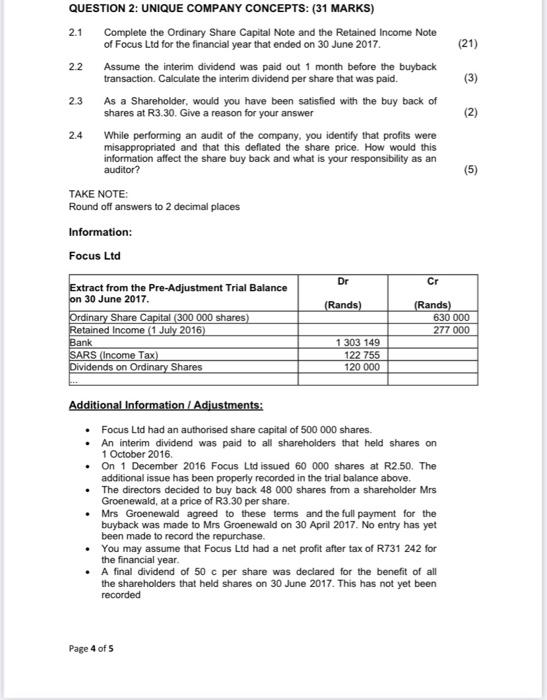

Question: 2.1 (21) ( (3 2.2 (3) 23 (2) QUESTION 2: UNIQUE COMPANY CONCEPTS: (31 MARKS) Complete the Ordinary Share Capital Note and the Retained Income

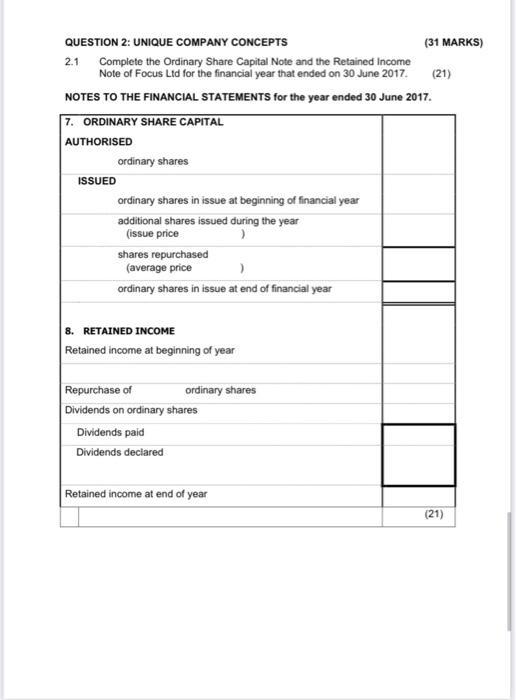

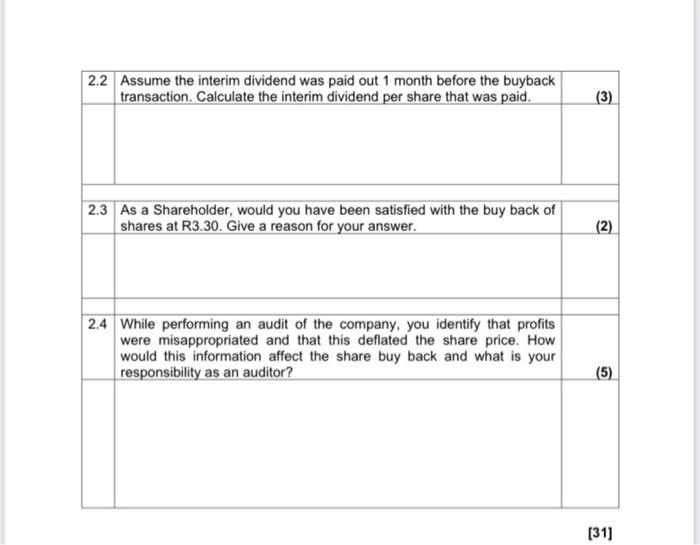

2.1 (21) ( (3 2.2 (3) 23 (2) QUESTION 2: UNIQUE COMPANY CONCEPTS: (31 MARKS) Complete the Ordinary Share Capital Note and the Retained Income Note of Focus Ltd for the financial year that ended on 30 June 2017. Assume the interim dividend was paid out 1 month before the buyback transaction. Calculate the interim dividend per share that was paid. As a Shareholder, would you have been satisfied with the buy back of shares at R3.30. Give a reason for your answer While performing an audit of the company, you identify that profits were misappropriated and that this deflated the share price. How would this information affect the share buy back and what is your responsibility as an auditor? TAKE NOTE: Round off answers to 2 decimal places Information: Focus Ltd 2.4 (5) Dr Cr (Rands) Extract from the Pre-Adjustment Trial Balance on 30 June 2017. Ordinary Share Capital (300 000 shares) Retained Income (1 July 2016) Bank SARS (Income Tax) Dividends on Ordinary Shares (Rands) 630 000 277 000 1 303 149 122 755 120 000 Additional Information / Adjustments: Focus Ltd had an authorised share capital of 500 000 shares. . An interim dividend was paid to all shareholders that held shares on 1 October 2016 On 1 December 2016 Focus Ltd issued 60 000 shares at R2.50. The additional issue has been properly recorded in the trial balance above. The directors decided to buy back 48 000 shares from a shareholder Mrs Groenewald, at a price of R3.30 per share. Mrs Groenewald agreed to these terms and the full payment for the buyback was made to Mrs Groenewald on 30 April 2017. No entry has yet been made to record the repurchase. You may assume that Focus Ltd had a net profit after tax of R731 242 for the financial year A final dividend of 50 c per share was declared for the benefit of all the shareholders that held shares on 30 June 2017. This has not yet been recorded Page 4 of 5 QUESTION 2: UNIQUE COMPANY CONCEPTS (31 MARKS) 2.1 Complete the Ordinary Share Capital Note and the Retained Income Note of Focus Ltd for the financial year that ended on 30 June 2017 (21) NOTES TO THE FINANCIAL STATEMENTS for the year ended 30 June 2017. 7. ORDINARY SHARE CAPITAL AUTHORISED ordinary shares ISSUED ordinary shares in issue at beginning of financial year additional shares issued during the year (issue price shares repurchased (average price ordinary shares in issue at end of financial year 8. RETAINED INCOME Retained income at beginning of year Repurchase of ordinary shares Dividends on ordinary shares Dividends paid Dividends declared Retained income at end of year (21) 2.2 Assume the interim dividend was paid out 1 month before the buyback transaction. Calculate the interim dividend per share that was paid. (3) 2.3 As a Shareholder, would you have been satisfied with the buy back of shares at R3.30. Give a reason for your answer. (2) ) 2.4 While performing an audit of the company, you identify that profits were misappropriated and that this deflated the share price. How would this information affect the share buy back and what is your responsibility as an auditor? (5) [31] 2.1 (21) ( (3 2.2 (3) 23 (2) QUESTION 2: UNIQUE COMPANY CONCEPTS: (31 MARKS) Complete the Ordinary Share Capital Note and the Retained Income Note of Focus Ltd for the financial year that ended on 30 June 2017. Assume the interim dividend was paid out 1 month before the buyback transaction. Calculate the interim dividend per share that was paid. As a Shareholder, would you have been satisfied with the buy back of shares at R3.30. Give a reason for your answer While performing an audit of the company, you identify that profits were misappropriated and that this deflated the share price. How would this information affect the share buy back and what is your responsibility as an auditor? TAKE NOTE: Round off answers to 2 decimal places Information: Focus Ltd 2.4 (5) Dr Cr (Rands) Extract from the Pre-Adjustment Trial Balance on 30 June 2017. Ordinary Share Capital (300 000 shares) Retained Income (1 July 2016) Bank SARS (Income Tax) Dividends on Ordinary Shares (Rands) 630 000 277 000 1 303 149 122 755 120 000 Additional Information / Adjustments: Focus Ltd had an authorised share capital of 500 000 shares. . An interim dividend was paid to all shareholders that held shares on 1 October 2016 On 1 December 2016 Focus Ltd issued 60 000 shares at R2.50. The additional issue has been properly recorded in the trial balance above. The directors decided to buy back 48 000 shares from a shareholder Mrs Groenewald, at a price of R3.30 per share. Mrs Groenewald agreed to these terms and the full payment for the buyback was made to Mrs Groenewald on 30 April 2017. No entry has yet been made to record the repurchase. You may assume that Focus Ltd had a net profit after tax of R731 242 for the financial year A final dividend of 50 c per share was declared for the benefit of all the shareholders that held shares on 30 June 2017. This has not yet been recorded Page 4 of 5 QUESTION 2: UNIQUE COMPANY CONCEPTS (31 MARKS) 2.1 Complete the Ordinary Share Capital Note and the Retained Income Note of Focus Ltd for the financial year that ended on 30 June 2017 (21) NOTES TO THE FINANCIAL STATEMENTS for the year ended 30 June 2017. 7. ORDINARY SHARE CAPITAL AUTHORISED ordinary shares ISSUED ordinary shares in issue at beginning of financial year additional shares issued during the year (issue price shares repurchased (average price ordinary shares in issue at end of financial year 8. RETAINED INCOME Retained income at beginning of year Repurchase of ordinary shares Dividends on ordinary shares Dividends paid Dividends declared Retained income at end of year (21) 2.2 Assume the interim dividend was paid out 1 month before the buyback transaction. Calculate the interim dividend per share that was paid. (3) 2.3 As a Shareholder, would you have been satisfied with the buy back of shares at R3.30. Give a reason for your answer. (2) ) 2.4 While performing an audit of the company, you identify that profits were misappropriated and that this deflated the share price. How would this information affect the share buy back and what is your responsibility as an auditor? (5) [31]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts