Question: 21 23 Which statement below is incorrect? O A. Fama-French factors drive nsk premiums B. Assets with lower expected returns might be attractive if they

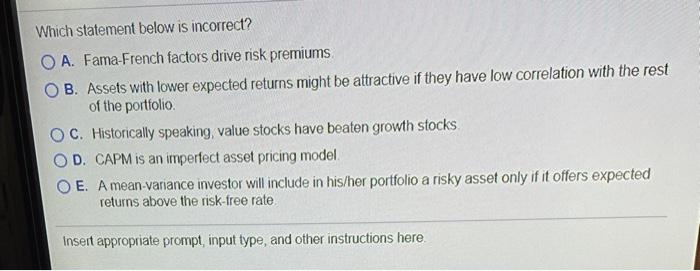

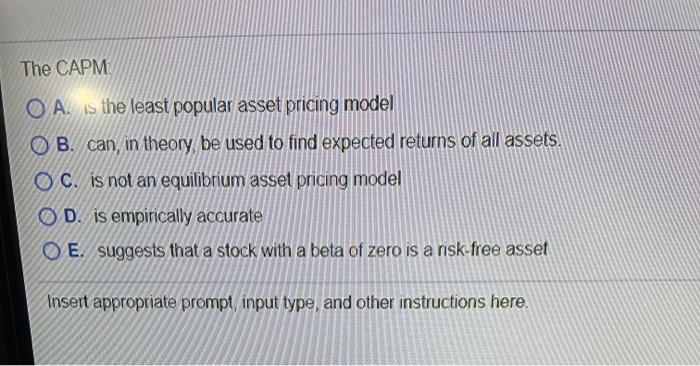

Which statement below is incorrect? O A. Fama-French factors drive nsk premiums B. Assets with lower expected returns might be attractive if they have low correlation with the rest of the portfolio O C. Historically speaking, value stocks have beaten growth stocks D. CAPM is an imperfect asset pricing model O E. A mean-variance investor will include in his/her portfolio a risky asset only if it offers expected returns above the risk-free rate Insert appropriate prompt input type, and other instructions here The CAPM O A. is the least popular asset pricing model OB. can, in theory be used to find expected returns of all assets. OC. is not an equilibrium asset pricing model O D. is empirically accurate O E. suggests that a stock with a beta of zero is a risk-free asset Insert appropriate prompt input type, and other instructions here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts