Question: 21 Question 7 (2 points) A customer did not pay their $1000 account receivable balance. After 6 months, the company wrote the account off. In

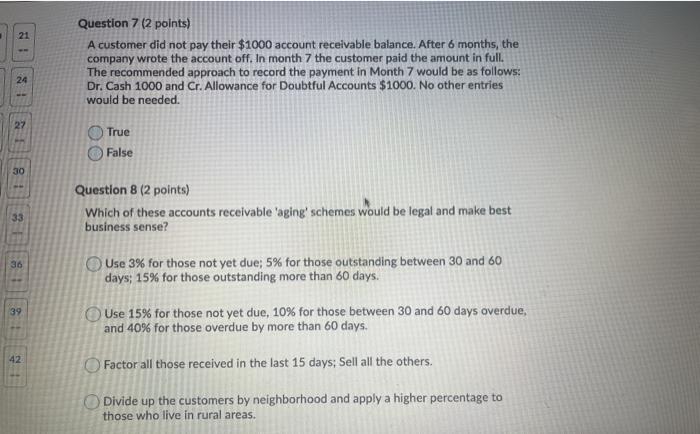

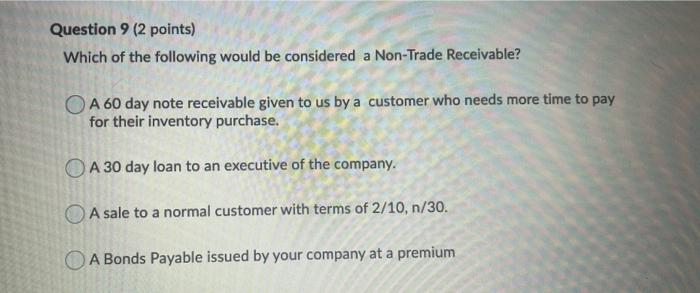

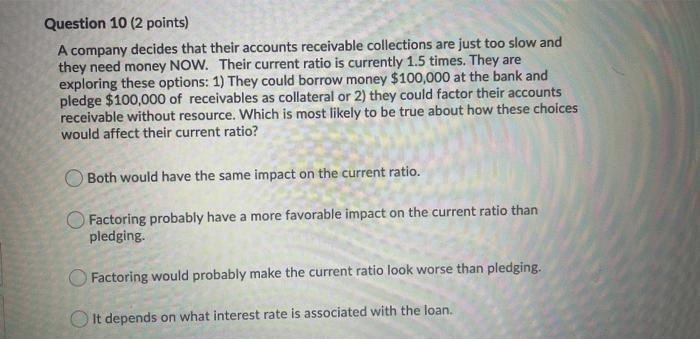

21 Question 7 (2 points) A customer did not pay their $1000 account receivable balance. After 6 months, the company wrote the account off. In month 7 the customer paid the amount in full. The recommended approach to record the payment in Month 7 would be as follows: Dr. Cash 1000 and Cr. Allowance for Doubtful Accounts $1000. No other entries would be needed. 24 27 True False 30 Question 8 (2 points) Which of these accounts receivable 'aging schemes would be legal and make best business sense? 33 36 Use 3% for those not yet due; 5% for those outstanding between 30 and 60 days; 15% for those outstanding more than 60 days. 39 Use 15% for those not yet due, 10% for those between 30 and 60 days overdue, and 40% for those overdue by more than 60 days. 42 Factor all those received in the last 15 days: Sell all the others. Divide up the customers by neighborhood and apply a higher percentage to those who live in rural areas. Question 9 (2 points) Which of the following would be considered a Non-Trade Receivable? A 60 day note receivable given to us by a customer who needs more time to pay for their inventory purchase. A 30 day loan to an executive of the company. A sale to a normal customer with terms of 2/10, n/30. O A Bonds Payable issued by your company at a premium Question 10 (2 points) A company decides that their accounts receivable collections are just too slow and they need money NOW. Their current ratio is currently 1.5 times. They are exploring these options: 1) They could borrow money $100,000 at the bank and pledge $100,000 of receivables as collateral or 2) they could factor their accounts receivable without resource. Which is most likely to be true about how these choices would affect their current ratio? Both would have the same impact on the current ratio. Factoring probably have a more favorable impact on the current ratio than pledging. Factoring would probably make the current ratio look worse than pledging. It depends on what interest rate is associated with the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts