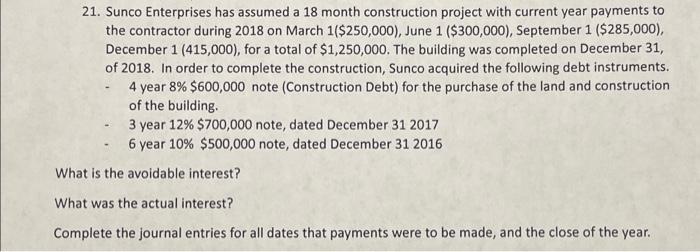

Question: 21. Sunco Enterprises has assumed a 18 month construction project with current year payments to the contractor during 2018 on March 1($250,000), June 1($300,000), September

21. Sunco Enterprises has assumed a 18 month construction project with current year payments to the contractor during 2018 on March 1($250,000), June 1($300,000), September 1($285,000), December 1(415,000), for a total of $1,250,000. The building was completed on December 31 , of 2018. In order to complete the construction, Sunco acquired the following debt instruments. - 4 year 8%$600,000 note (Construction Debt) for the purchase of the land and construction of the building. - 3 year 12%$700,000 note, dated December 312017 - 6 year 10%$500,000 note, dated December 312016 What is the avoidable interest? What was the actual interest? omplete the journal entries for all dates that payments were to be made, and the close of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts