Question: 21 Using the yield curve in the Appendix, see that the 1yr rate is 2.500% and the 2yr rate is 2.660%. What is the implied

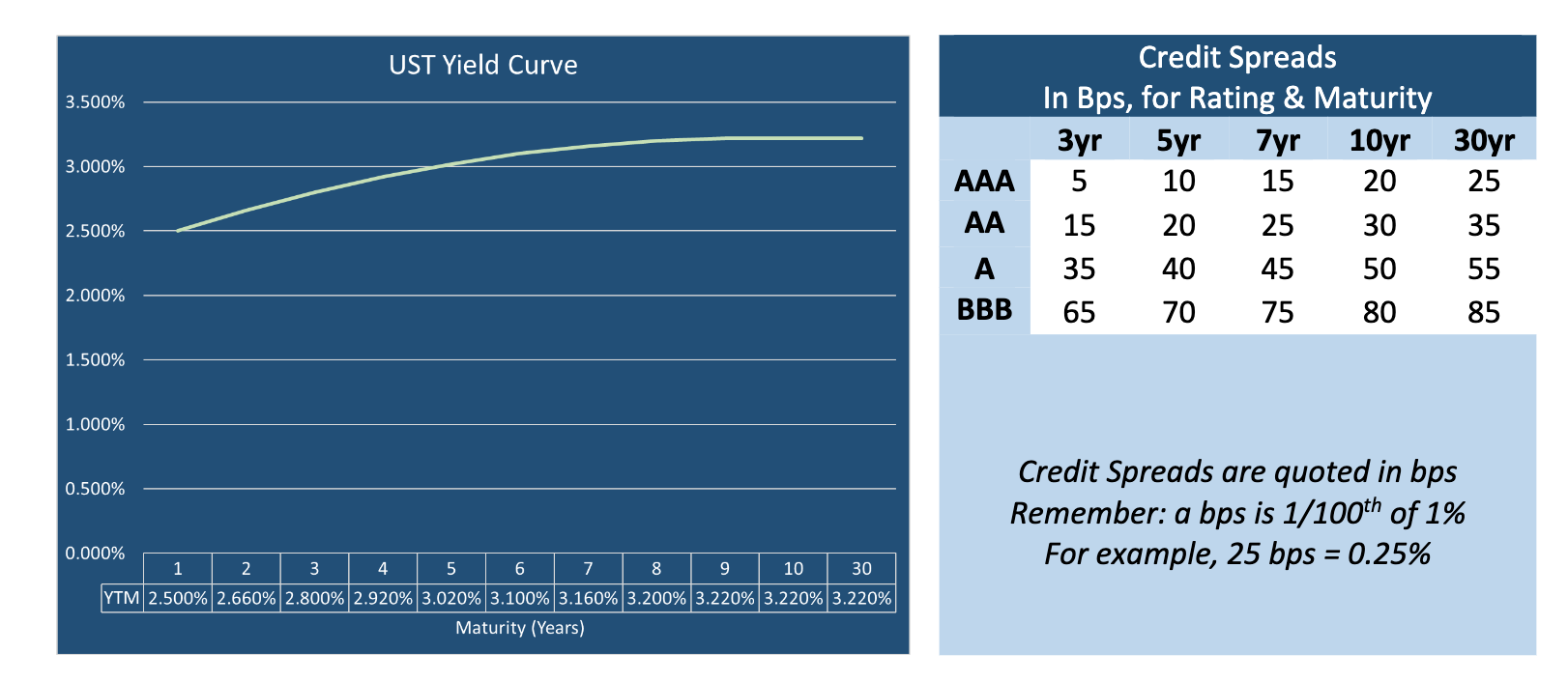

21 Using the yield curve in the Appendix, see that the 1yr rate is 2.500% and the 2yr rate is 2.660%. What is the implied 1yr rate in 1 year (to two decimal places)? 22 Using the yield curve in the Appendix, what is the implied 3yr rate in 2 years (to two decimal places)? UST Yield Curve 3.500% 3.000% Credit Spreads In Bps, for Rating & Maturity 3yr 5yr Zyr 10yr 5 10 15 20 15 20 25 30 35 40 45 50 65 70 75 80 AAA AA A BBB 2.500% 30yr 25 35 55 85 2.000% 1.500% 1.000% 0.500% Credit Spreads are quoted in bps Remember: a bps is 1/100th of 1% For example, 25 bps = 0.25% 0.000% 1 2 3 4 5 6 7 8 9 10 30 YTM 2.500% 2.660% 2.800% 2.920% 3.020% 3.100% 3.160% 3.200% 3.220% 3.220% 3.220% Maturity (Years)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts