Question: 2.1. In the model SUU (2) = 75 A(2) = 1.21 SU (1) = 60 A(1) = 1.1 SUM (2) = 65 A(2) = 1.21

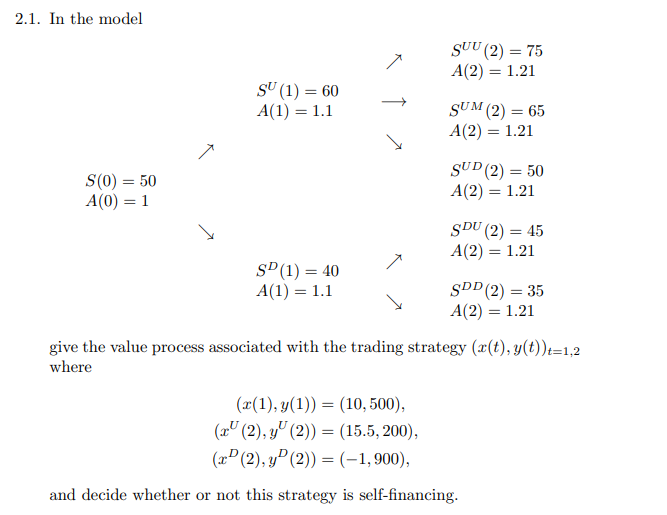

2.1. In the model SUU (2) = 75 A(2) = 1.21 SU (1) = 60 A(1) = 1.1 SUM (2) = 65 A(2) = 1.21 S(O) = 50 A(0) = 1 SUD (2) = 50 A(2) = 1.21 SDU (2) = 45 A(2) = 1.21 = SD(1) = 40 A(1) = 1.1 SDD(2) = 35 A(2) = 1.21 = give the value process associated with the trading strategy (x(t), y(t))t=1,2 where (2(1),y(1)) = (10,500), (2" (2), y' (2)) = (15.5, 200), (2D(2), y(2)) = (-1,900), and decide whether or not this strategy is self-financing. 2.1. In the model SUU (2) = 75 A(2) = 1.21 SU (1) = 60 A(1) = 1.1 SUM (2) = 65 A(2) = 1.21 S(O) = 50 A(0) = 1 SUD (2) = 50 A(2) = 1.21 SDU (2) = 45 A(2) = 1.21 = SD(1) = 40 A(1) = 1.1 SDD(2) = 35 A(2) = 1.21 = give the value process associated with the trading strategy (x(t), y(t))t=1,2 where (2(1),y(1)) = (10,500), (2" (2), y' (2)) = (15.5, 200), (2D(2), y(2)) = (-1,900), and decide whether or not this strategy is self-financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts