Question: 21. In preparing a statement of cash flows, a conversion of bonds into common stock will be reported in a. b. c. d. the financing

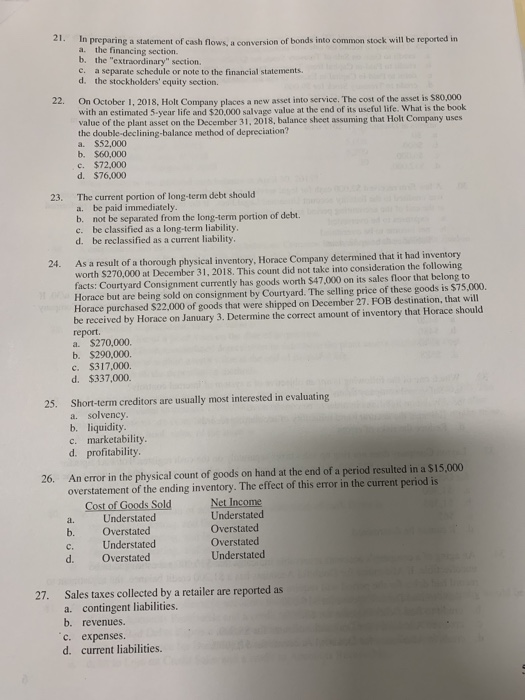

21. In preparing a statement of cash flows, a conversion of bonds into common stock will be reported in a. b. c. d. the financing section. the "extraordinary" section. a separate schedule or note to the financial statements. the stockholders' equity section. 22. On October 1,2018, Holt Company places a new asset into service. The cost of the asset is $80,000 with an estimated 5 year life and $20,000 salvage value at the end of its useful life. What is the book value of the plant asset on the December 31., 2018, balance sheet assuming that Holt Company uses the double-declining-balance method of depreciation? a. $52,000 b. $60,000 c. $72,000 d. $76,000 23. The current portion of long-term debt should a. be paid immediately. b. not be separated from the long-term portion of debt. c. be classified as a long-term liability d. be reclassified as a current liability As a result of a thorough physical inventory, Horace Company determined that it had inventory worth $270,000 at December 31, 2018. This count did not take into consideration the following facts: Courtyard Consignment currently has goods worth $47,000 on its sales floor that belong to Horace but are being sold on consignment by Courtyard. The selling price of these goods is $7,000 Horace purchased $22,000 of goods that were shipped on December 27. FOB destination, that will be received by Horace on January 3. Determine the correct amount of inventory that Horace should report a. $270,000 b. $290,000. c. $317,000. d. $337,000. 24. Short-term creditors are usually most interested in evaluating a. solvency b. liquidity 25. c. marketability d. profitability 26. An error in the physical count of goods on hand at the end of a period resulted in a $15,000 overstatement of the ending inventory. The effect of this error in the current period is Cost of Goods Sold Understated Net Income Understated Overstated Overstated Understated a. b. Overstated c. Understated d. Overstated 27. Sales taxes collected by a retailer are reported as a. contingent liabilities. b. revenues. c. expenses. d. current liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts