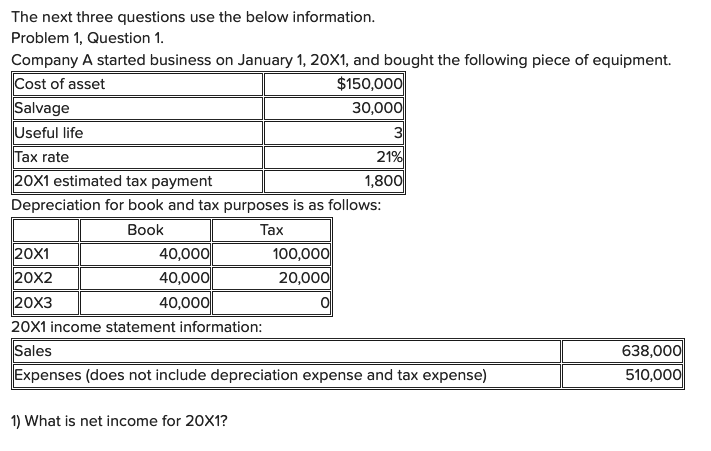

Question: 21% The next three questions use the below information. Problem 1, Question 1. Company A started business on January 1, 20X1, and bought the following

21% The next three questions use the below information. Problem 1, Question 1. Company A started business on January 1, 20X1, and bought the following piece of equipment. Cost of asset $150,000 Salvage 30,000 Useful life Tax rate 20X1 estimated tax payment 1,800 Depreciation for book and tax purposes is as follows: Book Tax 20x1 40,000 100,000 20x2 1 4 0,000 20,000 20x3 40,000 20x1 income statement information: Sales 638,000 Expenses (does not include depreciation expense and tax expense) 510,000 1) What is net income for 20X1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts