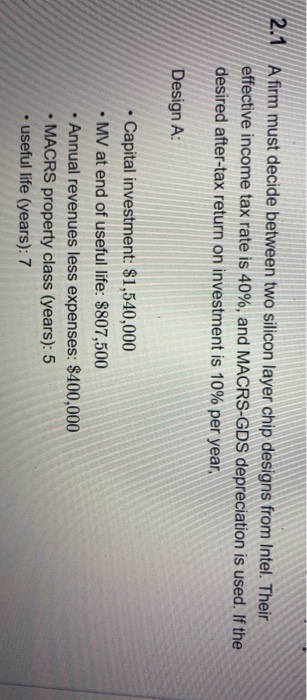

Question: 2.1 A firm must decide between two silicon layer chip designs from Intel. Their effective income tax rate is 40%, and MACRS-GDS depreciation is used.

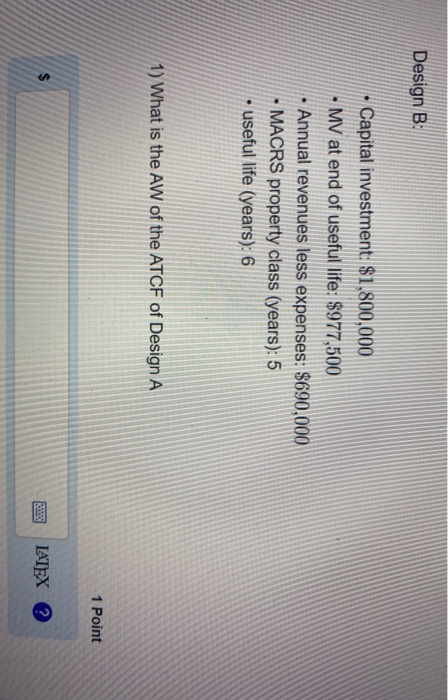

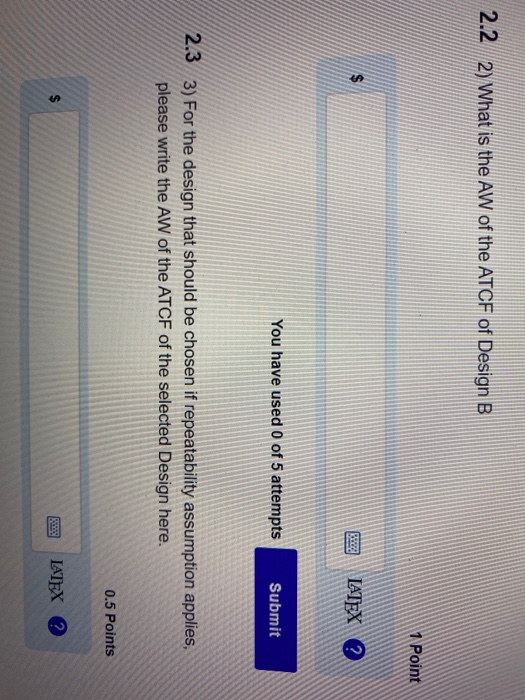

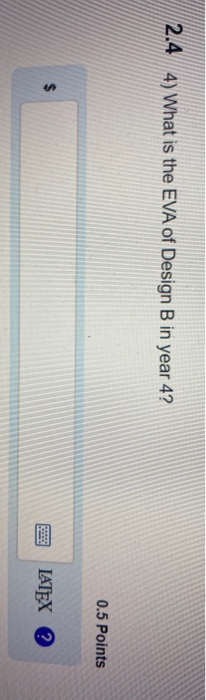

2.1 A firm must decide between two silicon layer chip designs from Intel. Their effective income tax rate is 40%, and MACRS-GDS depreciation is used. If the desired after-tax return on investment is 10% per year, Design A: Capital investment: $1,540,000 MV at end of useful life: $807,500 Annual revenues less expenses: $400,000 MACRS property class (years): 5 useful life (years): 7 Design B: Capital investment: $1,800,000 - MV at end of useful life: $977,500 Annual revenues less expenses: $690,000 MACRS property class (years): 5 useful life (years): 6 1) What is the AW of the ATCF of Design A 1 Point LATEX 2.2 2) What is the AW of the ATCF of Design B 1 Point $ LATEX ? You have used 0 of 5 attempts Submit 2.3 3) For the design that should be chosen if repeatability assumption applies, please write the AW of the ATCF of the selected Design here. 0.5 Points $ LATEX ? 2.4 4) What is the EVA of Design B in year 4? 0.5 Points $ LATEX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts