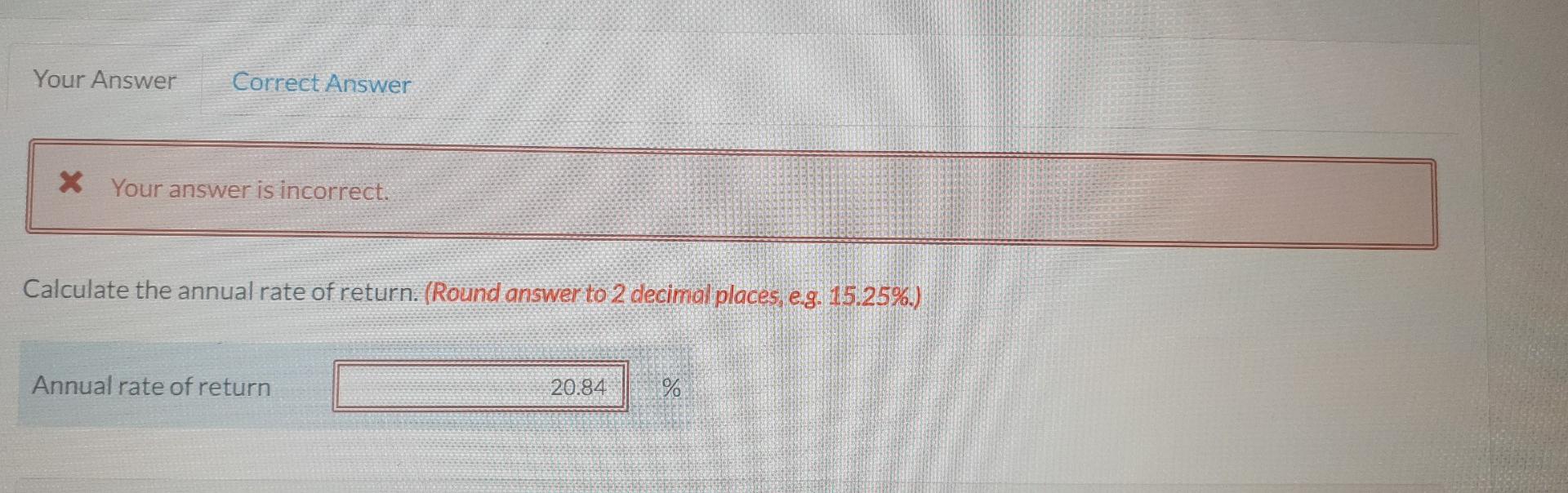

Question: 20.83 is also wrong Sweet Acacia Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following

20.83 is also wrong

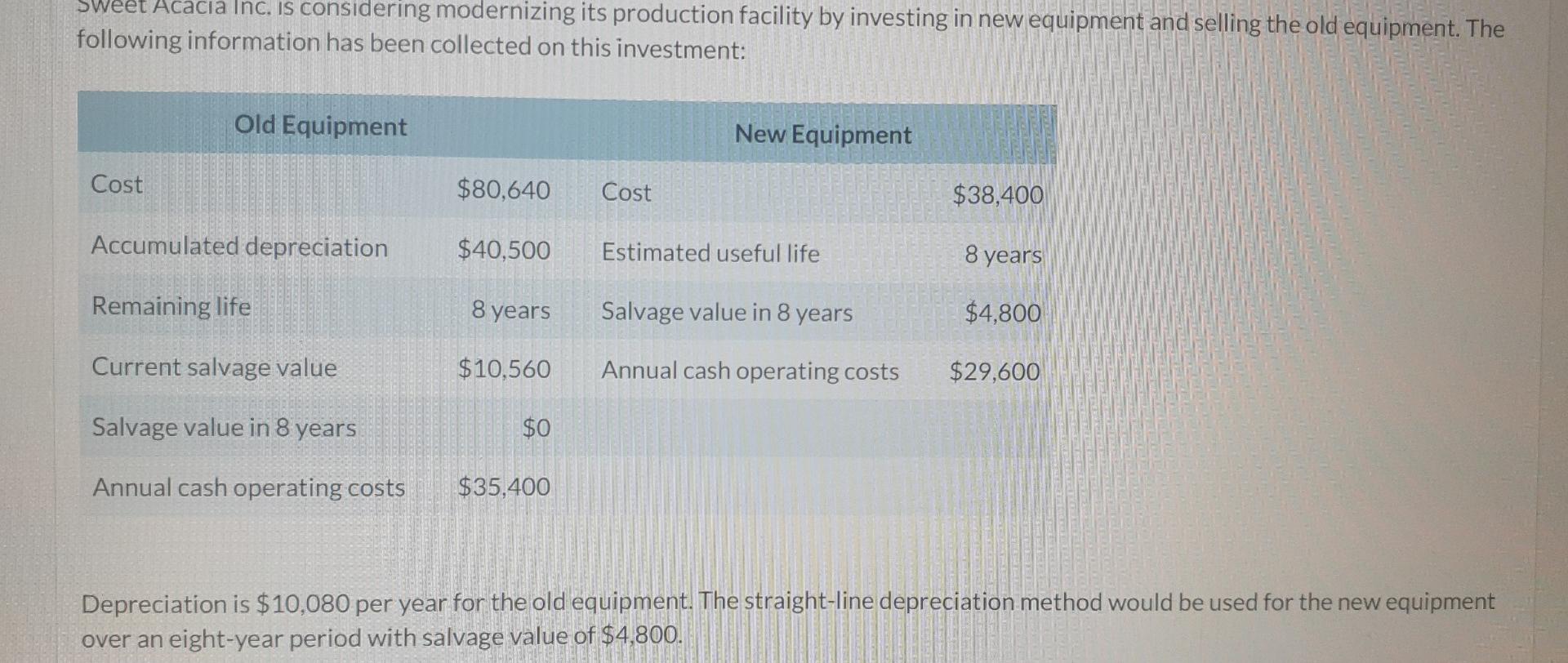

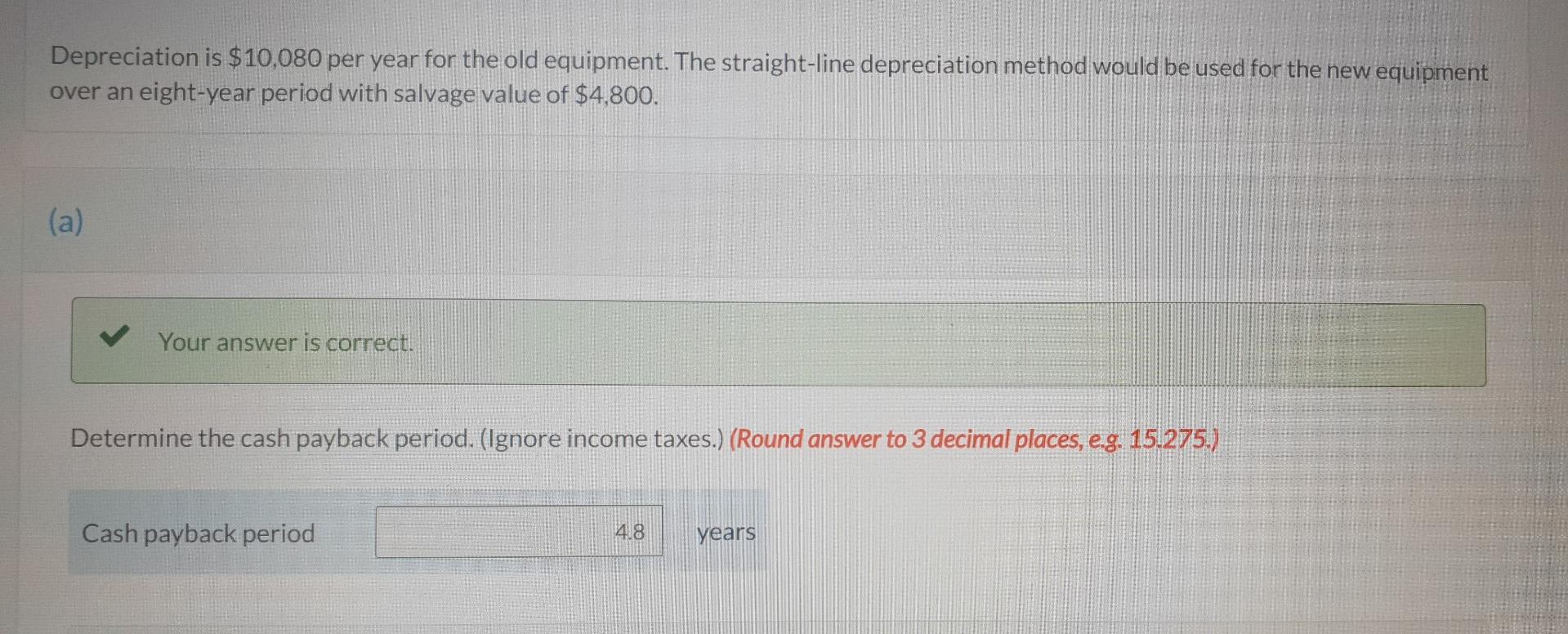

Sweet Acacia Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Old Equipment New Equipment Cost $80,640 Cost $38,400 Accumulated depreciation $40,500 Estimated useful life 8 years Remaining life 8 years Salvage value in 8 years . $4,800 Current salvage value $10,560 Annual cash operating costs $29,600 Salvage value in 8 years $0 Annual cash operating costs $35,400 Depreciation is $10,080 per year for the old equipment. The straight-line depreciation method would be used for the new equipment over an eight-year period with salvage value of $4,800. Depreciation is $10,080 per year for the old equipment. The straight-line depreciation method would be used for the new equipment over an eight-year period with salvage value of $4,800. (a) Your answer is correct. Determine the cash payback period. (Ignore income taxes.) (Round answer to 3 decimal places, e.g. 15.275.) Cash payback period 4.8 years Your Answer Correct Answer * Your answer is incorrect. Calculate the annual rate of return. (Round answer to 2 decimal places, eg. 15.25%.) Annual rate of return 20.84 %Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock