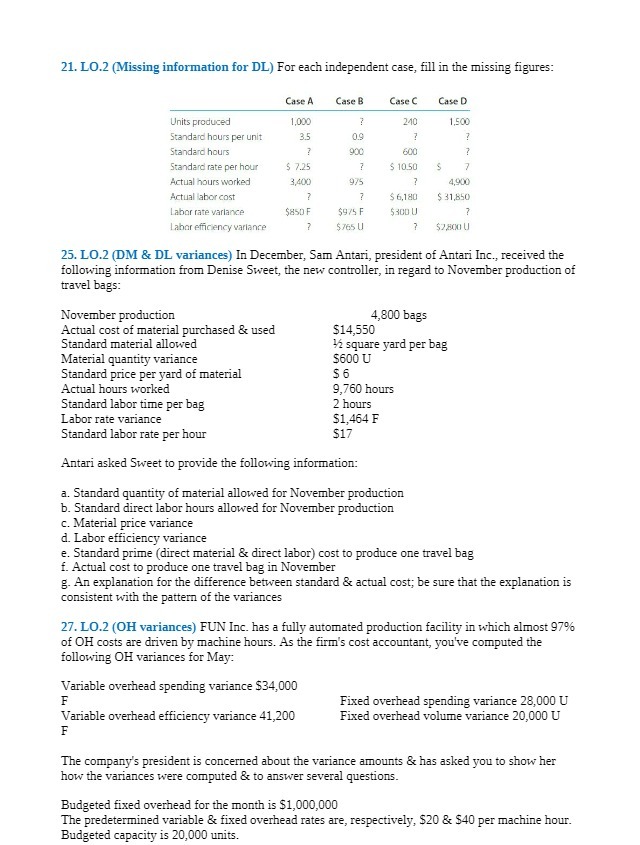

Question: 21. LO.2 (Missing information for DL) For each independent case, fill in the missing figures: Case A Case B Case C Case D Units produced

21. LO.2 (Missing information for DL) For each independent case, fill in the missing figures: Case A Case B Case C Case D Units produced 1,000 240 1500 Standard hours per unit 3.5 0.9 Standard hours 900 600 7 Standard rate per hour $ 7.25 $ 10.50 Actual hours worked 3,400 1400 Actual labor cost $ 6,180 $ 31,850 Labor rate variance 5850 F $975 F $300 U Labor efficiency variance $765 U $7,800 U 25. LO.2 (DM & DL variances) In December, Sam Antari, president of Antari Inc., received the following information from Denise Sweet, the new controller, in regard to November production of travel bags: November production 4,800 bags Actual cost of material purchased & used $14,550 Standard material allowed 12 square yard per bag Material quantity variance $600 U Standard price per yard of material $6 Actual hours worked 9,760 hours Standard labor time per bag 2 hours Labor rate variance $1,464 F Standard labor rate per hour $17 Antari asked Sweet to provide the following information: a. Standard quantity of material allowed for November production b. Standard direct labor hours allowed for November production c. Material price variance d. Labor efficiency variance e. Standard prime (direct material & direct labor) cost to produce one travel bag f. Actual cost to produce one travel bag in November g. An explanation for the difference between standard & actual cost; be sure that the explanation is consistent with the pattern of the variances 27. LO.2 (OH variances) FUN Inc. has a fully automated production facility in which almost 97% of OH costs are driven by machine hours. As the firm's cost accountant, you've computed the following OH variances for May: Variable overhead spending variance $34,000 F Fixed overhead spending variance 28,000 U Variable overhead efficiency variance 41,200 Fixed overhead volume variance 20,000 U F The company's president is concerned about the variance amounts & has asked you to show her how the variances were computed & to answer several questions. Budgeted fixed overhead for the month is $1,000,000 The predetermined variable & fixed overhead rates are, respectively, $20 & $40 per machine hour. Budgeted capacity is 20,000 units