Question: 21) Future taxable amounts is calculated using the future enacted tax rate. (answer True or False) 22) Pretax income and income before taxes would typically

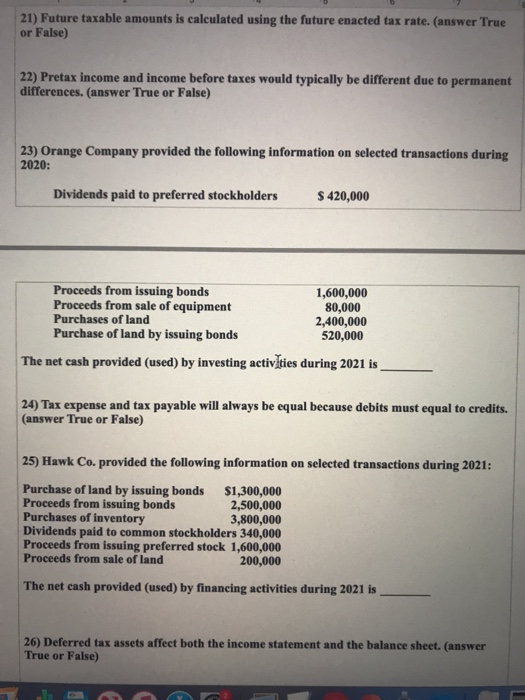

21) Future taxable amounts is calculated using the future enacted tax rate. (answer True or False) 22) Pretax income and income before taxes would typically be different due to permanent differences. (answer True or False) 23) Orange Company provided the following information on selected transactions during 2020: Dividends paid to preferred stockholders $ 420,000 Proceeds from issuing bonds 1,600,000 Proceeds from sale of equipment 80,000 Purchases of land 2,400,000 Purchase of land by issuing bonds 520,000 The net cash provided (used) by investing activties during 2021 is 24) Tax expense and tax payable will always be equal because debits must equal to credits. (answer True or False) 25) Hawk Co. provided the following information on selected transactions during 2021: Purchase of land by issuing bonds $1,300,000 Proceeds from issuing bonds 2,500,000 Purchases of inventory 3,800,000 Dividends paid to common stockholders 340,000 Proceeds from issuing preferred stock 1,600,000 Proceeds from sale of land 200,000 The net cash provided (used) by financing activities during 2021 is 26) Deferred True or False) assets affect both the income statement and the balance sheet. (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts