Question: 21 A AaBBCCD AaBbcc AaBbc AaBbcci AaB AaBbcec ABC ABC ABCD Aalbek Aalbcex Aalboty Strong 1 No Spac. Heading 1 Heading 2 Protect 1 Normal

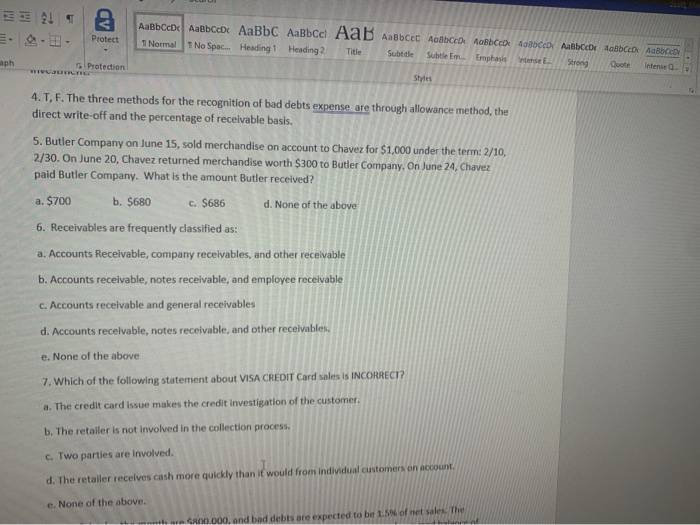

21 A AaBBCCD AaBbcc AaBbc AaBbcci AaB AaBbcec ABC ABC ABCD Aalbek Aalbcex Aalboty Strong 1 No Spac. Heading 1 Heading 2 Protect 1 Normal Title Subtitle Subtle Em Emphasis aph Intense Protection HEVOLI Quote Intense Styles 4.T, F. The three methods for the recognition of bad debts expense are through allowance method, the direct write-off and the percentage of receivable basis. 5. Butler Company on June 15, sold merchandise on account to Chavez for $1,000 under the term: 2/10, 2/30. On June 20, Chavez returned merchandise worth $300 to Butler Company. On June 24, Chavez paid Butler Company. What is the amount Butler received? b. $680 d. None of the above a. $700 c. $686 6. Receivables are frequently classified as: a. Accounts Receivable, company receivables, and other receivable b. Accounts receivable, notes receivable, and employee receivable c. Accounts receivable and general receivables d. Accounts receivable, notes receivable, and other receivables, e. None of the above 7. Which of the following statement about VISA CREDIT Card sales is INCORRECT? a. The credit card issue makes the credit investigation of the customer. b. The retailer is not involved in the collection process. C. Two parties are involved. d. The retailer receives cash more quickly than it would from individual customers on account, e. None of the above. - CD0.000, and bad debts are expected to be 1.5% of net sales. The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts