Question: 21. The average returns, standard deviations, and betas for three funds are given below along with data for the S&P 500 Index. The risk-free

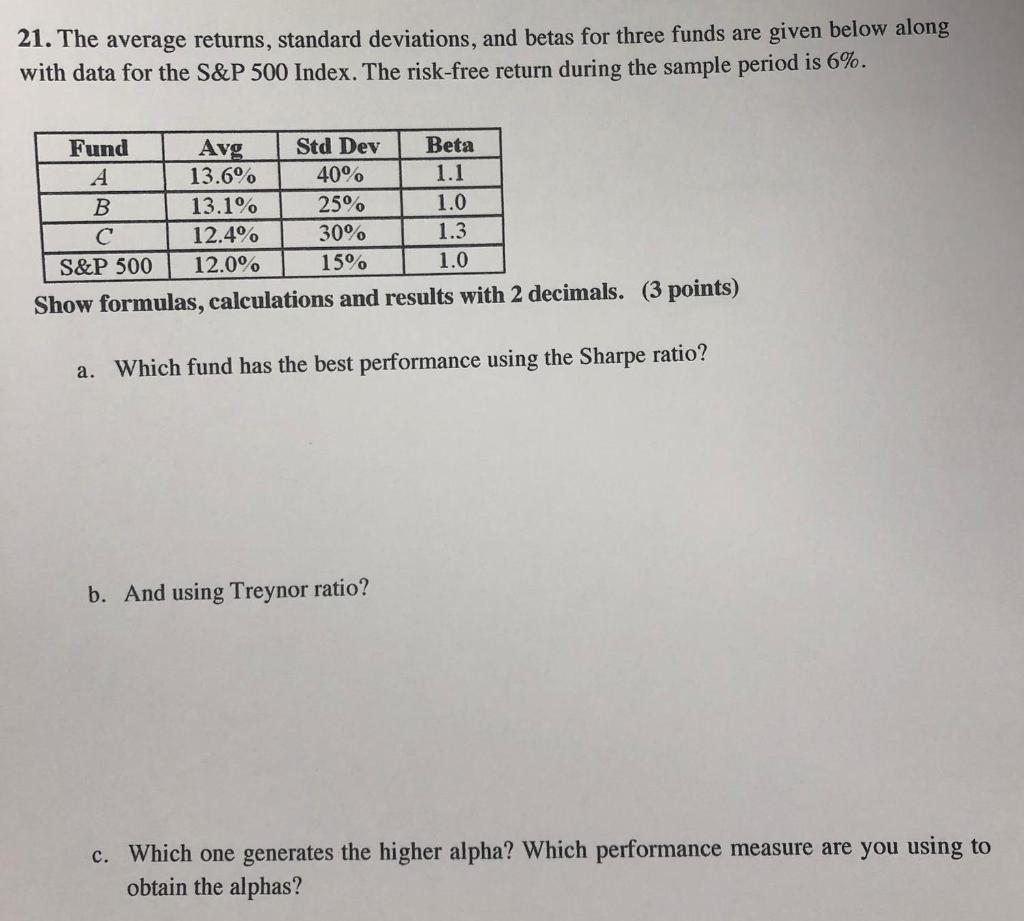

21. The average returns, standard deviations, and betas for three funds are given below along with data for the S&P 500 Index. The risk-free return during the sample period is 6%. Fund Avg Std Dev Beta A 13.6% 40% 1.1 B 13.1% 25% 1.0 C 12.4% 30% 1.3 S&P 500 12.0% 15% 1.0 Show formulas, calculations and results with 2 decimals. (3 points) a. Which fund has the best performance using the Sharpe ratio? b. And using Treynor ratio? c. Which one generates the higher alpha? Which performance measure are you using to obtain the alphas?

Step by Step Solution

There are 3 Steps involved in it

To determine the performance of each fund using the Sharpe ratio we need to calculate the excess return of each fund which is the difference between the average return of the fund and the riskfree rat... View full answer

Get step-by-step solutions from verified subject matter experts