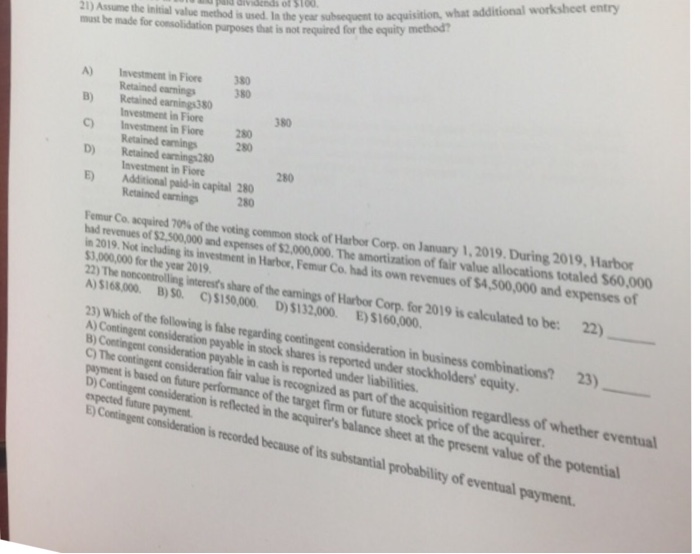

Question: 21) Assume the initial value method is used. Ia t must be made for cossolidation parposes that is not required for the equity the year

21) Assume the initial value method is used. Ia t must be made for cossolidation parposes that is not required for the equity the year subsequent to acquisition, what additional worksheet entry A) Investment in Fiore Retained earnings 380 BRetained earnings380 nvestment in Fiore 380 C) Investment in Fiore 20 280 Retained carmings D) Retained earnings280 280 Investment in Fiore Additional paid-in capital 280 E etained eaning 280 Femur Co. acquired 70% ofthe voting common stock of Harbor Corp. on January 1,2019. During 2019, Harbor had revenues of $2,500,000 and expenses of $2,000,000. The amortization of fair value allocations totaled $60,000 in 2019. Not including is investment in Harbor,Femur Co. had its own revenues of $4,500,000 and expenses of 3,000,000 for the year 2019 )5168,000 B)SO. C)S1S0,000 D)S132,000 E)$160 22) The noncontroling interests share of the camings of Harbor C Corp, for 2019 is calculated to be: 22) 23) Which of the following is false regarding A) Contingent consideration payable in stock shares is repoted under stockholders equity )Contingent consideration payable in cash is reported under liabilities C) The contingent consideration fair value is recognized as part of the acquisition regardless of whether eventual payment is based on future performance of the target firm or future stock price of the acquirer. DjContingent consideration is reflected in the acquirer's balance sheet at the present value of the potential expected future payment contingent consideration in business combinations? 23) )Contingent consideration is recorded because of its substantial probability of eventual payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts