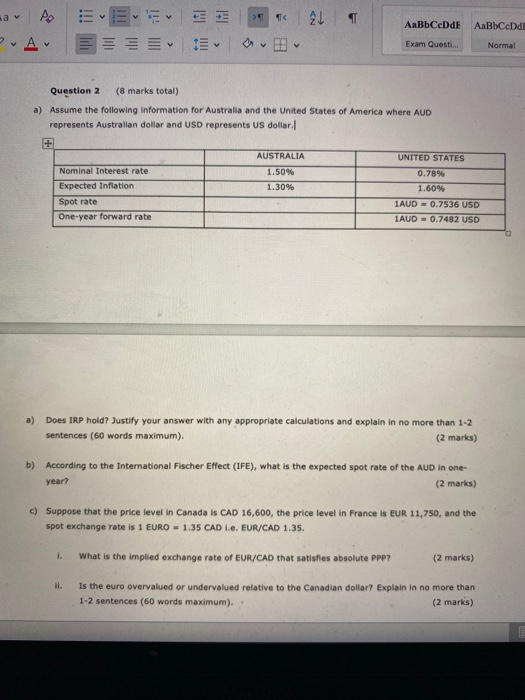

Question: > 21 AaBbCcDdF Ao 2. Av AaBMCcDd. E v Exam Questi... Normal Question 2 (8 marks total) a) Assume the following information for Australia and

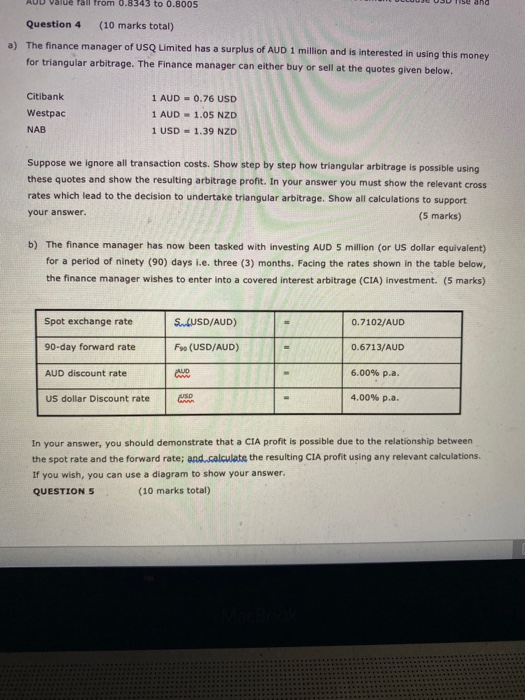

> 21 AaBbCcDdF Ao 2. Av AaBMCcDd. E v Exam Questi... Normal Question 2 (8 marks total) a) Assume the following information for Australia and the United States of America where AUD represents Australian dollar and USD represents US dollar. UNITED STATES AUSTRALIA 1.50% 1.30% Nominal Interest rate Expected Inflation Spot rate One-year forward rate 0.78% 1.60% 1AUD - 0.7536 USD 1AUD = 0.7482 USD a) Does IRP hold? Justify your answer with any appropriate calculations and explain in no more than 1-2 sentences (60 words maximum). (2 marks) b) According to the International Fischer Effect (IFE), what is the expected spot rate of the AUD in one- year? (2 marks) .) Suppose that the price level in Canada is CAD 16,600, the price level in France Is EUR 11,750, and the spot exchange rate is 1 EURO = 1.35 CAD I.. EUR/CAD 1.35. . What is the implied exchange rate of EUR/CAD that satisfies absolute PPP? (2 marks) Il. Is the euro overvalued or undervalued relative to the Canadian dollar? Explain in no more than 1-2 sentences (60 words maximum). (2 marks) AUD value fall from 0.8343 to 0.8005 ise and Question 4 (10 marks total) a) The finance manager of USQ Limited has a surplus of AUD 1 million and is interested in using this money for triangular arbitrage. The Finance manager can either buy or sell at the quotes given below. Citibank Westpac NAB 1 AUD = 0.76 USD 1 AUD - 1.05 NZD 1 USD = 1.39 NZD Suppose we ignore all transaction costs. Show step by step how triangular arbitrage is possible using these quotes and show the resulting arbitrage profit. In your answer you must show the relevant cross rates which lead to the decision to undertake triangular arbitrage. Show all calculations to support your answer. (5 marks) b) The finance manager has now been tasked with investing AUD 5 million (or US dollar equivalent) for a period of ninety (90) days i.e. three (3) months. Facing the rates shown in the table below, the finance manager wishes to enter into a covered interest arbitrage (CIA) investment. (5 marks) Spot exchange rate SMLUSD/AUD) 0.7102/AUD 90-day forward rate F90 (USD/AUD) 0.6713/AUD AUD discount rate AUD 6.00% p.a. US dollar Discount rate USD 4.00% p.a. In your answer, you should demonstrate that a CIA profit is possible due to the relationship between the spot rate and the forward rate; and calculate the resulting CIA profit using any relevant calculations. If you wish, you can use a diagram to show your answer. QUESTIONS (10 marks total)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts