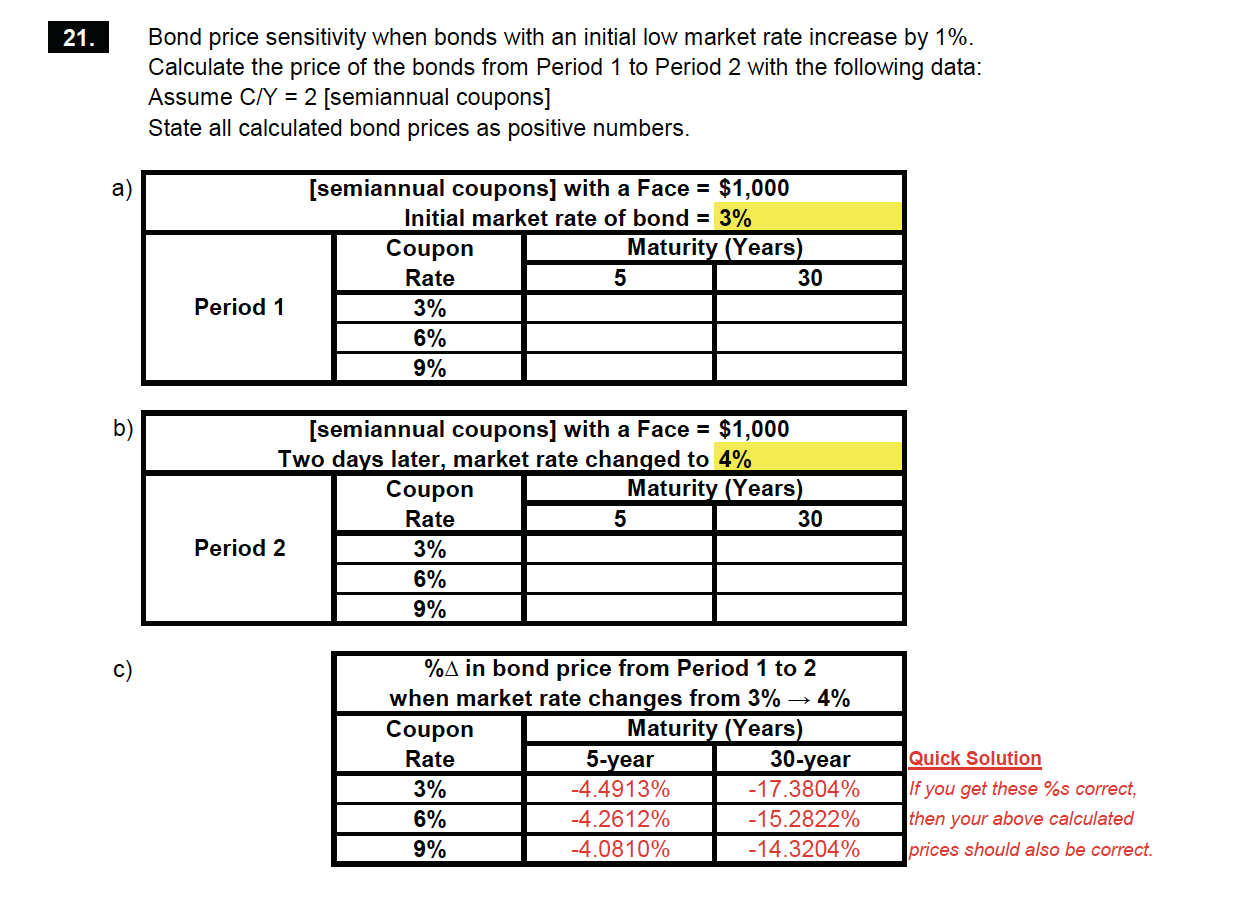

Question: 21. Bond price sensitivity when bonds with an initial low market rate increase by 1%. Calculate the price of the bonds from Period 1 to

21. Bond price sensitivity when bonds with an initial low market rate increase by 1%. Calculate the price of the bonds from Period 1 to Period 2 with the following data: Assume C/Y = 2 [semiannual coupons] State all calculated bond prices as positive numbers. a) [semiannual coupons] with a Face = $1,000 Initial market rate of bond = 3% Coupon Maturity (Years) Rate 5 30 Period 1 3% 6% 9% b) [semiannual coupons] with a Face = $1,000 Two days later, market rate changed to 4% Coupon Maturity (Years) Rate 5 30 Period 2 3% 6% 9% c) %A in bond price from Period 1 to 2 when market rate changes from 3% -4% Coupon Maturity (Years) Rate 5-year 30-year 3% -4.4913% -17.3804% 6% -4.2612% -15.2822% 9% -4.0810% -14.3204% Quick Solution If you get these %s correct, then your above calculated prices should also be correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts