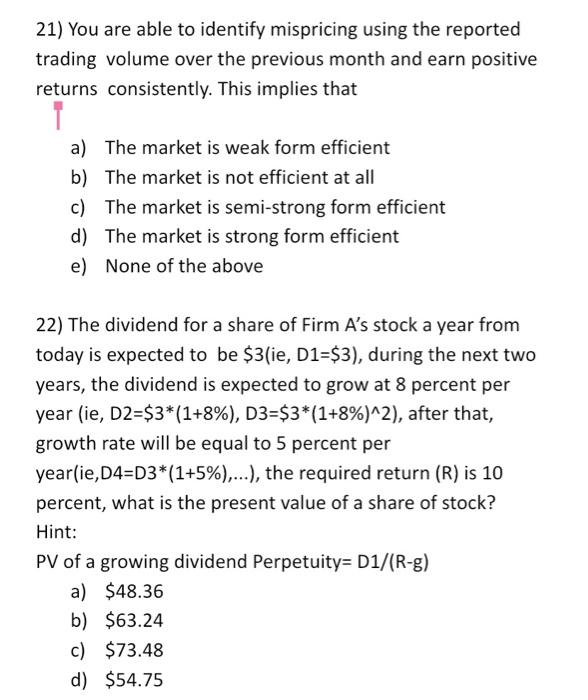

Question: 21) You are able to identify mispricing using the reported trading volume over the previous month and earn positive returns consistently. This implies that I

21) You are able to identify mispricing using the reported trading volume over the previous month and earn positive returns consistently. This implies that I a) The market is weak form efficient b) The market is not efficient at all c) The market is semi-strong form efficient d) The market is strong form efficient e) None of the above 22) The dividend for a share of Firm A's stock a year from today is expected to be $3(ie, D1=$3), during the next two years, the dividend is expected to grow at 8 percent per year (ie, D2=$3*(1+8%), D3=$3*(1+8%)^2), after that, growth rate will be equal to 5 percent per year(ie, D4=D3*(1+5%),...), the required return (R) is 10 percent, what is the present value of a share of stock? Hint: PV of a growing dividend Perpetuity= D1/(R-8) a) $48.36 b) $63.24 c) $73.48 d) $54.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts