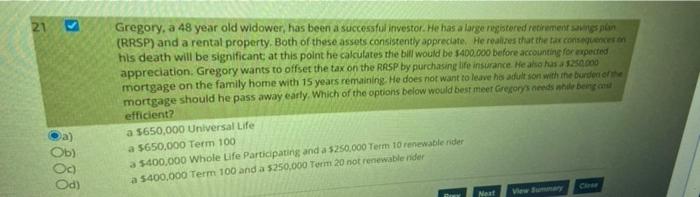

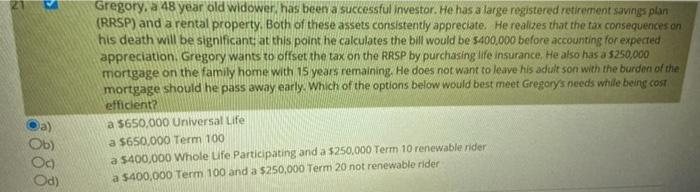

Question: 21 Gregory, a 48 year old widower, has been a successful investor. He has a large registered retirement sans plon (RRSP) and a rental property.

21 Gregory, a 48 year old widower, has been a successful investor. He has a large registered retirement sans plon (RRSP) and a rental property. Both of these assets consistently appreciate. He reales that the tax consequence his death will be significant at this point he calculates the bill would be $400.000 before accounting for expected appreciation. Gregory wants to offset the tax on the RASP by purchasing life insurance. He also has a $250.000 mortgage on the family home with 15 years remaining He does not want to leave he adult son with the burden ohne mortgage should he pass away early. Which of the options below would best meer Gregory needs who bergan efficient? a $650,000 Universal Life a $650,000 Term 100 5400.000 Whole Life Participating and a $250,000 Term 10 renewable rider a $400,000 Term 100 and a $250,000 Torm 20 not renewable rider a) Ob) O Next Gregory, a 48 year old widower, has been a successful investor. He has a large registered retirement savings plan (RRSP) and a rental property. Both of these assets consistently appreciate. He realizes that the tax consequences on his death will be significant at this point he calculates the bill would be 5400,000 before accounting for expected appreciation, Gregory wants to offset the tax on the RRSP by purchasing life insurance. He also has a $250,000 mortgage on the family home with 15 years remaining. He does not want to leave his adult son with the burden of the mortgage should he pass away early. Which of the options below would best meet Gregory's needs while being cost efficient? a $650,000 Universal Life a $650,000 Term 100 a $400,000 Whole Life Participating and a $250,000 Term 10 renewable rider a $400,000 Term 100 and a $250,000 Term 20 not renewable rider Ob) O Od)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts