Question: 21 Plot annual historical volatility with 1-year implied volatility in a graph. (2 marks) Q2 Referring to the graph in Q1, analyse the relationship between

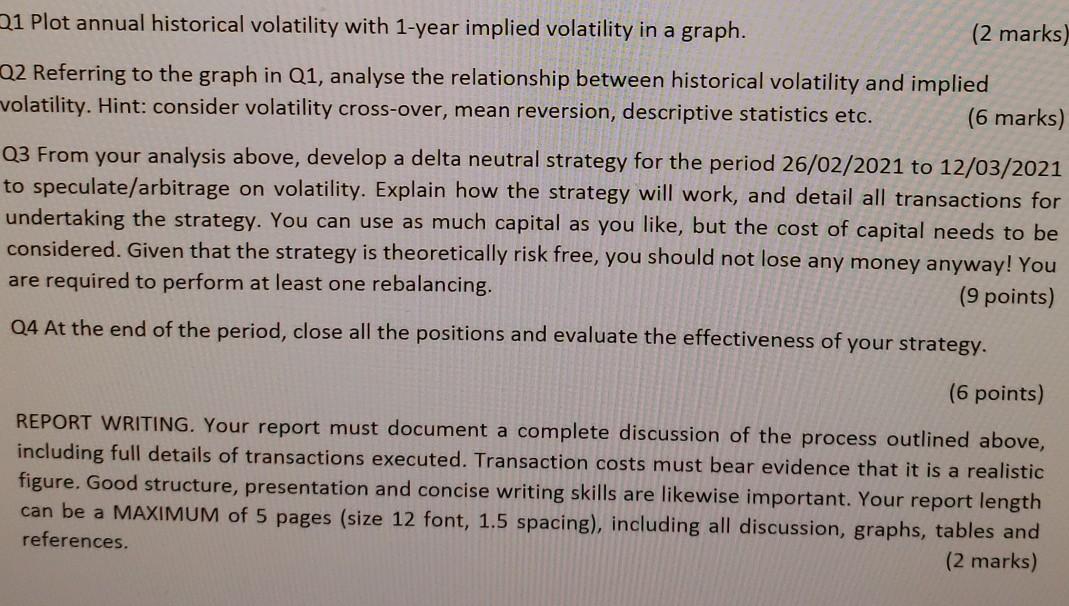

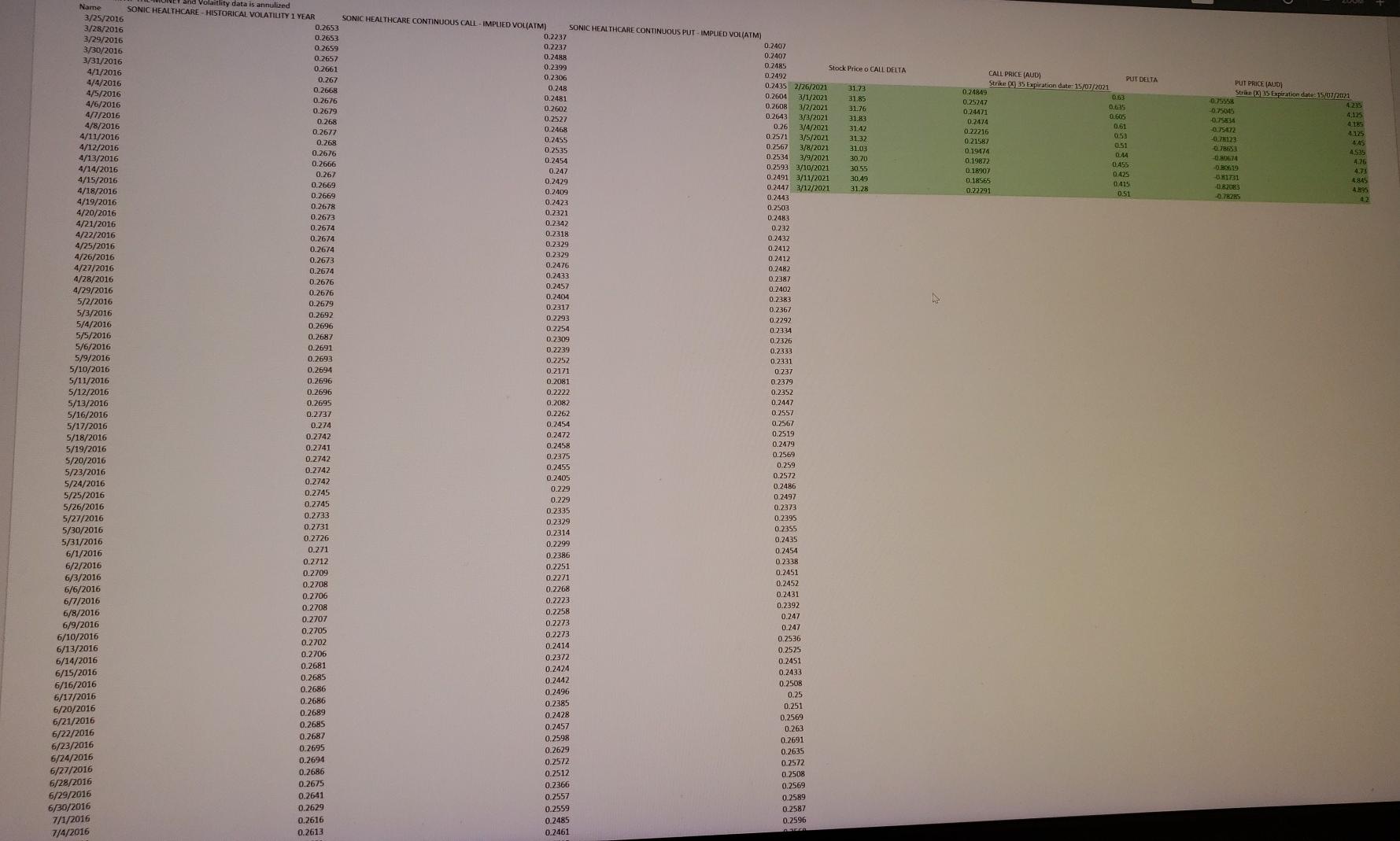

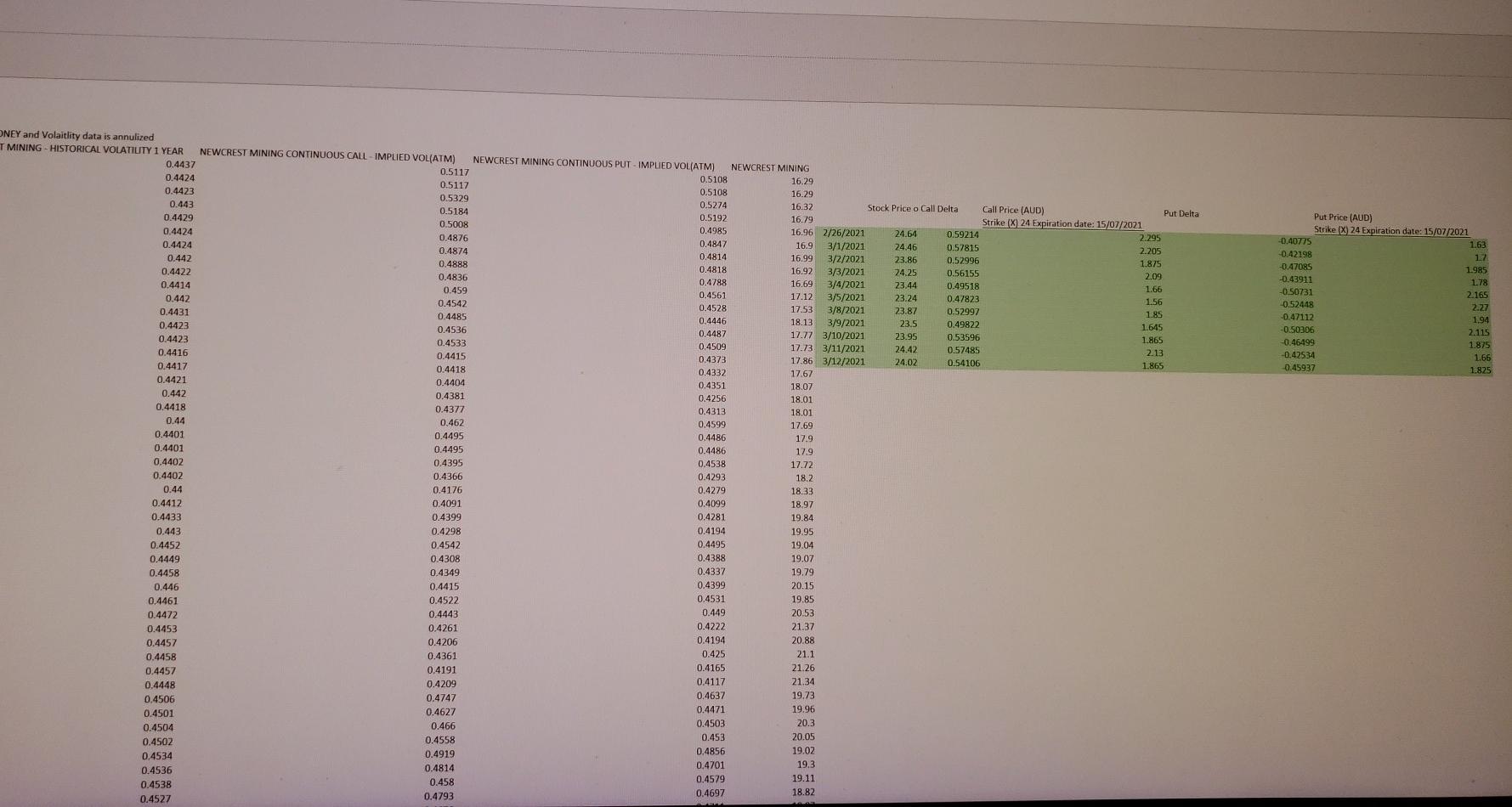

21 Plot annual historical volatility with 1-year implied volatility in a graph. (2 marks) Q2 Referring to the graph in Q1, analyse the relationship between historical volatility and implied volatility. Hint: consider volatility cross-over, mean reversion, descriptive statistics etc. (6 marks) Q3 From your analysis above, develop a delta neutral strategy for the period 26/02/2021 to 12/03/2021 to speculate/arbitrage on volatility. Explain how the strategy will work, and detail all transactions for undertaking the strategy. You can use as much capital as you like, but the cost of capital needs to be considered. Given that the strategy is theoretically risk free, you should not lose any money anyway! You are required to perform at least one rebalancing. (9 points) Q4 At the end of the period, close all the positions and evaluate the effectiveness of your strategy. (6 points) REPORT WRITING. Your report must document a complete discussion of the process outlined above, including full details of transactions executed. Transaction costs must bear evidence that it is a realistic figure. Good structure, presentation and concise writing skills are likewise important. Your report length can be a MAXIMUM of 5 pages (size 12 font, 1.5 spacing), including all discussion, graphs, tables and references. (2 marks) 3/2/2021 CALL PRICE (AUD) PUT DELTA Strike (35 Expiration date: 15/07/2021 0.24849 0,63 0.25247 0.635 0.24471 0.GOS 0.2474 0.61 0.22216 053 0.21587 0.51 0.19474 0.44 0.19872 0.455 0.18907 0.425 0.18564 0415 0.22291 0.51 PUT PRICE (AUD) Strike 35 Expiration date: 15/07/2021 0.75954 4:235 0.750 4,125 0.75834 4.185 -0.75472 4125 49.8123 4.45 0.761 4535 4.26 0.80629 4.71 3.8171 4.845 RIOR 4.95 -0.782S 0.2491 Name 3/25/2016 3/28/2016 3/29/2016 3/30/2016 3/31/2016 4/1/2016 4/4/2016 4/5/2016 4/6/2016 4/7/2016 4/8/2016 4/11/2016 4/12/2016 4/13/2016 4/14/2016 4/15/2016 4/18/2016 4/19/2016 4/20/2016 4/21/2016 4/22/2016 4/25/2016 4/26/2016 4/27/2016 4/28/2016 4/29/2016 5/2/2016 5/3/2016 5/4/2016 5/5/2016 5/6/2016 5/9/2016 5/10/2016 S/11/2016 5/12/2016 5/13/2016 5/16/2016 5/17/2016 5/18/2016 5/19/2016 5/20/2016 5/23/2016 5/24/2016 5/25/2016 5/26/2016 5/27/2016 5/30/2016 5/31/2016 6/1/2016 6/2/2016 6/3/2016 6/6/2016 6/7/2016 6/8/2016 6/9/2016 6/10/2016 6/13/2016 6/14/2016 0.2081 SONIC HEALTHCARE - HISTORICAL VOLATIUTY 1 YEAR Volaitlity data is annulized SONIC HEALTHCARE CONTINUOUS CALL - IMPLIED VOLATM) 0.2653 SONIC HEALTHCARE CONTINUOUS PUT-IMPUED VOL(ATM) 0.2653 0.2237 0.2659 0.2237 0.2407 0.2652 0.2488 0.2407 0.2661 0.2399 0.2485 Stock Price o CALL DELTA 0.267 0.2306 0.2492 0.2668 0.248 0.2435 2/26/2021 31.73 0.2676 0.2481 0.2604 3/1/2021 31.85 0.2679 0.2602 0.2608 31.76 0.268 0.2527 0.2643 3/3/2021 31.83 0.2677 0.2468 0.26 3/4/2021 31.42 0.268 0.2455 0.2571 3/5/2021 31.32 0.2676 0.2535 0.2567 3/8/2021 31.03 0.2666 0.2454 0.2534 3/9/2021 30.70 0.267 0.247 0.2593 3/10/2021 30.55 0.2669 0.2429 3/11/2021 30.49 0.2669 0.2409 0.2447 3/12/2021 31.28 0.2678 0.2423 0.2443 0.2503 0.2321 0.2673 0.2483 0.2342 0.2674 0.232 0.2674 0.2318 0.2432 0.2329 0.2674 0.2412 0.2673 0.2329 0.2412 0.2476 0.2674 0.2482 0.2676 0.2433 0.2387 0.2457 0.2676 0.2402 0.2404 0.2679 0.2383 0.2317 0.2692 0.2367 0.2696 0.2293 0.2292 0.2254 0.2687 0.2334 0.2309 0.2691 0.2326 0.2239 0.2693 0.2333 0.2252 0.2694 0.2331 0.2171 0.2696 0.237 0.2379 0.2696 0.2222 0.2352 0.2695 0.2082 0.2447 0.2737 0.2262 0.2557 0.274 0.2454 0.2567 0.2742 0.2472 0.2519 0.2741 0.2458 0.2742 0.2375 0.2569 0.2742 0.2455 0.259 0.2742 0.2405 0.2572 0.2745 0.229 0.2486 0.2745 0.229 0.2497 0.2733 0.2335 0.2373 0.2731 0.2329 0.2395 0.2314 0.2355 0.2726 0.2435 0.2299 0.271 0.2454 0.2386 0.2712 0.2251 0.2338 0.2709 0.2451 0.2271 0.2708 0.2452 0.2706 0.2268 0.2431 0.2708 0.2223 0.2258 0.2392 0.2707 0.2273 0.247 0.2705 0.247 0.2273 0.2702 0.2706 0.2414 0.2525 0.2681 0.2372 0.2451 0.2424 0.2685 0.2433 0.2442 0.2686 0.2508 0.2496 0.2686 0.25 0.2385 0.2689 0.2428 0.2685 0.2569 0.2457 0.2687 0.263 0.2598 0.2695 0.2691 0.2694 0.2635 0.2572 0.2686 0.2572 0.2512 0.2675 0.2508 0.2641 0.2366 0.2569 0.2557 0.2629 0.2589 0.2559 0.2587 0.2616 0.2485 0.2596 0.2613 0.2479 0.2536 0.251 6/15/2016 6/16/2016 6/17/2016 6/20/2016 6/21/2016 6/22/2016 6/23/2016 6/24/2016 6/27/2016 6/28/2016 6/29/2016 6/30/2016 7/1/2016 7/4/2016 0.2629 0.2461 0.5008 0.56155 0.47823 Put Price (AUD) Strike (X) 24 Expiration date: 15/07/2021 -0.40775 1.63 0.42198 12 -0.47085 1.985 -0.43911 1.78 -0.50731 2.165 -0.52448 2.27 -0.47112 1.94 0.50306 2.115 -0.46499 1.875 -0.42534 1.66 0.45937 1.825 0.4313 0.4599 ONEY and Volaitlity data is annulized T MINING - HISTORICAL VOLATILITY 1 YEAR 0.4437 0.4424 0.4423 0443 4429 0.9429 0.4424 0.4424 0.9424 0.442 0.442 0.4422 0.1422 0.4414 W.4419 0.442 0.4431 0,4423 0.4423 0.4416 0.4417 0.4421 0.442 0.4418 0.44 0.4401 0.4401 0.4402 0.4402 0.44 0.4412 0.4433 0.443 0.4452 0.4449 0.4458 0.446 0.4461 0.4472 0.4453 0.4457 0.4458 0.4457 0.4448 0.4506 0.4501 0.4504 0.4502 0.4534 0.4536 0.4538 0.4527 NEWCREST MINING CONTINUOUS CALL - IMPLIED VOL(ATM) NEWCREST MINING CONTINUOUS PUT - IMPUED VOL(ATM) 0.5117 0.5117 0.5108 0.5329 0.5108 0.5184 0.5274 0.5192 0.4876 0.4985 0.4847 0.4874 0,4814 0.4888 0.4830 0.4818 0.4788 0.459 0.4561 0.4542 0.4528 0.4485 0.4446 0.4536 0.4487 0.4533 . 0.4509 0.4415 0.4373 0.4418 0.4332 0.4404 0.4351 0.4381 0.4256 0.4377 0.462 0.4495 0.4486 0.4495 0.4486 0.4395 0,4538 0.4366 0.4293 0.4176 0.4279 0.4091 0.4099 0.4399 0.4281 0.4298 0.4194 0,4542 0.4495 0.4308 0.4388 0.4349 0.4337 0.4415 0.4399 0.4522 0.4531 0.4443 0.449 0.4261 0.4222 0.4206 0.4194 0.4361 0.425 0.4191 0.4165 0.4117 0.4747 14747 0.4637 0.4627 0.44 0.466 0.4503 0.4558 0.453 0.4919 0.4856 0.4814 0.4701 0.458 0.4579 0.4793 0.4697 NEWCREST MINING 16.29 16.29 16.32 Stock Price o Call Delta Call Price (AUD) 16.79 Put Delta Strike (X) 24 Expiration date: 15/07/2021 16.96 2/26/2021 24.64 0.59214 16.9 2.295 3/1/2021 24.46 0.57815 16.99 2.205 3/2/2021 23,86 0.52996 16.92 1.875 3/3/2021 24.25 16.69 2.09 3/4/2021 23.44 0.49518 17.12 1.66 3/5/2021 23.24 1.56 17.53 3/8/2021 23.87 0.52997 1.85 18.13 3/9/2021 23.5 0.49822 1.645 17.77 3/10/2021 23.95 0.53596 17.73 3/11/2021 1.865 24.42 0.57485 17.86 3/12/2021 2.13 24.02 0.54106 1.865 17.67 18.07 18.01 18.01 17.69 17.9 12.9 17.9 17.72 11.14 18,2 18.33 18.97 19.84 19.95 19.04 19.07 19.79 20.15 19.85 20.53 21.37 20.88 21.1 21.26 21.34 19.73 19.96 20.3 20.05 19.02 19.3 19.11 18.82 0.4209 0.2222 6.4835 -0.52428 6.5712 PUT PRICE Strike (X) 6 Expiration date: 15/07/2021 -0.51668 0.495 0.48993 0:46 0505 0.51371 0485 0.52663 0.495 -0.49831 0465 0.52666 0,495 0.48461 0.435 -0.44221 0.38 0.39302 0.32 034466 0.29 0.47083 6.8832 VOLANTY 1 YEAR SYDNEY AIRPORT CONTINUOUS CALL - IMPLIED VOL(ATM) 0.2216 SYDNEY AIRPORT CONTINUOUS PUT-IMPLIED VOLIATM) 0.1992 SYDNEY AIRPORT STAPLED UNITS 0.2216 0.1924 0.1992 0.2221 6,5127 0.1924 0.2208 0.2223 6.5127 0.2102 0.2147 6.4152 0.2223 Stock Price o CALL DELTA CALL PRICE 0.206 0.1993 6.4835 0.2223 PUT DELTA 0.206 Strike (X) 6 Expiration date: 15/01 2021 0.2222 0.2046 6.5225 2/26/2021 5.86 0.48107 0.2081 0.2192 6.4932 3/1/2021 5.93 0.2019 0.50928 0.2224 0.2222 3/2/2021 5.84 0,385 0.47327 0.2131 0.2125 6.4542 0.2225 3/3/2021 0335 5.87 0.48413 0.2016 0.345 0.2139 3/4/2021 0.2224 6.4932 5.84 0.2066 0.47208 3/5/2021 0.2074 5.91 0.33 0.223 0.49912 0.2037 0.2204 0.36 3/8/2021 6.5615 5.84 0.2237 0.2019 6.6785 0.325 3/9/2021 0.2218 5.95 0,51493 0.2235 0.1905 0.38 6.5712 0.2116 3/10/2021 6.06 0.2235 0:SS765 0.197 0.43 0.212 6.5907 3/11/2021 6.19 0.2232 0.60671 0.2 0515 0.2072 6.5615 3/12/2021 6.34 0.65869 0.2232 0.2018 0.615 0.2227 6.581 0.2246 0.2036 6.5712 0.226 0.2229 0.1906 0.2145 6.4152 0.2229 0.2004 6.4347 0.2231 0.2191 0.2034 0.2239 6.503 0.2231 0.2055 0.2239 6.4445 0.2231 0.2055 6.4445 0.2405 0.2231 0.2237 0.2309 6,425 0.223 0.2068 6.464 0.2149 0.2222 0.2209 6.62 0.201 0.2222 0.1846 6.6395 0.2091 0.2235 0.1967 6,6492 0.2108 0.1953 0.2228 6.8247 0.2003 0.223 0.1965 6.815 0.1922 0.1961 0.2228 0.2068 0.1983 0.2226 6.9515 0.2028 0.1989 0.2236 7.0197 0.1932 0.2051 0.2234 7.1757 0.1996 0.2066 0.2236 7.1172 0.213 0.1906 7.049 0.2237 0.2054 0.1874 6.9807 0.2222 0,2066 0.189 7.01 0.2221 0.2092 0.1951 7.127 0.2223 0.2084 0.183 7.0587 0.2216 0.2202 0.1948 7.01 0.2218 0.2124 0.2097 7.088 0.222 0.2226 0.1906 7.0392 0.2223 0.2236 0.1992 0.2219 0.219 0.2002 7.0002 0.2217 0.2222 0.1862 7.0392 0.2221 0.2174 0.1939 7.1465 0.2225 0.2316 0.1877 7.0587 0.2235 0.2502 0.1747 6.9027 0.223 0.206 0.1977 6.8735 0.2224 0.1987 0.1987 6.8832 0.2217 0.2043 0.2072 6.932 0.2219 0.2067 0.2078 7.0392 0.7217 0.2136 0.2008 6.9807 0.2079 0.2219 0.2013 6.9125 0.2212 0.2041 0.1988 6.9027 0.2159 0.2096 0.1932 6.9222 0.1932 0.2141 0.2096 6.9222 0.2136 0.2211 0.2005 6.8052 0.2054 0.2057 0.2127 6.7662 0.2052 0.2141 0.2068 6.8247 0.2057 0.1944 0.219 6.932 0.2057 0.212 6.9027 0.2049 0.221 0.2093 7.049 0.2204 0.2047 0.2131 7.0587 0.2339 0.2048 0.2151 7.0197 0.2522 0.2056 6.9222 0.2051 0.239 7.0977 0.2064 0.2133 0.2693 6.815 0.2099 0.2133 0.2282 6.698 0.2106 0.2036 6.7662 0.2108 0.2286 0.2204 6.8247 0.2123 0.2109 0.2281 6.9807 0.2081 6.9612 0.2126 0.2355

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock